ASX Stocks That May Be Undervalued In December 2025

As the Australian market shows signs of potential recovery with a late-week rally, investors are keenly observing opportunities that might arise from recent economic shifts. In this context, identifying undervalued stocks can be particularly appealing, as they may offer growth potential amidst current market fluctuations and rate adjustments.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$1.34 | A$2.26 | 40.8% |

| NRW Holdings (ASX:NWH) | A$5.13 | A$8.95 | 42.7% |

| Lynas Rare Earths (ASX:LYC) | A$12.85 | A$23.50 | 45.3% |

| LGI (ASX:LGI) | A$4.03 | A$7.73 | 47.9% |

| Guzman y Gomez (ASX:GYG) | A$21.05 | A$38.70 | 45.6% |

| Genesis Minerals (ASX:GMD) | A$6.90 | A$13.55 | 49.1% |

| Cromwell Property Group (ASX:CMW) | A$0.465 | A$0.86 | 46% |

| CleanSpace Holdings (ASX:CSX) | A$0.63 | A$1.11 | 43.4% |

| Bellevue Gold (ASX:BGL) | A$1.51 | A$2.79 | 45.9% |

| Airtasker (ASX:ART) | A$0.325 | A$0.63 | 48.7% |

Let's take a closer look at a couple of our picks from the screened companies.

FINEOS Corporation Holdings (ASX:FCL)

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for life, accident, and health insurers as well as employee benefits providers across North America, the Asia Pacific, the Middle East, and Africa, with a market cap of A$904.73 million.

Operations: The company generates revenue of €135.90 million from its software and programming segment, focusing on solutions for insurers and benefits providers across various regions.

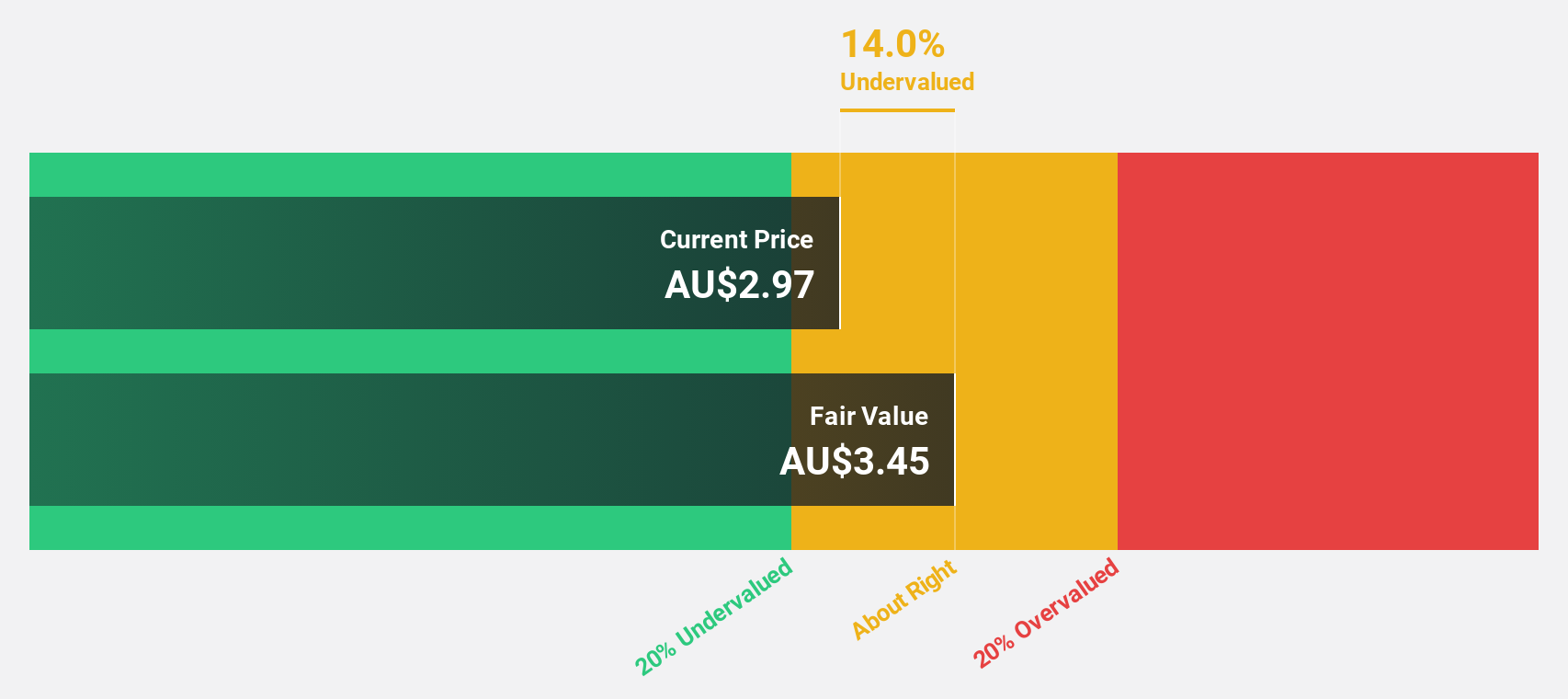

Estimated Discount To Fair Value: 12.8%

FINEOS Corporation Holdings is trading at A$2.65, below its estimated fair value of A$3.04, reflecting a 12.8% undervaluation based on discounted cash flow analysis. The company is forecast to achieve revenue growth of 9.2% annually and become profitable within three years, surpassing average market growth expectations. Recent board changes include appointing Michael Kelly as Executive Chairman and Stephen Devine as a Non-Executive Director, potentially enhancing strategic direction and governance stability.

- Our comprehensive growth report raises the possibility that FINEOS Corporation Holdings is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in FINEOS Corporation Holdings' balance sheet health report.

Guzman y Gomez (ASX:GYG)

Overview: Guzman y Gomez Limited operates and manages quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$2.15 billion.

Operations: The company generates revenue primarily from its quick service restaurants, amounting to A$465.04 million.

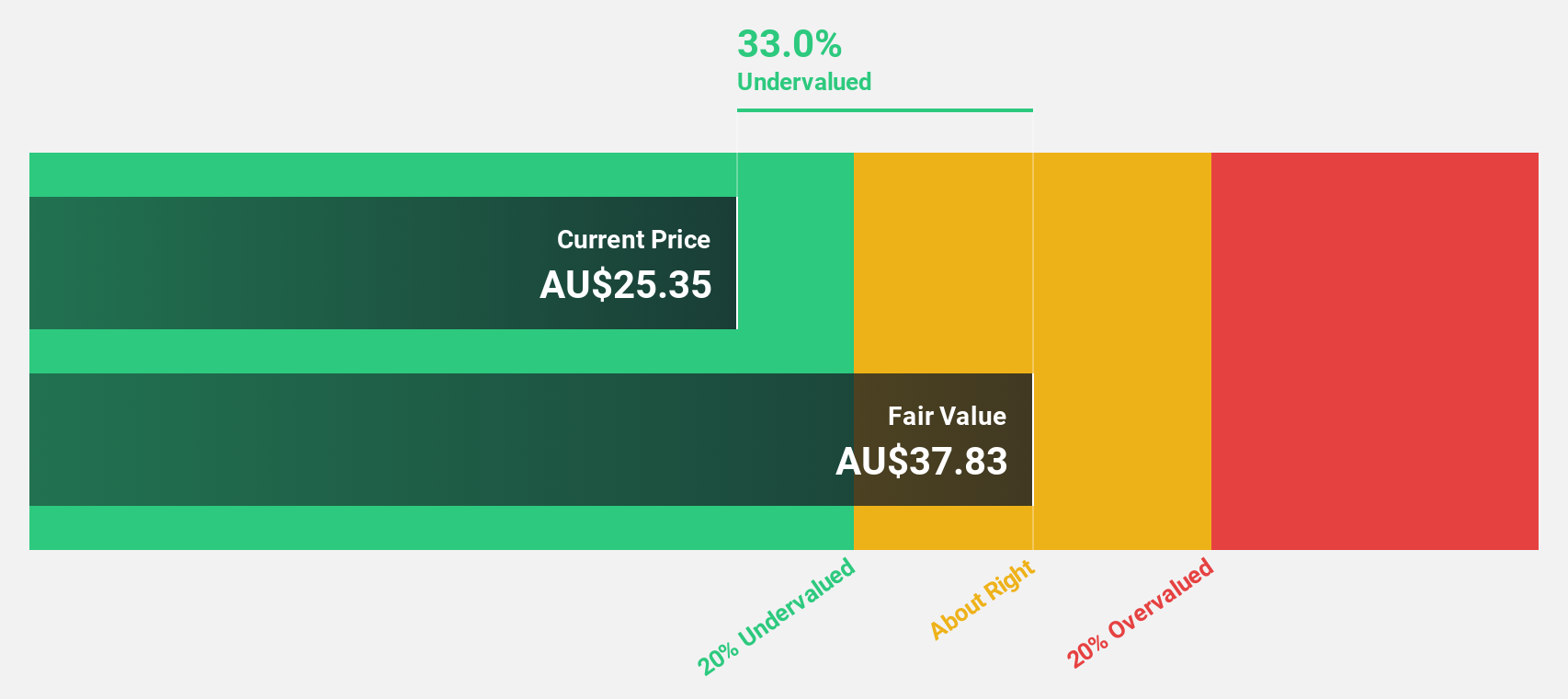

Estimated Discount To Fair Value: 45.6%

Guzman y Gomez is trading at A$21.05, significantly below its estimated fair value of A$38.7, indicating a 45.6% undervaluation based on discounted cash flow analysis. The company recently announced a share buyback program worth A$100 million to enhance shareholder returns while supporting growth plans, including opening 32 new restaurants in FY26. Although revenue growth is forecasted at 15.5% annually, earnings are expected to grow significantly faster at 32.6%.

- Insights from our recent growth report point to a promising forecast for Guzman y Gomez's business outlook.

- Navigate through the intricacies of Guzman y Gomez with our comprehensive financial health report here.

Nuix (ASX:NXL)

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa, with a market cap of A$609.08 million.

Operations: The company generates revenue of A$221.50 million from its software and programming segment.

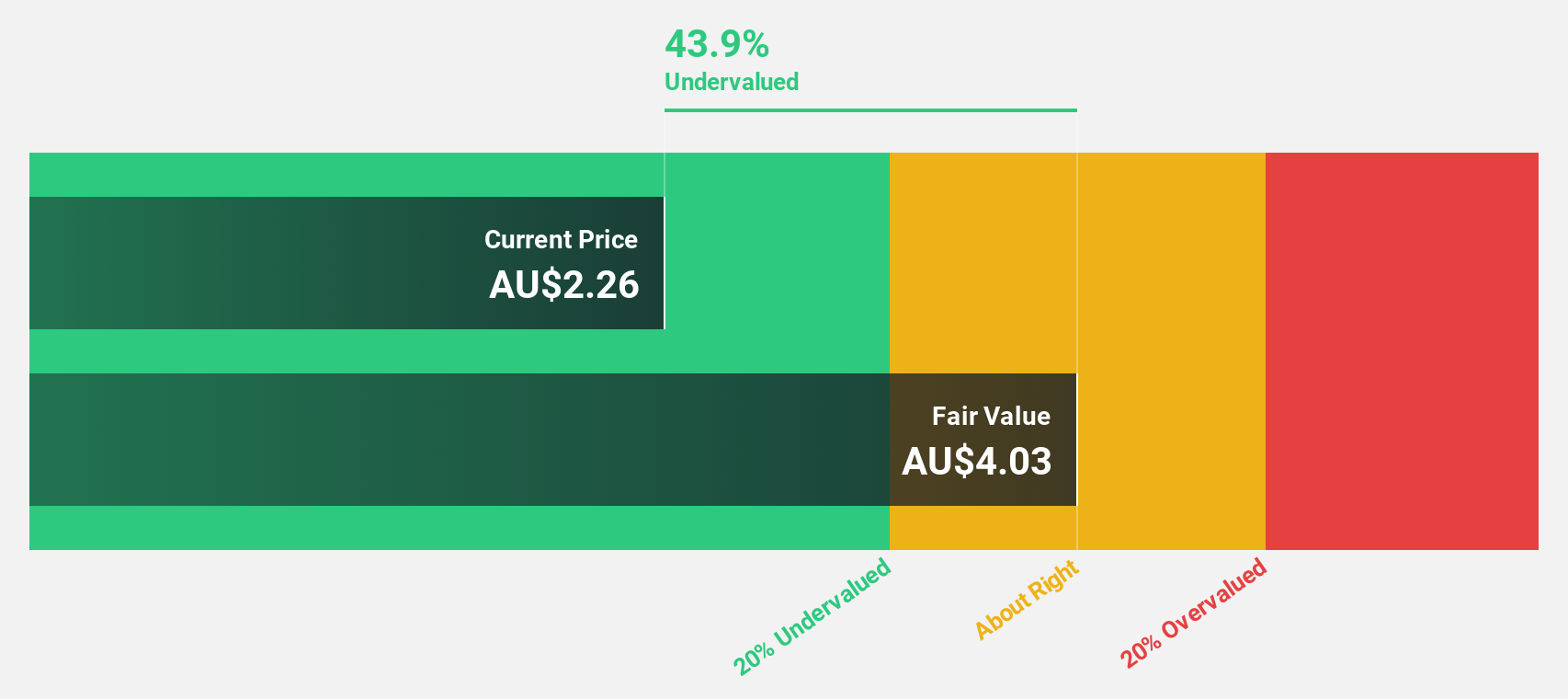

Estimated Discount To Fair Value: 11.6%

Nuix is trading at A$1.82, slightly below its estimated fair value of A$2.06, suggesting it is somewhat undervalued based on cash flows. The company is expected to become profitable within three years, with revenue growth forecasted at 9.5% annually—outpacing the broader Australian market's 5.9%. Despite a low projected return on equity of 10.2%, recent constitutional amendments reflect strategic adaptability to virtual shareholder meetings amid evolving regulations and health considerations.

- Our earnings growth report unveils the potential for significant increases in Nuix's future results.

- Dive into the specifics of Nuix here with our thorough financial health report.

Turning Ideas Into Actions

- Dive into all 34 of the Undervalued ASX Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报