How Investors Are Reacting To Kamigumi (TSE:9364) Considering A New Representative Director

- Kamigumi Co., Ltd. held a board meeting on 12 December 2025 to consider a change in its Representative Director (President), signaling a potential leadership transition at the top of the company.

- Because leadership changes can reshape corporate priorities and risk oversight, this move may mark a meaningful shift in Kamigumi’s longer-term direction.

- We will now examine how the potential change in Kamigumi’s Representative Director could influence the company’s investment narrative and outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Kamigumi's Investment Narrative?

To own Kamigumi today, you really need to believe in a steady, cash-generative logistics business that can modestly grow earnings while returning a lot of profits through higher dividends and ongoing buybacks. Recent guidance points to incremental growth rather than a rapid expansion story, and the share price already reflects strong multi‑year returns, plus a valuation above both peer and estimated fair P/E levels. That makes near‑term catalysts like successful execution of the current buyback program, delivery against upgraded FY2026 guidance, and continuity of the 70% payout target especially important. The board’s move to consider changing the Representative Director slots directly into this picture: if it is a smooth, internally consistent transition, the impact on these catalysts may be limited; if it signals a shift in capital allocation or risk appetite, it could become material very quickly.

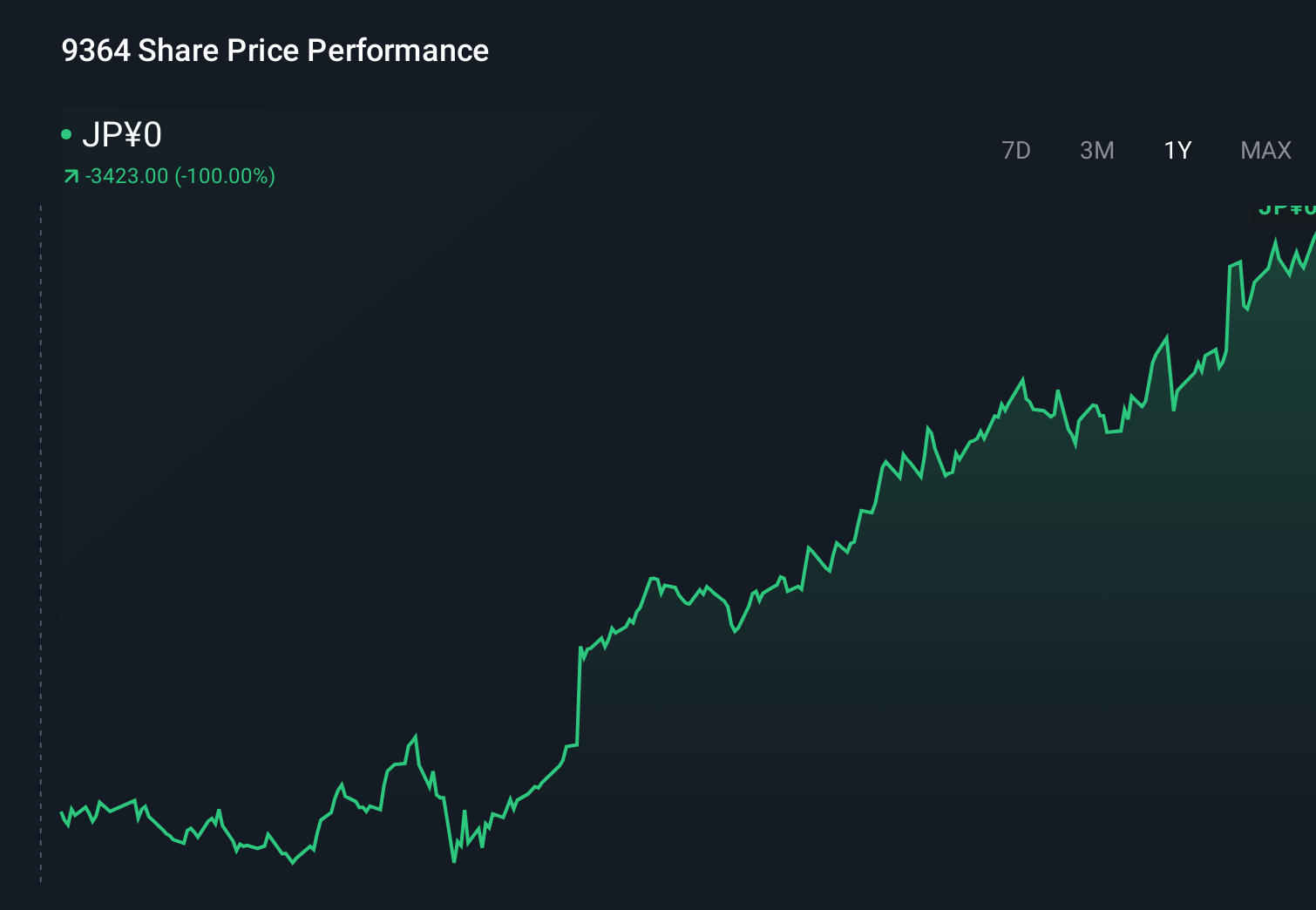

However, investors should be aware of one governance weakness that could amplify any leadership missteps. Kamigumi's shares are on the way up, but they could be overextended by 8%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Kamigumi - why the stock might be worth just ¥5033!

Build Your Own Kamigumi Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kamigumi research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kamigumi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kamigumi's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报