Is Toast (TOST) Undervalued After Recent Share Price Pullback?

Toast (TOST) has quietly slipped about 2% over the past day and roughly 12% over the past 3 months, even as revenue and net income continue to grow at a double digit clip.

See our latest analysis for Toast.

That pullback sits within a choppier backdrop, with Toast’s share price returning around negative 3% year to date and a softer 1 year total shareholder return. Its 3 year total shareholder return remains strongly positive, suggesting momentum has cooled but longer term believers are still in the green.

If Toast’s trajectory has you thinking about what else is out there in tech enabled growth, it could be a good moment to explore fast growing stocks with high insider ownership.

With shares lagging despite double digit growth in revenue and profits, and Wall Street targets sitting meaningfully higher than today’s price, is Toast quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 25.5% Undervalued

With Toast last closing at $35.28 against a narrative fair value near the high $40s, the story leans heavily on sustained growth and richer margins ahead.

The consistent increase in ARPU both through upselling additional modules (inventory, loyalty, marketing, etc.) and innovative fintech solutions like Toast Capital suggests Toast is successfully scaling its platform ecosystem, boosting net retention rates and high margin recurring revenue streams.

Curious how recurring revenue, rising profitability, and a premium future earnings multiple all combine into a bullish fair value story? The full narrative explains the growth runway and the assumptions that support that higher valuation.

Result: Fair Value of $47.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained marketing spend and tougher restaurant industry conditions could pressure margins and payment volumes, challenging the bullish growth and valuation assumptions.

Find out about the key risks to this Toast narrative.

Another Way to Look at Value

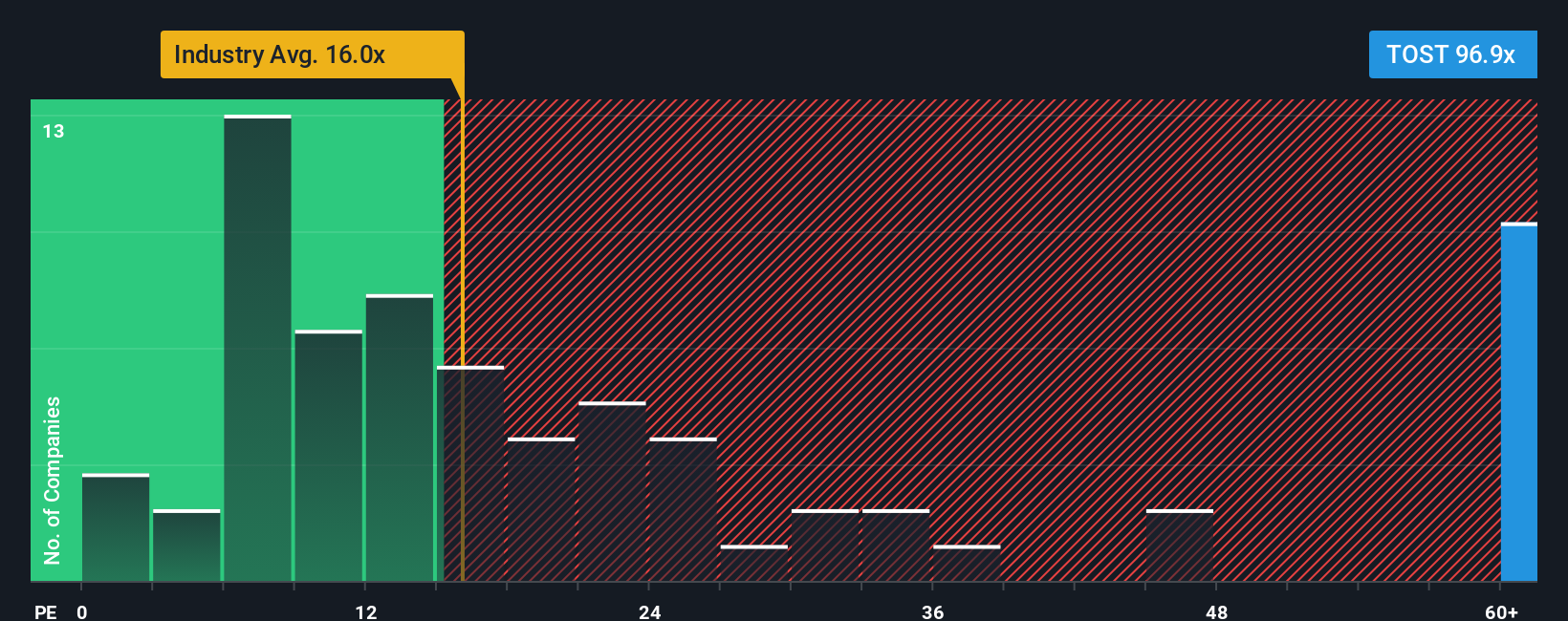

Analysts and narratives lean toward Toast being undervalued, but our earnings based valuation paints a very different picture. At 76 times earnings versus a 22.5 times fair ratio, 13.6 times for the industry and 39.1 times for peers, the stock screens as expensive. This raises the question of how much growth is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toast Narrative

If this viewpoint does not fully align with yours or you would rather lean on your own due diligence, you can craft a custom take in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Toast.

Ready for your next investing edge?

Before you move on, lock in fresh ideas by using the Simply Wall Street Screener so you are not relying on just one stock story.

- Capture potential mispricings by scanning these 908 undervalued stocks based on cash flows that may be trading below what their cash flows suggest they are worth.

- Ride structural shifts in automation and productivity by targeting these 26 AI penny stocks positioned at the forefront of artificial intelligence adoption.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that could add dependable yield to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报