InnoCare Pharma (SEHK:9969): Assessing Valuation After Landmark NTRK Solid-Tumor Approval for Zurletrectinib

InnoCare Pharma (SEHK:9969) just cleared a major milestone, with China’s regulator approving its next generation TRK inhibitor zurletrectinib for NTRK fusion positive solid tumors, the company’s first green light in solid cancers.

See our latest analysis for InnoCare Pharma.

The zurletrectinib approval lands after a volatile stretch, with InnoCare’s share price still up strongly this year thanks to a 150.79% year to date share price return. At the same time, the 90 day share price return of negative 19.88% shows momentum cooling from earlier highs, while the 1 year total shareholder return of 131.28% highlights how much long term holders have already benefited from the rerating.

If today’s move has you rethinking your healthcare exposure, it could be a smart moment to scan for other potential winners among healthcare stocks.

With shares still trading at roughly a 30% discount to both analyst targets and intrinsic value despite rapid revenue and profit growth, is InnoCare a mispriced oncology innovator, or is the market already discounting its future pipeline success?

Most Popular Narrative Narrative: 25.4% Undervalued

With the narrative fair value set at HK$19.12 versus the HK$14.27 last close, the valuation hinges on aggressive growth and a rich future multiple.

The company has a strong pipeline with numerous drugs in late stage development, including tafasitamab, zurletrectinib, and others, expecting approvals and launches in the next few years, which could significantly bolster future revenues. The introduction of InnoCare's ADC platform aims to tap into new therapeutic areas with highly differentiated products, potentially opening new revenue streams and improving net margins through innovative therapies with a better safety profile.

Want to see why this story assumes soaring revenues, rising margins, and a premium earnings multiple rarely seen in Hong Kong biotech? The full narrative unpacks the bold forecasts driving that fair value.

Result: Fair Value of $19.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, these upside assumptions rest on flawless execution, with intense biotech competition and heavy R&D spending both capable of derailing the earnings ramp.

Find out about the key risks to this InnoCare Pharma narrative.

Another Lens on Valuation

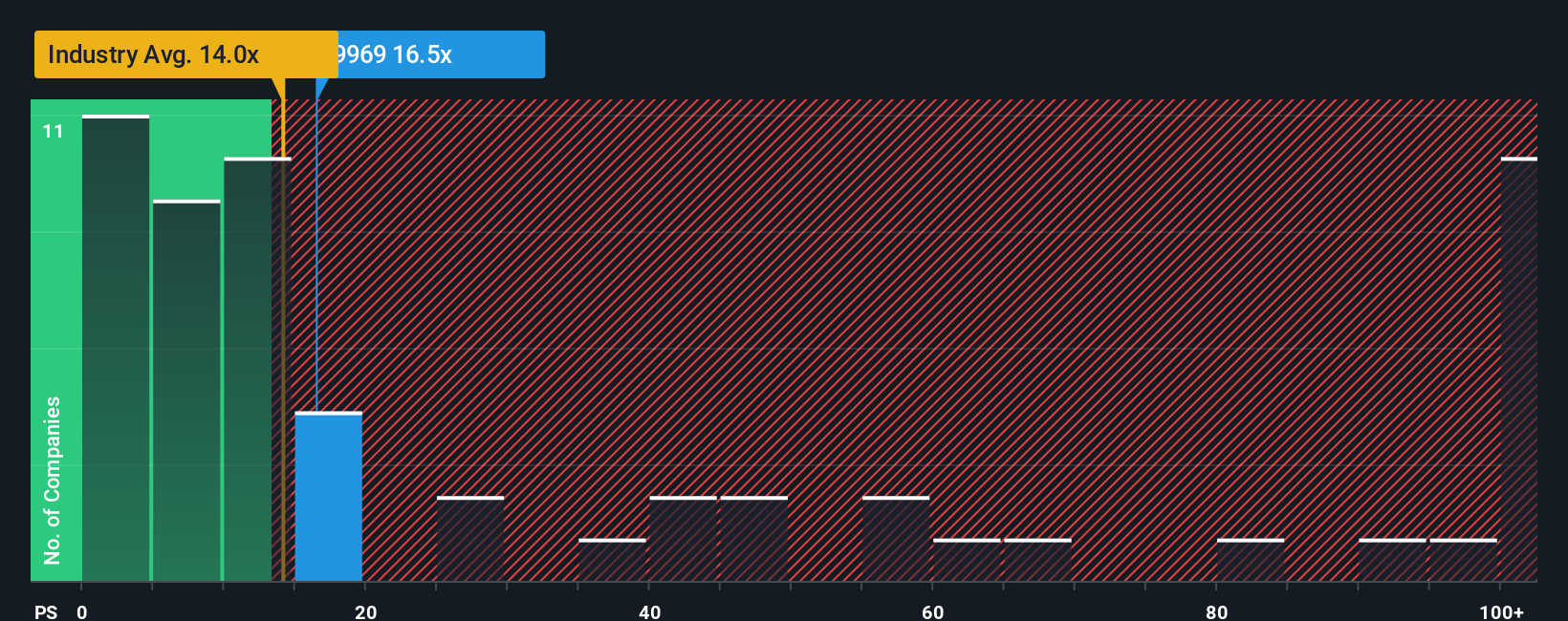

Price to sales tells a more cautious story. InnoCare trades at 15.4 times sales versus 13.2 times for the Hong Kong biotech sector, while our fair ratio points closer to 11.2 times. That rich gap suggests less margin of safety if growth stumbles. Is the premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own InnoCare Pharma Narrative

If you see things differently or prefer digging into the numbers yourself, you can craft a customized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding InnoCare Pharma.

Looking for more investment ideas?

Before you log off, line up your next move by using our stock screeners to spot standout opportunities that other investors may be ignoring.

- Explore potential mispriced quality by scanning these 908 undervalued stocks based on cash flows that still trade below what their cash flows suggest they are worth.

- Consider powerful secular trends by targeting these 26 AI penny stocks harnessing artificial intelligence to reshape entire industries.

- Review potential income-oriented opportunities with these 13 dividend stocks with yields > 3% that offer yields above 3% and may help strengthen your portfolio’s cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报