Is National Bank of Canada (TSX:NA) Overvalued After Its Recent Share Price Rally?

National Bank of Canada (TSX:NA) has quietly put together an impressive run, with the share price up about 7% over the past month and roughly 33% over the past year, outpacing many domestic peers.

See our latest analysis for National Bank of Canada.

That steady climb in the share price, capped by a recent move to about CA$172.62, suggests investors are warming to National Bank of Canada. Solid recent share price returns and strong multi year total shareholder returns point to momentum building, not fading.

If this kind of momentum in financials has your attention, it is a good time to explore fast growing stocks with high insider ownership for other under the radar opportunities with strong backing.

With shares near record highs and a solid track record of growth, the key question now is whether National Bank of Canada is still trading below its intrinsic value, or if the market has already priced in its future gains.

Most Popular Narrative: 2.8% Overvalued

With National Bank of Canada closing at about CA$172.62 against a narrative fair value near CA$168, the story leans toward a mildly rich valuation built on improving earnings visibility.

Recent Street research reflects a broadly constructive stance on National Bank of Canada, with several bullish analysts lifting their price targets into the mid to high C$160s and one firm moving to a more positive recommendation. At the same time, some commentators emphasize execution risks as the bank pursues growth beyond its core Quebec franchise.

Want to see why steady revenue expansion, shifting profit margins, and a richer future earnings multiple still add up to only a small valuation premium? The full narrative unpacks the growth math step by step, including how long term assumptions on earnings, returns on equity, and discount rates combine to justify that fair value line in the sand.

Result: Fair Value of $168 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could unravel if regional concentration in Quebec and ongoing margin pressure from higher funding and technology costs begin to have a greater impact than expected.

Find out about the key risks to this National Bank of Canada narrative.

Another View: Ratios Send a Different Signal

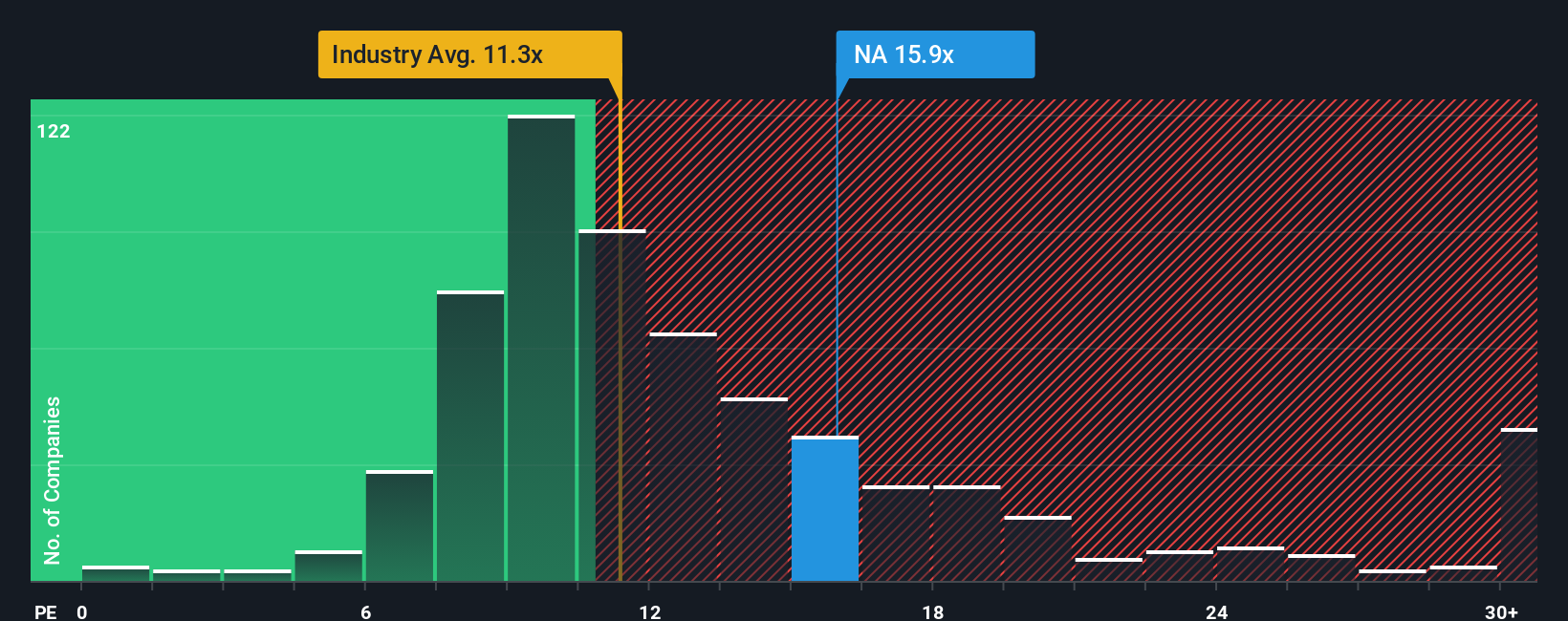

While the narrative fair value says National Bank of Canada is slightly overvalued, its 17.5x earnings multiple looks expensive versus North American banks at 12x, peers at 14.5x, and a fair ratio of 13.9x. That premium narrows the margin for error if growth disappoints. This raises the question: what is the market really paying up for?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Bank of Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Bank of Canada Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your National Bank of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunities with targeted stock ideas from the Simply Wall Street Screener so you are not left watching from the sidelines.

- Capture high-upside potential by scanning these 3612 penny stocks with strong financials that already show the balance and momentum serious investors look for.

- Consider the next wave of innovation by focusing on these 26 AI penny stocks positioned to benefit from real world AI adoption and rising data demand.

- Strengthen your core portfolio with these 13 dividend stocks with yields > 3% that may support long term income while still offering room for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报