Did IQVIA’s (IQV) Debt Refinancing and Lower SOFR Costs Just Shift Its Investment Narrative?

- On December 9, 2025, IQVIA Holdings Inc. amended its Fifth Amended and Restated Credit Agreement to refinance multiple term and revolving loan facilities into new classes, lower interest on certain US dollar borrowings by removing the term SOFR credit spread adjustment, and release its Swiss and Japanese subsidiaries from borrower obligations.

- This refinancing simplifies IQVIA’s capital structure and reduces borrowing costs, potentially freeing up cash flow and management capacity for its healthcare data, analytics, and clinical research operations worldwide.

- Next, we’ll examine how lower interest costs from eliminating the SOFR spread adjustment could influence IQVIA’s existing investment narrative and outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

IQVIA Holdings Investment Narrative Recap

To own IQVIA, you generally need to believe that its healthcare data, AI-enabled analytics, and outsourced clinical research will keep attracting steady, long-term client demand. The latest refinancing slightly eases one of the key risks around high leverage, but does not fundamentally change nearer term execution risks in competitive CRO bidding or potential margin pressure from mix shifts.

The recent Q3 2025 results, with revenue of US$4,100 million and year to date revenue of US$11,946 million, are the most relevant backdrop for this credit amendment, since lower interest expense now interacts directly with an already sizeable earnings base. How effectively IQVIA converts its large R&D Solutions backlog and expanding real world evidence work into profit growth, while defending margins in a more price competitive market, will be central to the story from here.

Yet the biggest issue investors should be aware of is how higher leverage and refinancing needs could interact with...

Read the full narrative on IQVIA Holdings (it's free!)

IQVIA Holdings' narrative projects $18.4 billion revenue and $1.8 billion earnings by 2028. This requires 5.4% yearly revenue growth and about a $0.6 billion earnings increase from $1.2 billion today.

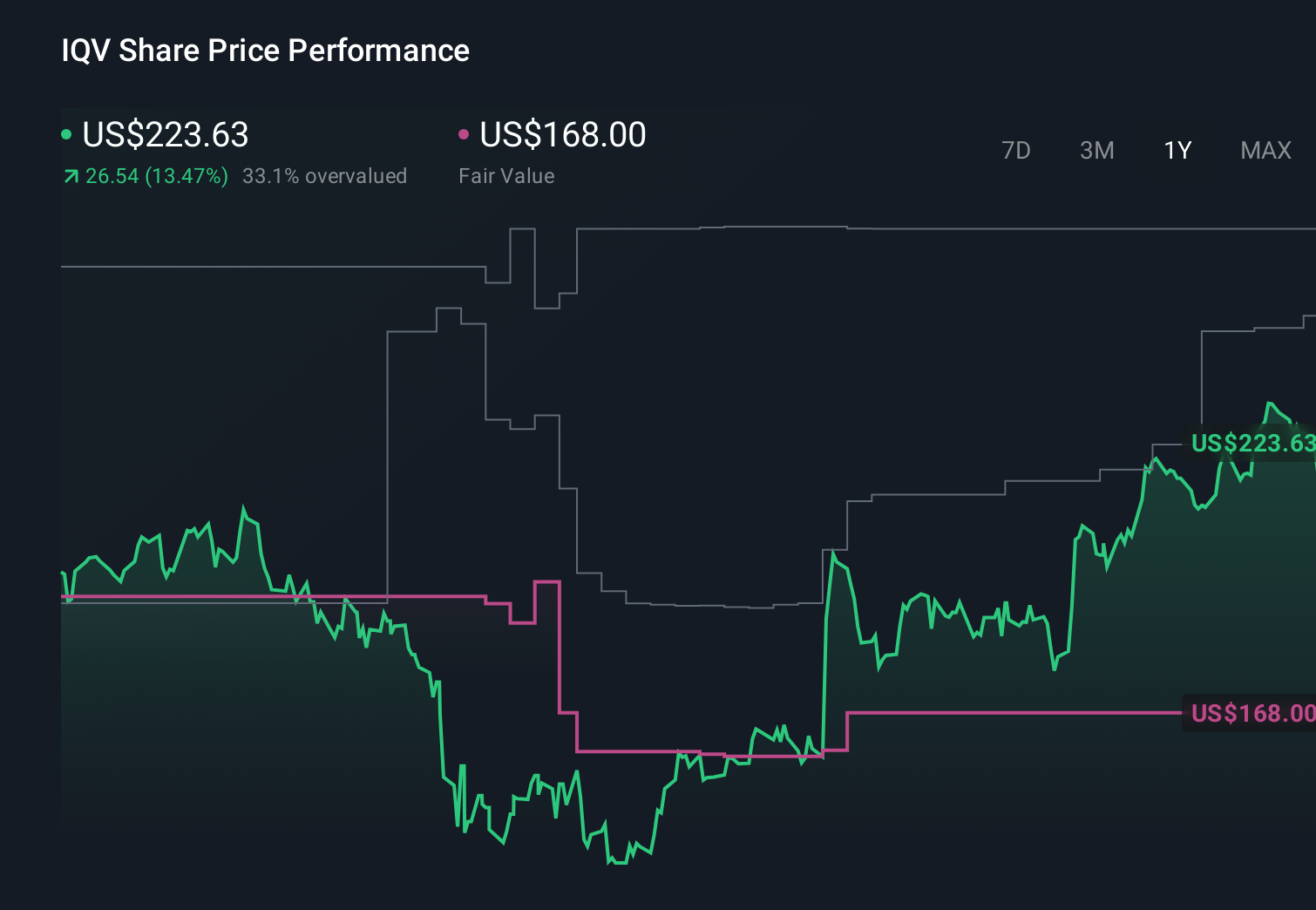

Uncover how IQVIA Holdings' forecasts yield a $250.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see IQVIA’s fair value between US$250 and about US$309 per share, highlighting a wide spread of expectations. You can weigh those views against IQVIA’s ongoing margin pressure from competitive CRO pricing and mix shifts, which could influence how much of its revenue growth ultimately reaches the bottom line.

Explore 4 other fair value estimates on IQVIA Holdings - why the stock might be worth as much as 39% more than the current price!

Build Your Own IQVIA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IQVIA Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IQVIA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IQVIA Holdings' overall financial health at a glance.

No Opportunity In IQVIA Holdings?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报