Assessing LendingClub’s Valuation After Strong Q3, $100M Buyback and Home Improvement Expansion

LendingClub (LC) has been drawing fresh attention after a standout third quarter, a newly authorized $100 million buyback, and a push into home improvement financing that broadens its lending ecosystem and future revenue mix.

See our latest analysis for LendingClub.

Those strong quarterly numbers, the 52 week high and the new $100 million buyback have clearly reset expectations. A roughly 15% one month share price return and a three year total shareholder return of around 122% suggest momentum is still building from a higher base, even after recent pullbacks that leave the stock around $19.90.

If LendingClub's momentum has you thinking about where else growth and sentiment might be lining up, now is a good time to explore fast growing stocks with high insider ownership.

With earnings inflecting, a fresh buyback, and new growth avenues opening, investors now face the key question: at roughly $20 a share, is LendingClub undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 10.3% Undervalued

With LendingClub last closing at 19.90 dollars versus a narrative fair value near 22.18 dollars, the spread hinges on earnings power and capital returns.

The hybrid digital marketplace/bank model continues to scale. Marketplace originations and balance sheet loans are growing in tandem, with the former providing high-margin, capital-light revenue, and the latter building durable recurring net interest income. This dual engine offers operating leverage for sustained growth in earnings and tangible book value.

Curious how this dual engine translates into that higher valuation band, and what profit and margin profile it assumes over time, dig into the full narrative.

Result: Fair Value of $22.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained reliance on personal loans and intensifying competition from fintech and big tech lenders could pressure margins and disrupt that upbeat earnings trajectory.

Find out about the key risks to this LendingClub narrative.

Another Lens on Value

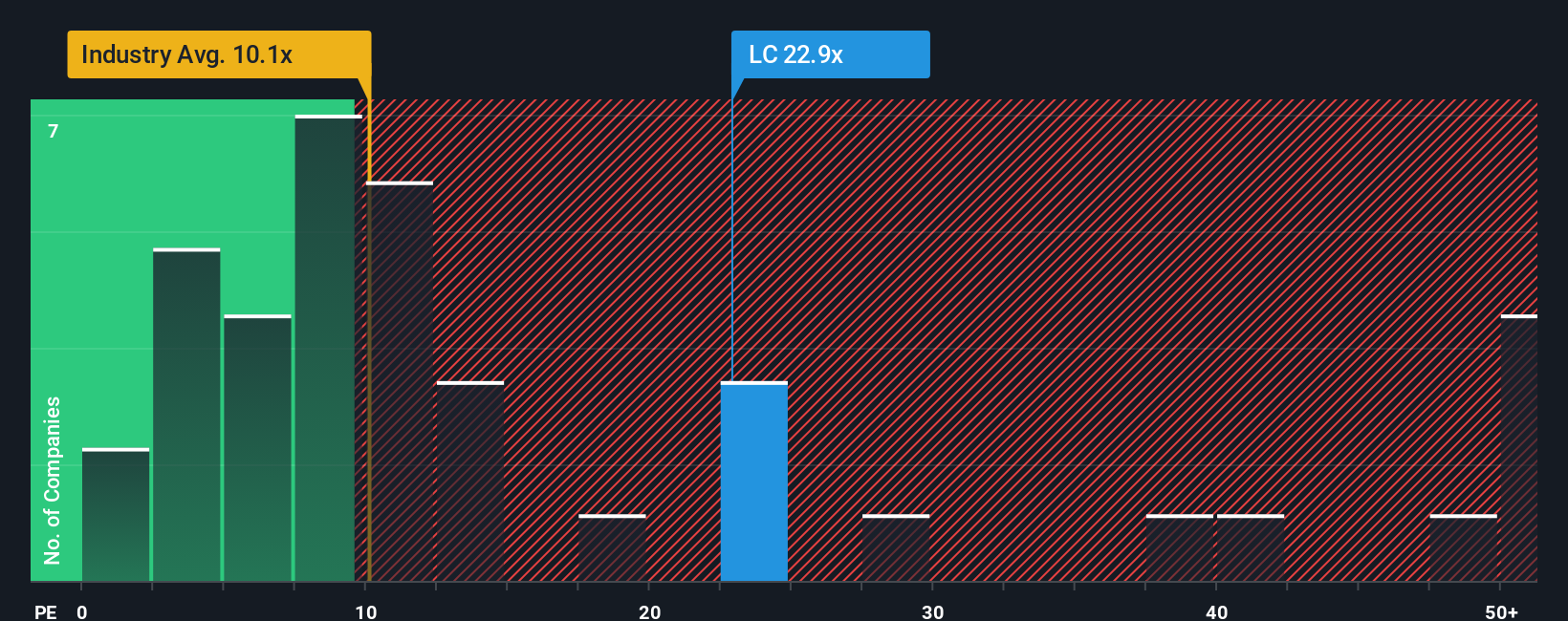

On earnings multiples, LendingClub looks pricey, trading at about 22.1 times earnings versus roughly 9.5 times for the US Consumer Finance industry and around 6.2 times for close peers, even though our fair ratio implies a more forgiving 23 times. Is the market already baking in a lot of execution risk here, or is this a rare case where a premium might still be worth paying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LendingClub Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your LendingClub research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity. Use the Simply Wall Street Screener to uncover fresh, data driven ideas that could help you refine your portfolio.

- Explore long term income potential by targeting companies in these 13 dividend stocks with yields > 3% that may keep paying you while markets move.

- Consider structural trends in automation, data, and smart software by focusing on these 26 AI penny stocks that could benefit from wider adoption.

- Look for possible mispricings by scanning these 908 undervalued stocks based on cash flows that the market may be overlooking at the moment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报