Reassessing Mizuho Financial Group (TSE:8411)’s Valuation After a Strong Share Price Run-Up

Mizuho Financial Group (TSE:8411) has quietly pushed higher this month, and the move is starting to look more like a trend than a blip. With shares gaining over 7% recently, investors are reassessing its valuation backdrop.

See our latest analysis for Mizuho Financial Group.

That recent 7.7% one month share price return has come on top of a strong year to date share price return of 47.3% and a striking five year total shareholder return of 437.1%. This suggests momentum is building as investors warm to Mizuho’s gradual earnings and balance sheet improvements.

If Mizuho’s run has you wondering what else might be setting up for multi year gains, this could be a good moment to explore fast growing stocks with high insider ownership.

Given that Mizuho trades slightly above the average analyst target yet still screens at a material intrinsic discount, the key question is straightforward: are investors overlooking further upside or already pricing in the next leg of growth?

Most Popular Narrative: 5.3% Overvalued

With Mizuho’s last close at ¥5,721 versus a narrative fair value of about ¥5,435, the story leans toward a modestly stretched valuation.

The analysts have a consensus price target of ¥4971.818 for Mizuho Financial Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥6070.0, and the most bearish reporting a price target of just ¥3800.0.

Want to see what justifies paying up for slower revenue but rising margins, shrinking share count, and a richer future earnings multiple? The full narrative reveals the exact profit path, valuation logic, and discounting assumptions driving that fair value view.

Result: Fair Value of ¥5,435.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising governance and infrastructure costs, or execution missteps on integrations like Rakuten and Greenhill, could quickly compress margins and cap valuation upside.

Find out about the key risks to this Mizuho Financial Group narrative.

Another Take on Value

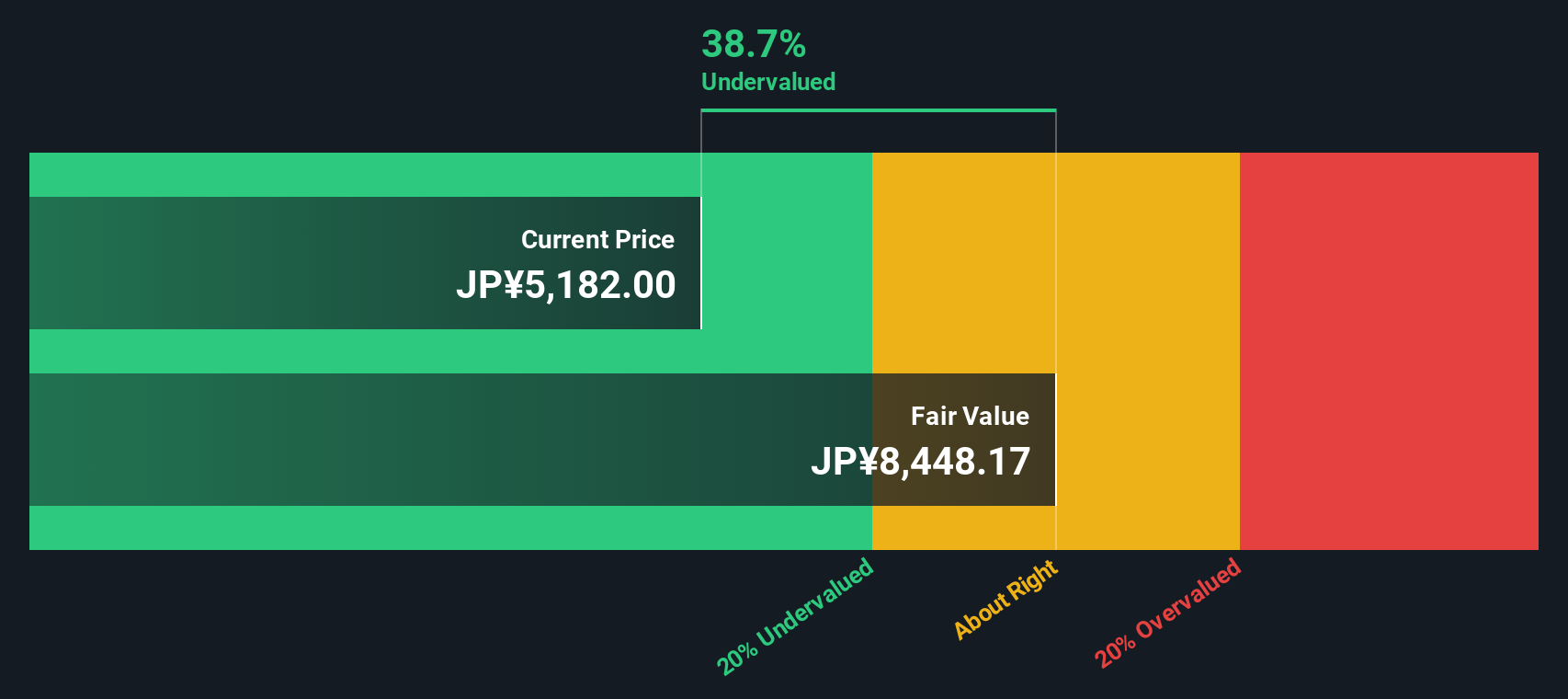

Our DCF model tells a very different story, putting Mizuho’s fair value near ¥8,750, about 35% above today’s ¥5,721 price. If cash flows justify such a premium while the narrative says mildly overvalued, which lens should investors trust when momentum cools?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mizuho Financial Group Narrative

If you are not fully sold on this view, or simply prefer to dig into the numbers yourself, you can shape a custom thesis in just a few minutes by starting with Do it your way.

A great starting point for your Mizuho Financial Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction opportunities?

Before momentum shifts again, set yourself up with fresh ideas from the Simply Wall Street Screener and keep your watchlist stocked with tomorrow’s potential winners.

- Capture potential multi baggers early by reviewing these 3612 penny stocks with strong financials that already show financial strength instead of relying on hype alone.

- Ride powerful structural growth by targeting these 30 healthcare AI stocks reshaping diagnostics, treatment decisions, and efficiency across global health systems.

- Position for the next secular trend by screening these 80 cryptocurrency and blockchain stocks building real businesses around blockchain infrastructure and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报