Symbotic (SYM) Valuation Check After Capital Raise, SoftBank Share Sale and Goldman Sachs Downgrade

Symbotic (SYM) just pulled off a sizable capital raise and watched a key shareholder cash out shares at the same time, all as a major bank turned more cautious on the story.

See our latest analysis for Symbotic.

Those moves land at an interesting time, with Symbotic’s share price at $61.43 and strong momentum still in play, including a roughly 19% 3 month share price return and a striking three year total shareholder return above 400%. This suggests investors are pricing in sizable long term growth despite fresh capital and softer sentiment headlines.

If Symbotic’s latest raise has you rethinking where growth capital might work hardest, it could be worth scanning other automation and robotics style names via high growth tech and AI stocks.

With the stock now sitting almost exactly at Wall Street’s price target, strong multi year returns, and fresh dilution in the mix, is Symbotic still mispriced by a skeptical market, or has the rally already baked in years of future growth?

Most Popular Narrative: 50% Undervalued

With Symbotic’s fair value estimate of $61.71 sitting just above the recent $61.43 close, the most followed narrative sees finely balanced upside grounded in ambitious long term forecasts.

Increasing software and service revenue, software maintenance gross margins exceeding 70%, and more than doubling year over year demonstrates significant operating leverage and margin expansion, positioning Symbotic for greater profitability as its installed base scales.

Want to know what kind of growth justifies that ambitious profit shift and premium earnings multiple? The narrative leans on aggressive revenue expansion, rising margins, and a steep rerating in future valuation. Curious which specific assumptions turn today’s price into apparent value? The full story lays out the numbers behind that confidence.

Result: Fair Value of $61.71 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on smooth execution, and deployment delays or a slowdown from major customers like Walmart could quickly challenge those growth assumptions.

Find out about the key risks to this Symbotic narrative.

Another View: DCF Flips the Story

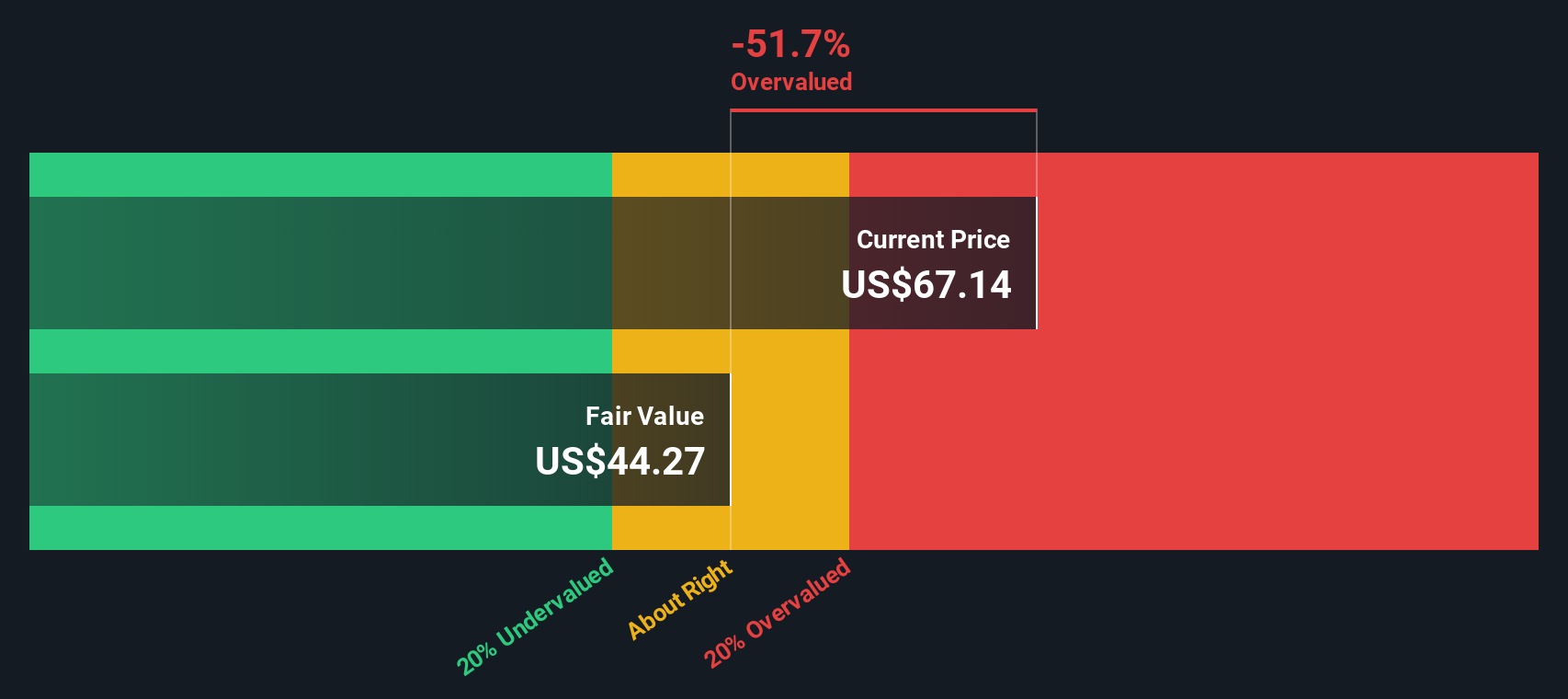

While the narrative driven fair value sits near the current share price, our DCF model is more cautious and suggests Symbotic is trading above an estimated fair value of about $46.20. If cash flows disappoint, is today’s price quietly baking in too much perfection?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Symbotic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Symbotic Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes using Do it your way.

A great starting point for your Symbotic research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next high conviction idea?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover stocks that fit your strategy before the market fully wakes up.

- Capitalize on early stage potential by scanning these 3612 penny stocks with strong financials for small companies with the balance sheets to support meaningful upside.

- Position yourself at the frontier of automation and data by targeting these 26 AI penny stocks that fuse strong fundamentals with real world AI adoption.

- Lock in value focused opportunities by hunting through these 908 undervalued stocks based on cash flows where market pessimism may have pushed quality cash generators to attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报