Is Take-Two (TTWO) Still Undervalued as GTA VI Hype Drives Record Bookings and Growth Expectations?

Anticipation around Grand Theft Auto VI is increasingly steering the conversation on Take-Two Interactive Software (TTWO), as investors weigh upbeat booking trends against a choppy earnings history and questions about long term profitability.

See our latest analysis for Take-Two Interactive Software.

The share price has cooled slightly in recent weeks, but a roughly 32% year to date share price return and a 30% one year total shareholder return suggest momentum is still broadly constructive as investors price in GTA VI upside and look past lumpy earnings.

If GTA VI has you rethinking where growth could come from next, it is also worth exploring high growth tech and AI stocks that might be shaping the next leg of the tech cycle.

With the stock still trading below the average analyst target but already up sharply this year, the key question now is simple: is Take-Two still a smart way to front run GTA VI, or has the market already priced in that next leg of growth?

Most Popular Narrative: 12.7% Undervalued

Compared with the last close at $241.47, the most followed narrative points to fair value closer to the high $270s, implying more upside still on the table.

Strategic investments in technology, AI, and content pipeline efficiency, alongside a strong release slate with multiple high-profile launches (including Borderlands 4, NBA 2K26, and Mafia: The Old Country), undergird management's outlook for record net bookings and enhanced profitability in the coming years.

Curious how record bookings, rising margins, and an unusually rich future earnings multiple all fit together into that fair value? The detailed playbook might surprise you.

Result: Fair Value of $276.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on flawless execution, with any delays to key releases or sustained weakness in mobile growth likely to challenge the bullish earnings trajectory.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another View: Market Ratios Flash Caution

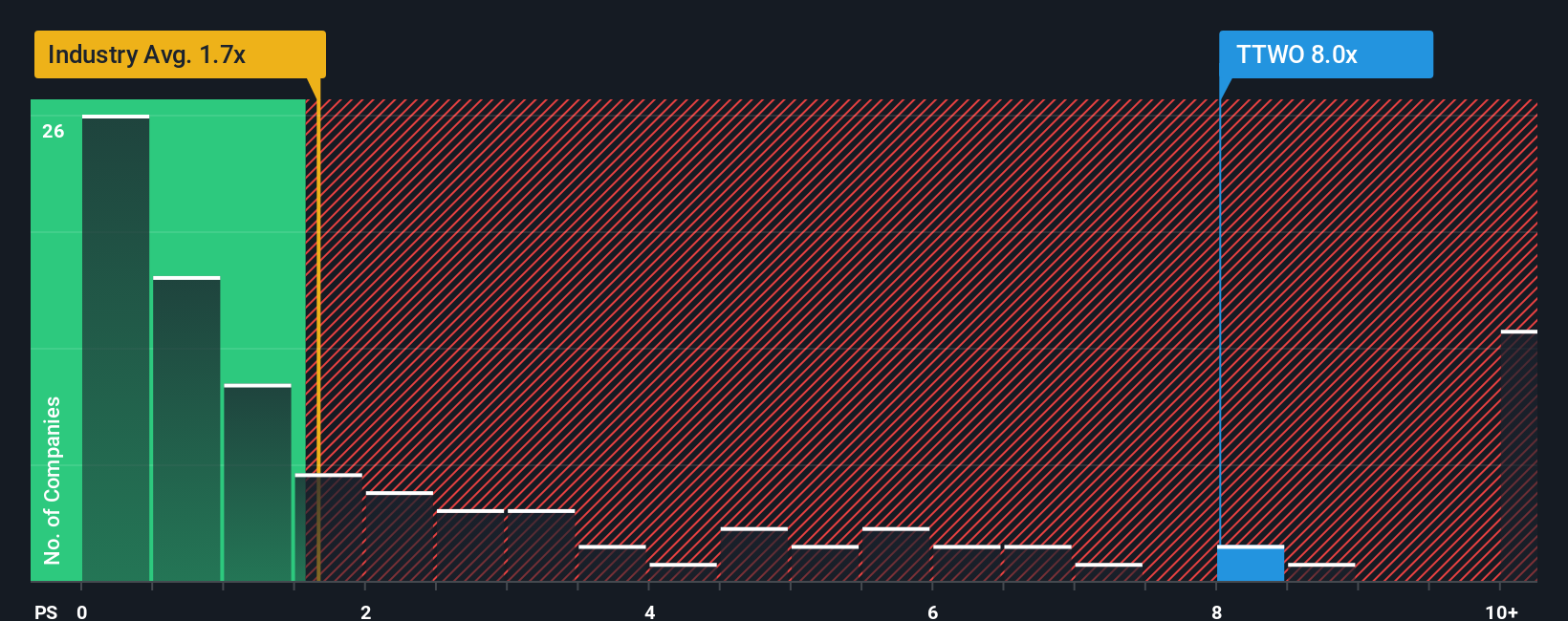

While the narrative model sees Take Two as about 12.7 percent undervalued, the market is pricing the stock at a rich 7.2 times sales, far above both the US Entertainment average at 1.4 times and peers at 5.7 times, and even above a fair ratio of 4.6 times. If multiples drift back toward that fair ratio, does today’s price still feel like a margin of safety?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Take-Two Interactive Software Narrative

If these views do not quite match your own, dive into the numbers yourself and build a custom storyline in under three minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Take-Two Interactive Software.

Ready to level up your next investment move?

If you stop with Take Two, you might miss stronger opportunities. Put Simply Wall Street’s Screener to work and upgrade your watchlist today.

- Capture asymmetrical upside by targeting mispriced potential using these 908 undervalued stocks based on cash flows, which combines solid fundamentals with attractive valuation gaps.

- Ride powerful long term trends by focusing on structural innovation through these 26 AI penny stocks at the heart of the AI transformation.

- Lock in more reliable cash flow potential by prioritizing steady income via these 13 dividend stocks with yields > 3% offering yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报