Assessing GXO Logistics (GXO) Valuation After Appointing Former CEVA COO Bart Beeks to New Role

GXO Logistics (GXO) just created a new Chief Operating Officer role and tapped industry veteran Bart Beeks to fill it, signaling a clear push to tighten execution as the company scales.

See our latest analysis for GXO Logistics.

The COO hire comes on the heels of GXO’s inaugural European bond issue and ongoing Wincanton integration, and that combination of strategic moves seems to be supporting a 23.38% year to date share price return and a 25.30% three year total shareholder return. This suggests momentum is quietly building rather than fading.

If you like the operational upgrade story at GXO, it could be a good moment to scan other logistics and adjacent names using our fast growing stocks with high insider ownership.

But with revenue and earnings growing, a fresh COO focused on margins, and the stock still trading below consensus targets, is GXO quietly undervalued here or is the market already pricing in the next leg of growth?

Most Popular Narrative: 16.9% Undervalued

With the narrative fair value sitting at $63.94 against GXO’s last close of $53.14, the storyline points to meaningful upside if execution lands.

Enhanced deployment of automation, AI, and proprietary software (with recent launches like GXO IQ) is rapidly improving warehouse productivity, reducing labor costs, and increasing operational efficiency, which is beginning to drive margin expansion and should positively impact net earnings and EBITDA margins.

Curious how much earnings power this assumes, and what kind of profit margins need to emerge from all that automation investment? The narrative lays it bare.

Result: Fair Value of $63.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, leadership turnover and Wincanton integration missteps could blunt those automation gains, delaying margin expansion and forcing investors to reassess the upside case.

Find out about the key risks to this GXO Logistics narrative.

Another Angle on Valuation

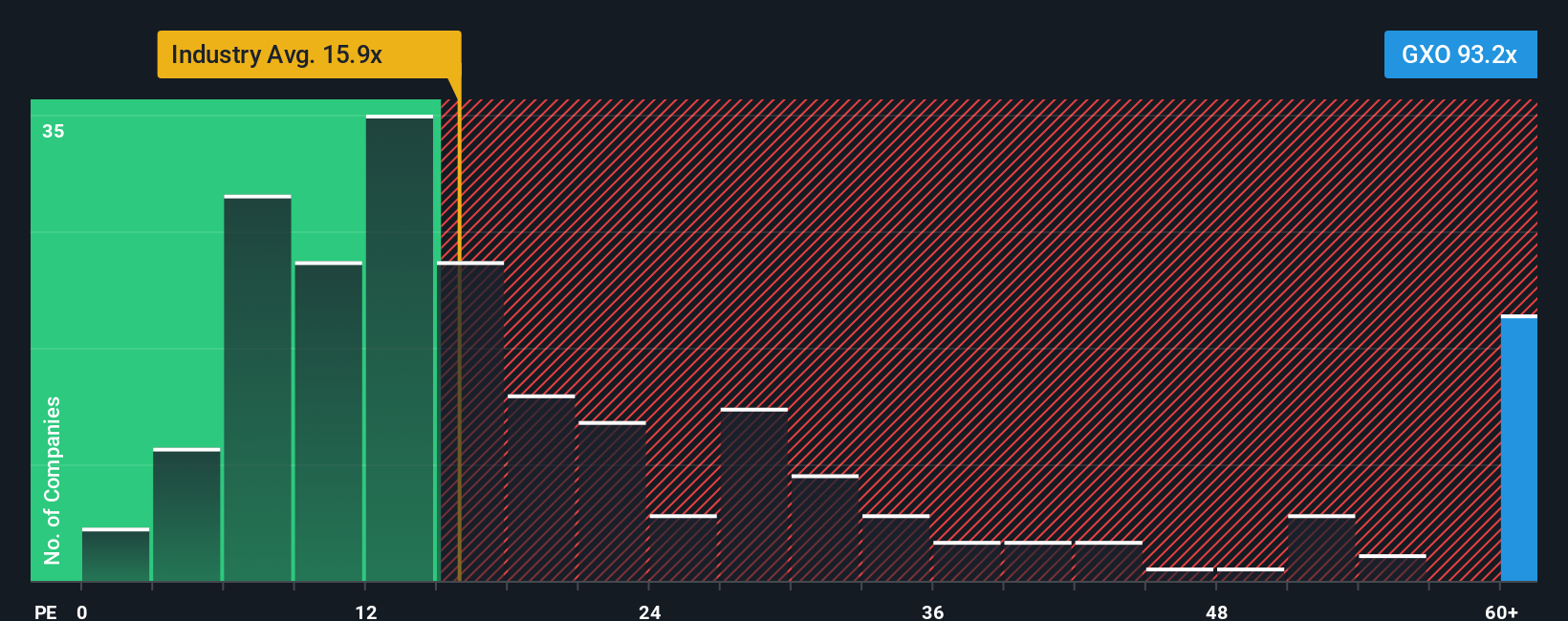

While the narrative points to 16.9% upside, our lens on earnings tells a different story. GXO trades on a steep 68.4x price to earnings ratio versus a 41.8x fair ratio, and well above the 15.9x industry and 23.4x peer averages, suggesting valuation risk rather than a hidden bargain.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GXO Logistics Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking For More Investment Ideas?

Do not stop at GXO when the rest of the market is full of mispriced potential. Use the Simply Wall St screener to uncover your next move.

- Capitalize on overlooked value by targeting companies trading below intrinsic worth through these 908 undervalued stocks based on cash flows, where strong cash flows back the story, not just sentiment.

- Explore structural trends in automation and machine learning by focusing on these 26 AI penny stocks that combine scalable technology with existing revenue traction.

- Strengthen your income stream by pinpointing reliable payers using these 13 dividend stocks with yields > 3%, helping you identify yields that may work harder than cash sitting idle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报