Ur-Energy (TSX:URE) Valuation After $100 Million Convertible Note Financing and Long-Term Growth Plans

Ur-Energy (TSX:URE) just priced a $100 million offering of 4.75% convertible senior notes due 2031, a financing move that could reshape its growth plans and future dilution path for shareholders.

See our latest analysis for Ur-Energy.

That financing comes after a choppy stretch for the stock, with a recent 1 day share price return of 3.53% lifting Ur-Energy to $1.76 even as its 90 day share price return sits at negative 17.76%, while the 5 year total shareholder return of 100.00% hints that long term investors have still been rewarded.

If this convertible note deal has you thinking more broadly about where capital is flowing in energy and resources, it might be a good time to see what else is catching attention through fast growing stocks with high insider ownership.

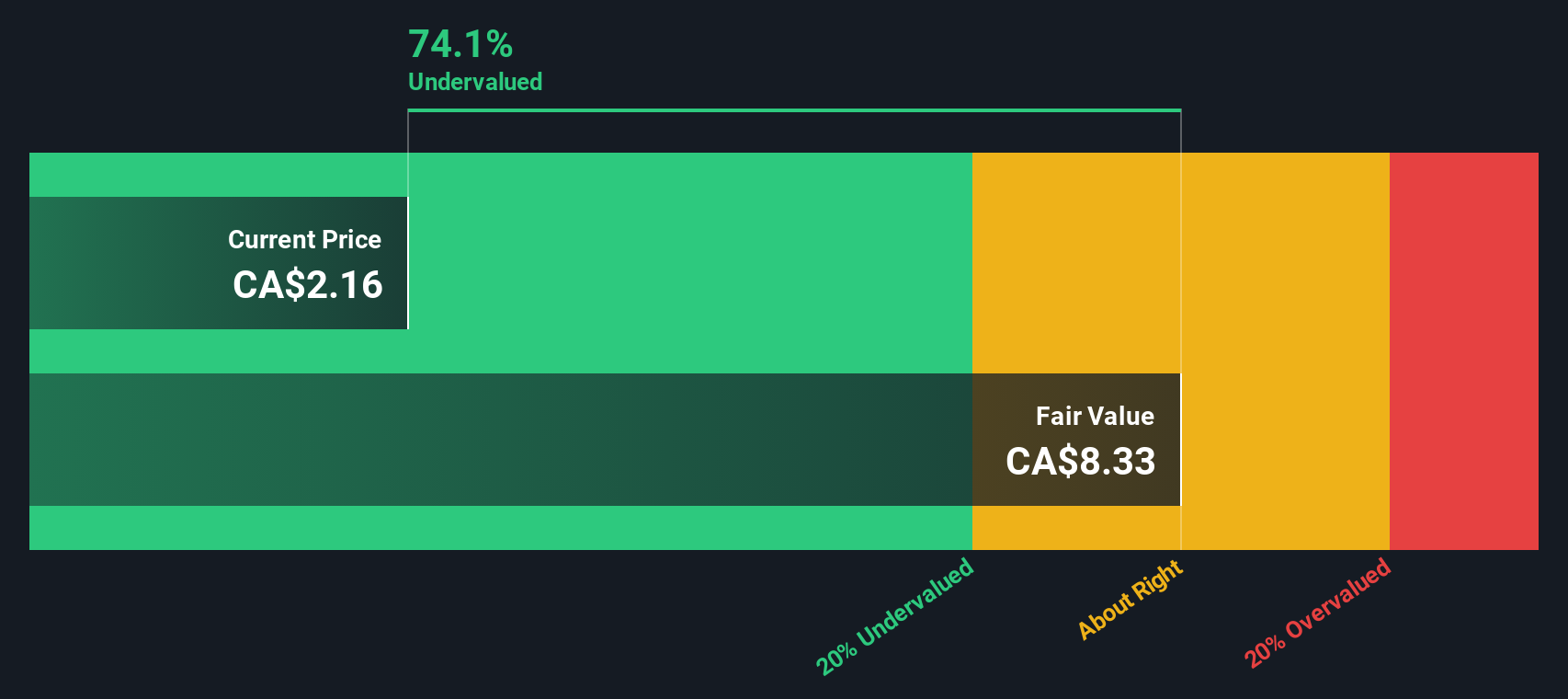

With the stock still trading at a steep discount to analyst targets despite a hefty five year return and fresh capital in hand, is Ur-Energy quietly undervalued, or is the market already baking in the next leg of growth?

Price-to-Sales of 12.2x: Is it justified?

Ur-Energy trades at CA$1.76, and the market is effectively valuing the business at 12.2 times its trailing twelve month sales, a steep premium to much of the Canadian Oil and Gas space.

The price to sales ratio compares a company’s market value to its revenue, a useful lens for loss making or early stage resource names where earnings remain negative. For Ur-Energy, which is still unprofitable and investing heavily in uranium projects, investors are clearly paying up today on the expectation that future production and cash flows will justify this higher sales multiple over time.

Against the broader Canadian Oil and Gas industry, where the average price to sales multiple sits around 2.8 times, Ur-Energy’s 12.2 times stands out as aggressively higher. This implies the market is already assigning it a premium growth and quality narrative relative to traditional producers. Yet when compared with the estimated fair price to sales ratio of 0 times from our modelling, that same 12.2 times looks extreme, suggesting considerable downside if sentiment were to revert toward that fair ratio anchor.

Explore the SWS fair ratio for Ur-Energy

Result: Price-to-Sales of 12.2x (OVERVALUED)

However, weak profitability and any slowdown in uranium demand or permitting progress could quickly challenge the lofty sales multiple the market currently assumes.

Find out about the key risks to this Ur-Energy narrative.

Another View on Value: Our DCF Take

While the 12.2 times sales multiple appears rich, our DCF model suggests a very different view, indicating fair value closer to CA$6.55 versus today’s CA$1.76. That indicates Ur-Energy may be trading below this estimate of value if long term cash flow plans occur as modeled, but how much confidence should be placed in those forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ur-Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ur-Energy Narrative

If you would rather dig into the numbers yourself and come to your own conclusions, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Ur-Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the next move in Ur-Energy plays out, give yourself options by scanning fresh opportunities across sectors so you are not caught watching from the sidelines.

- Look for potential multi baggers early by zeroing in on fast moving names using these 3611 penny stocks with strong financials before the crowd spots them.

- Explore candidates at the intersection of medicine and algorithms by using these 30 healthcare AI stocks.

- Identify income focused candidates that may help support your returns through market swings by filtering for robust payers via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报