Clas Ohlson (OM:CLAS B) Valuation Check After Robust Q2 Growth and Expanding Online Profitability

Clas Ohlson (OM:CLAS B) just delivered another strong Q2 update, with higher sales, wider margins and steady online growth. This gives investors fresh numbers to test whether the recent share pullback is overdone.

See our latest analysis for Clas Ohlson.

Even after a sharp 7 day share price pullback and a 90 day share price return of minus 26.5%, Clas Ohlson still has a 5 year total shareholder return above 370%. This suggests that long term momentum may remain intact despite short term nerves around positioning and valuation.

If this kind of recovery story has your attention, it could be a good moment to broaden your watchlist and discover fast growing stocks with high insider ownership.

With profits rising, online sales accelerating and the share price still trading at a hefty discount to analyst targets, the key question now is simple: is Clas Ohlson a bargain or is future growth already priced in?

Most Popular Narrative: 22.8% Undervalued

With Clas Ohlson last closing at SEK285.6 against a narrative fair value of SEK370, the current pullback is cast in a very different light.

The focus on a profitable online business, with online sales growth at 22%, aims to continually increase the share of online sales, positively impacting revenue and potentially improving net margins.

Want to see how steady growth, rising margins and a lower future earnings multiple still point to upside? Potentially surprising assumptions sit behind that fair value. Read on to uncover them.

Result: Fair Value of $370 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, currency swings and rising freight and wage costs could quickly squeeze margins, challenging both the upbeat growth story and that 2028 earnings trajectory.

Find out about the key risks to this Clas Ohlson narrative.

Another Angle on Value

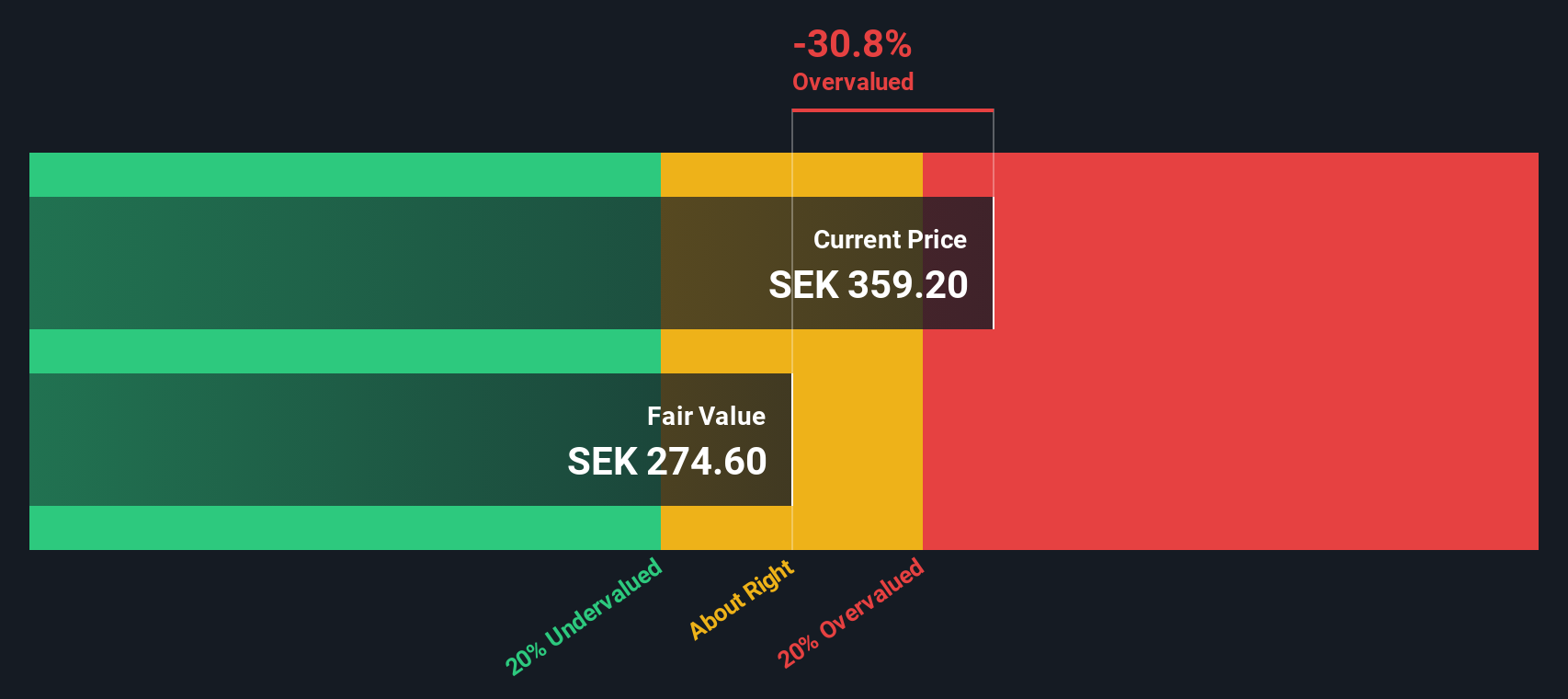

Our SWS DCF model reaches a very different conclusion, putting fair value closer to SEK216.76, which would make today’s SEK285.6 share price look overvalued rather than cheap. When two methods disagree this sharply, which set of assumptions do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Clas Ohlson for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Clas Ohlson Narrative

If you are not fully convinced by this view, or simply prefer to dig into the numbers yourself, you can shape your own in just a few minutes, Do it your way.

A great starting point for your Clas Ohlson research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, put Simply Wall Street to work and uncover fresh opportunities that match your strategy with targeted, data driven stock screens.

- Capture potential multi baggers early by scanning these 3611 penny stocks with strong financials where smaller companies show robust balance sheets and improving fundamentals.

- Ride powerful secular trends by reviewing these 30 healthcare AI stocks blending medical innovation with advanced algorithms for scalable growth prospects.

- Secure a steadier income stream by focusing on these 13 dividend stocks with yields > 3% that combine reliable payouts with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报