Assessing Pinnacle West Capital (PNW)’s Valuation After Its Recent Share Price Strength

Pinnacle West Capital (PNW) has quietly outperformed broader utilities over the past year, and at around $87 a share, investors are starting to ask whether the recent run still leaves upside.

See our latest analysis for Pinnacle West Capital.

At $87.81, the stock has been edging higher this year, with a 4.15% year to date share price return and a solid 5 year total shareholder return of 39.37%, suggesting steady momentum rather than a speculative spike.

If Pinnacle West’s steady climb has you rethinking your utility exposure, it could be worth comparing it with other stable growth stocks screener (None results) to see what else fits your strategy.

With earnings still growing, analysts seeing nearly 10% upside to their targets, and the shares trading close to intrinsic value estimates, is Pinnacle West undervalued today or already reflecting its next leg of growth?

Most Popular Narrative Narrative: 8.6% Undervalued

With Pinnacle West closing at $87.81 against a narrative fair value just above $96, the current pricing leaves a modest upside gap still open.

The analysts have a consensus price target of $95.538 for Pinnacle West Capital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $109.0, and the most bearish reporting a price target of just $80.0.

If you are curious what justifies a higher value for a steady regulated utility, and why projected margins and earnings multiples look closer to a growth story than a bond proxy, explore the full narrative to see which assumptions are most important in this upside case.

Result: Fair Value of $96.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering regulatory lag and potential overbuilding, if data center demand disappoints, could quickly challenge today’s upbeat earnings and valuation assumptions.

Find out about the key risks to this Pinnacle West Capital narrative.

Another View on Value

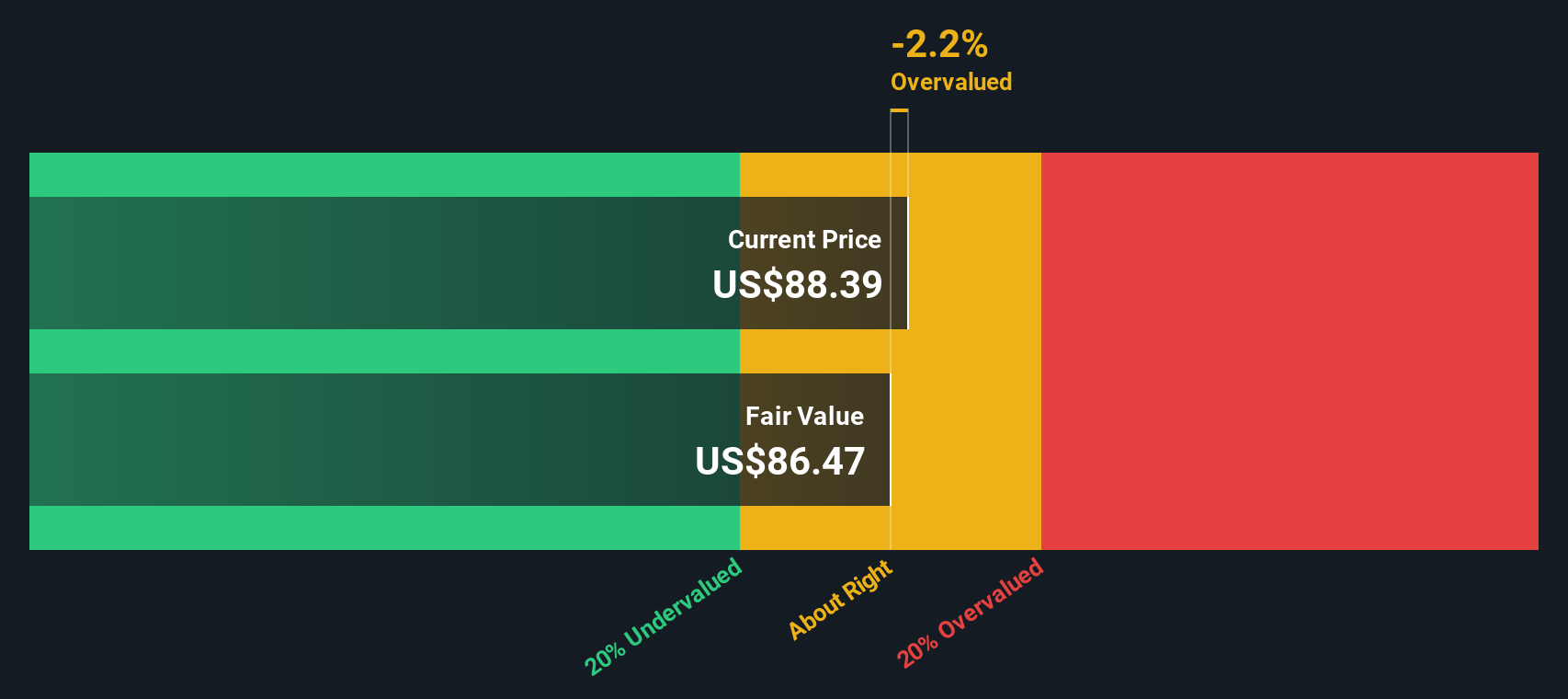

Our DCF model is less generous than the narrative fair value, with Pinnacle West trading slightly above our $86.32 estimate, which implies the shares are modestly overvalued rather than 8.6% undervalued. If cash flows, not multiples, tell the truer story, is upside already priced in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pinnacle West Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pinnacle West Capital Narrative

If you see Pinnacle West’s story differently or want to dig into the numbers yourself, you can build a tailored narrative in minutes, Do it your way.

A great starting point for your Pinnacle West Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one company, you could miss stronger opportunities. Let Simply Wall Street’s powerful screener surface stocks that match your strategy.

- Capture overlooked value by targeting companies trading below intrinsic worth with these 908 undervalued stocks based on cash flows, grounded in robust cash flow potential.

- Ride structural shifts in healthcare by focusing on innovators harnessing algorithms, automation and real time insights through these 30 healthcare AI stocks.

- Position yourself at the frontier of digital finance by assessing businesses building exchanges, infrastructure and applications across these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报