DBS (SGX:D05) Valuation Check After Record Profits, S$8b Capital Plan and Strategy Shift Under New CEO

DBS Group Holdings (SGX:D05) has just paired record profits with an S$8 billion capital return plan through 2027, while new CEO Tan Su Shan sharpens the strategy around digitalisation, regional deals, and fee driven growth.

See our latest analysis for DBS Group Holdings.

Those record numbers and the S$8 billion capital return plan appear to be resonating, with the share price at S$55.04 and a strong year to date share price return. The three year and five year total shareholder returns suggest momentum has been building over a longer horizon.

If DBS has you rethinking what quality income and growth look like in financials, it could be worth exploring fast growing stocks with high insider ownership as another source of ideas.

With double digit returns, record earnings and an S$8 billion capital return plan already on the table, the question now is simple: is DBS still undervalued or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 2% Undervalued

With the most followed narrative putting fair value near S$56.17 against a S$55.04 close, the gap is narrow but still signals upside potential.

Digital asset and payments ecosystem initiatives, leveraging early investments and regulatory engagement, position DBS to benefit from accelerated digital adoption and mobile penetration across Southeast Asia, supporting scalable high margin business lines and enhancing non interest income streams.

Want to see what powers that valuation gap? This narrative leans on modest revenue expansion, resilient margins, and a richer earnings multiple than regional banks usually command. Curious which precise financial levers justify that premium view and how far they could stretch fair value from here? Read on to unpack the full playbook behind the numbers.

Result: Fair Value of $56.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimistic path could be derailed by prolonged margin pressure from lower interest rates, as well as lingering regulatory constraints on capital deployment and digital growth.

Find out about the key risks to this DBS Group Holdings narrative.

Another Take On Valuation

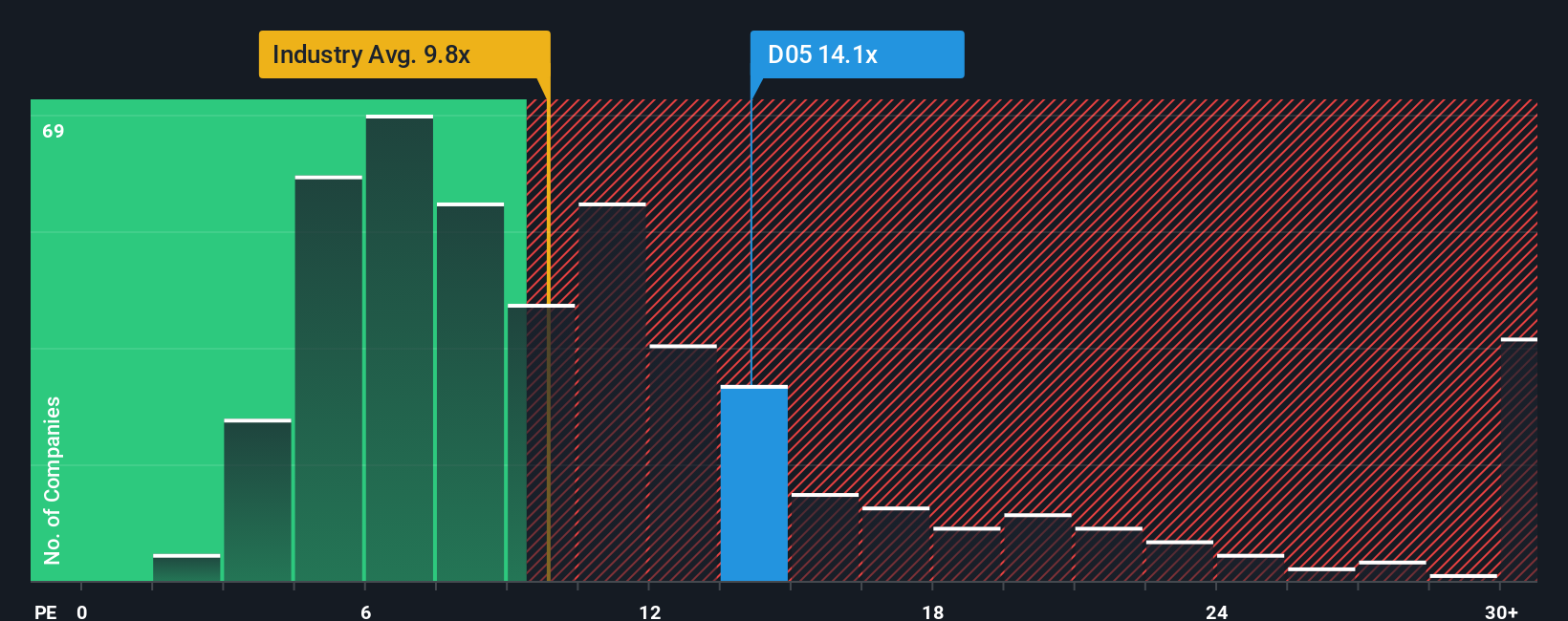

Our valuation checks using a single price to earnings yardstick paint a different picture. DBS screens as expensive at 14.1 times earnings versus a fair ratio of 12.4 times and is well above both Asian banks at 9.8 times and close peers at 11.2 times. Is the market overpaying for quality here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DBS Group Holdings Narrative

If you are not fully convinced by this view or would rather test your own assumptions against the data, you can build a custom DBS narrative in just a few minutes: Do it your way.

A great starting point for your DBS Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next round of opportunities using the Simply Wall St Screener, so potential winners never slip past your radar.

- Capture powerful long term compounding potential by reviewing these 13 dividend stocks with yields > 3% that combine income strength with resilient business models.

- Position yourself early in structural growth trends by scanning these 26 AI penny stocks poised to benefit from accelerating adoption of intelligent automation.

- Sharpen your value edge by targeting these 908 undervalued stocks based on cash flows where market prices still trail underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报