A look at Construction Partners (ROAD) valuation after upbeat EBITDA outlook and fastest peer-group revenue growth

Construction Partners (ROAD) just delivered a mixed Q3 that still managed to impress the market, with revenue roughly matching forecasts, organic growth falling short, yet full year EBITDA guidance moving higher.

See our latest analysis for Construction Partners.

The upbeat full year EBITDA outlook appears to be outweighing the organic growth shortfall, with the stock’s recent 7 day share price return of 6.83% helping rebuild momentum after a weaker 90 day patch, while multi year total shareholder returns remain exceptional.

If this kind of execution has you thinking about where else growth and ownership incentives might align, now is a good time to explore fast growing stocks with high insider ownership.

With ROAD trading below analyst targets despite strong multi year returns and upgraded EBITDA guidance, investors face a key question: is this still an underappreciated infrastructure growth story, or is the market already pricing in its next leg higher?

Most Popular Narrative: 14% Undervalued

With Construction Partners last closing at $110.08 against a narrative fair value of $128, the valuation story leans supportive of further upside potential.

Strong backlog coverage (80–85% of next 12 months' revenue) and recurring state/city DOT contracts, underpinned by secular demand for maintenance and expansion of aging U.S. road infrastructure, provide visibility and stability for future cash flows and support sustainable long-term earnings growth.

Curious how those seemingly routine road contracts translate into a premium earnings multiple and double digit growth path? The narrative leans on bold revenue, margin, and future valuation assumptions that could surprise anyone used to slower moving industrial names.

Result: Fair Value of $128 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that premium narrative could unravel if public infrastructure budgets tighten or regional weather and demand shocks disrupt backlog conversion and margin expansion.

Find out about the key risks to this Construction Partners narrative.

Another Angle on Valuation

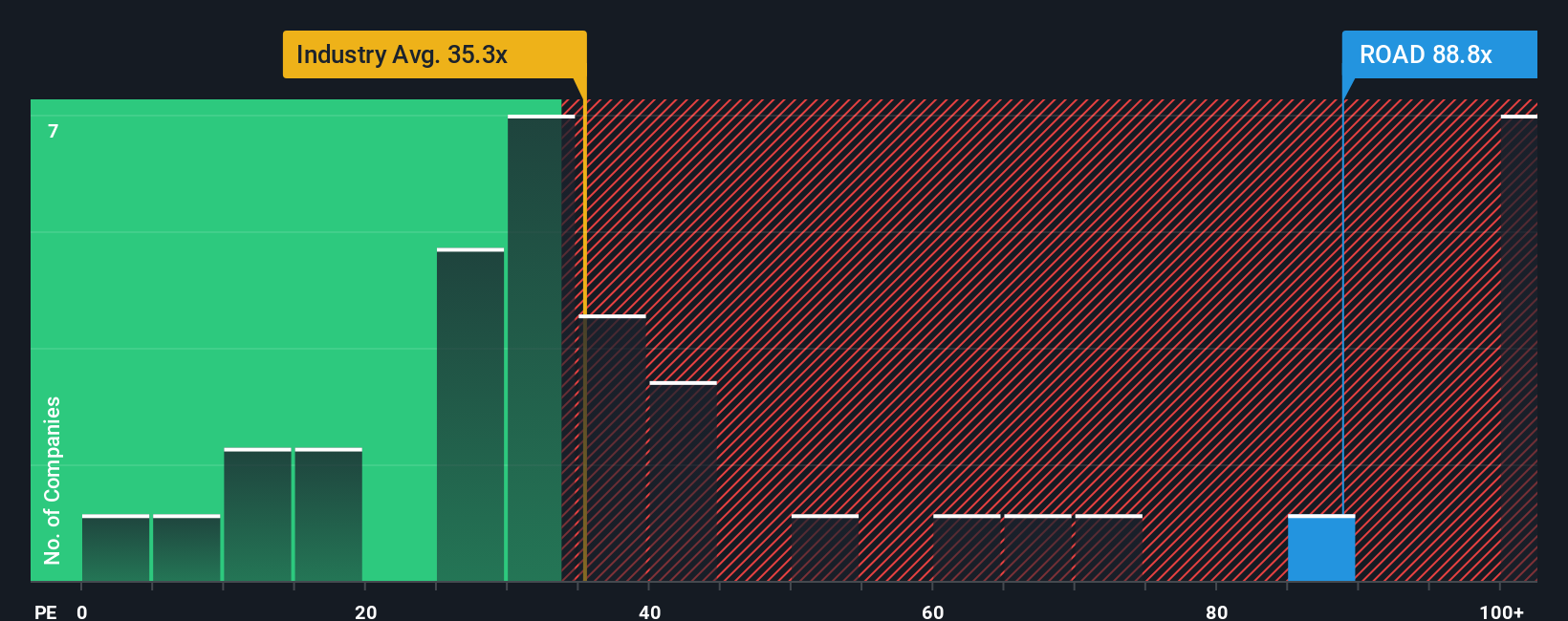

While the narrative fair value suggests upside, our earnings based lens tells a different story. ROAD trades on a P/E of 61.1x versus 32.3x for the US Construction industry and a fair ratio of 32.7x, which implies the market may already be baking in a lot of future growth. How comfortable are you paying that kind of premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Construction Partners Narrative

If this perspective does not fully match your view and you prefer to rely on your own work, you can build a fresh narrative in just a few minutes, Do it your way.

A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop at a single strong idea. Use the Simply Wall St screener to uncover fresh opportunities before everyone else is talking about them.

- Capture potential mispricings by targeting market laggards with improving fundamentals through these 908 undervalued stocks based on cash flows.

- Tap into structural growth in automation, data, and intelligent software by focusing on these 26 AI penny stocks.

- Strengthen your income stream with companies that pair stability and yield using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报