JFrog (FROG): Has the Recent Share Price Surge Left Any Valuation Upside?

JFrog (FROG) has quietly turned into one of the stronger software stories this year, with the stock climbing about 40% over the past 3 months and more than doubling year to date.

See our latest analysis for JFrog.

That surge has not come out of nowhere, with upbeat execution in its software supply chain platform and growing interest in DevSecOps tools helping drive a 16.7% 1 month share price return, as well as a powerful uptrend in longer term total shareholder returns.

If JFrog’s run has you thinking about what else might be gaining traction, this is a good moment to scan high growth tech and AI stocks for other high momentum software and AI names.

Yet with JFrog now trading almost exactly at Wall Street’s price target and still posting GAAP losses, investors face a dilemma: is there overlooked upside left in this DevSecOps leader, or has the market already priced in its next leg of growth?

Most Popular Narrative: 0.3% Undervalued

With JFrog’s last close at $68.98 sitting almost on top of the narrative fair value of $69.22, the story hinges on future growth and margins rather than a bargain price today.

The need for hybrid and multi cloud deployment models is intensifying as organizations seek cost predictability, compliance, and flexibility when running AI workloads. JFrog's platform, architected from inception for both cloud and on prem/hybrid, appeals to enterprises facing this complexity, helping to secure large, multi year enterprise contracts, boost retention, and expand average deal size.

Want to see why this outlook leans on brisk revenue growth, stronger margins, and a punchy future earnings multiple, not today’s profits? The narrative spells out the bold financial path behind that near perfect alignment between price and fair value, and the assumptions that must hold for it to last.

Result: Fair Value of $69.22 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat path could be disrupted if big enterprise deals slip or security growth lags, which would test confidence in JFrog’s premium valuation.

Find out about the key risks to this JFrog narrative.

Another View: Rich On Sales Metrics

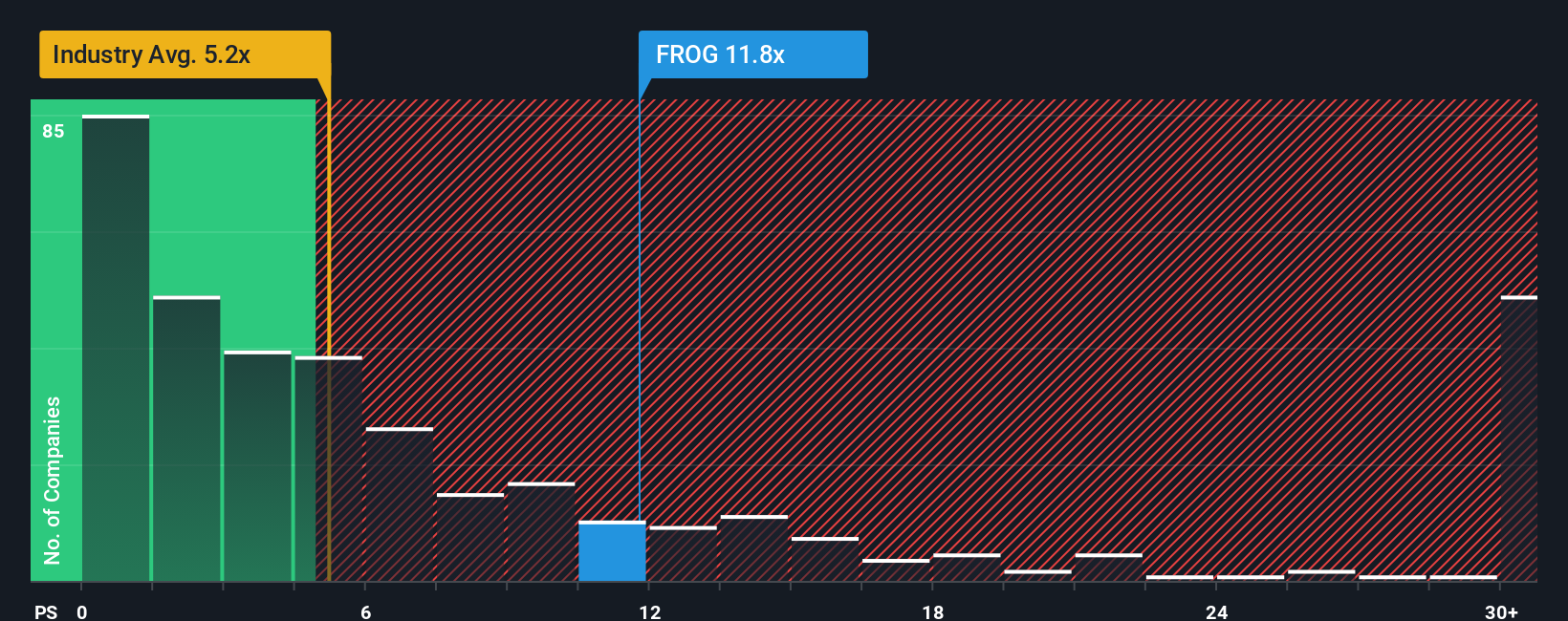

While the narrative fair value suggests JFrog is about fairly priced, its price to sales ratio of 16.2 times looks stretched versus the US software industry at 4.9 times and peers at 8.2 times, and even the fair ratio of 7.2 times. This raises the question of how long investors will keep paying up for this much growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JFrog Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in under three minutes, Do it your way.

A great starting point for your JFrog research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at JFrog. Use the Simply Wall Street Screener today to spot fresh opportunities before the crowd and keep your portfolio ahead of the market.

- Capture potential multi baggers early by targeting fast moving, higher risk names through these 3611 penny stocks with strong financials that still show solid underlying financial strength.

- Position yourself at the heart of the AI transformation by focusing on these 26 AI penny stocks that pair powerful growth narratives with tangible business traction.

- Identify potential value opportunities by zeroing in on these 908 undervalued stocks based on cash flows where market pessimism may have pushed prices below intrinsic cash flow estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报