Hubbell (HUBB): Assessing Valuation After Stronger Profits, Better Cash Flow and Higher 2025 EPS Guidance

Hubbell (HUBB) has quietly tightened its fundamentals, with improving operating profits, stronger free cash flow margins, and a raised 2025 adjusted EPS outlook, giving management more flexibility in how it rewards shareholders.

See our latest analysis for Hubbell.

That improving backdrop has not translated into runaway gains yet. The latest $448.0 share price sits on a modest year to date share price return of 6.7 percent and a far stronger three year total shareholder return of around 101 percent, suggesting long term momentum remains firmly intact.

If Hubbell’s steady compounding appeals, it may be worth seeing what else fits that profile by exploring fast growing stocks with high insider ownership for other potential standouts.

With profits climbing, cash generation strengthening, and analysts still seeing upside to today’s price, the key question now is whether Hubbell remains underappreciated or if the share price already reflects years of future growth.

Most Popular Narrative Narrative: 6.4% Undervalued

Compared with Hubbell’s last close at $448, the most followed narrative points to a higher fair value, setting up a case for modest upside.

The analysts have a consensus price target of $456.727 for Hubbell based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $511.0, and the most bearish reporting a price target of just $383.0.

Curious what kind of earnings curve and margin lift justify that premium price tag, and why the projected future multiple is still below industry leaders? The full narrative unpacks the exact growth runway, profitability path, and valuation math that underpin this fair value call.

Result: Fair Value of $478.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated tariff and raw material costs, along with softer grid automation demand, could pressure margins and challenge expectations for steady earnings expansion.

Find out about the key risks to this Hubbell narrative.

Another Angle on Valuation

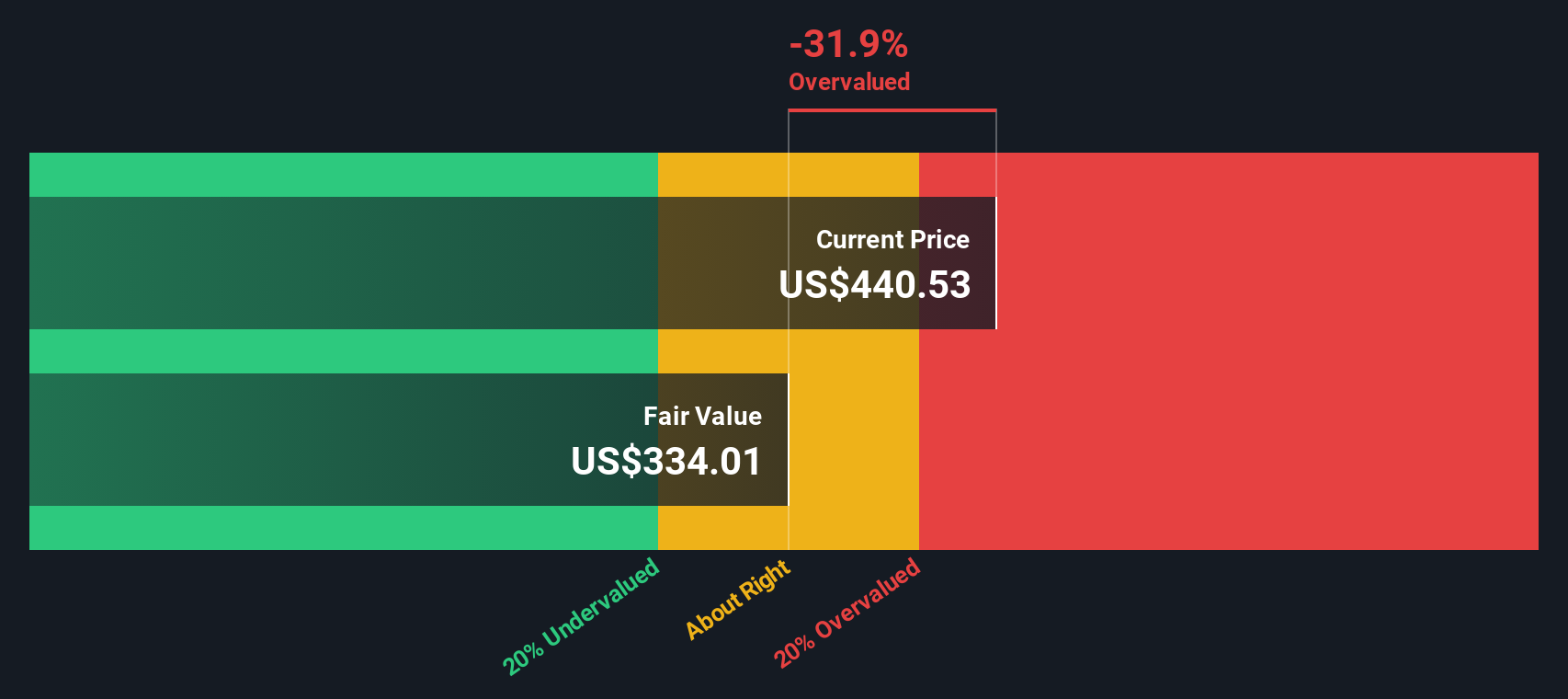

Our SWS DCF model presents a more cautious view, indicating that Hubbell, at $448, appears overvalued relative to an estimated fair value of $342.09. If analyst targets suggest potential upside while cash flow analysis indicates possible downside, which perspective should investors consider more carefully?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hubbell Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Hubbell.

Looking for more investment ideas?

Step up your research and tap into fresh opportunities with targeted stock lists on Simply Wall Street’s Screener before the market wakes up to them.

- Capture mispriced quality by scanning these 908 undervalued stocks based on cash flows that the market has not fully recognized yet, giving you a potential edge on future re-ratings.

- Ride structural growth by focusing on these 30 healthcare AI stocks using data, automation, and predictive analytics to reshape how care is delivered and monetized.

- Position ahead of the next wave of financial innovation with these 80 cryptocurrency and blockchain stocks at the forefront of blockchain infrastructure, payments, and digital asset ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报