Aluminum Corporation of China (SEHK:2600): Valuation Check After Sector Pressure and Supercycle Debate

Aluminum Corporation of China (SEHK:2600) dropped around 6% as non ferrous metal names came under pressure, even while talk of a new industrial metals supercycle and looming rate hikes pulled investor sentiment in opposite directions.

See our latest analysis for Aluminum Corporation of China.

Despite today's drop, the stock is still coming off a powerful run, with the share price delivering a roughly 46% return over the last 90 days and a three year total shareholder return above 250%. This suggests momentum is cooling rather than breaking.

If this move in Aluminum Corporation of China has you thinking more broadly about cyclical names, it could be a good moment to explore auto manufacturers as another way to position around industrial demand trends.

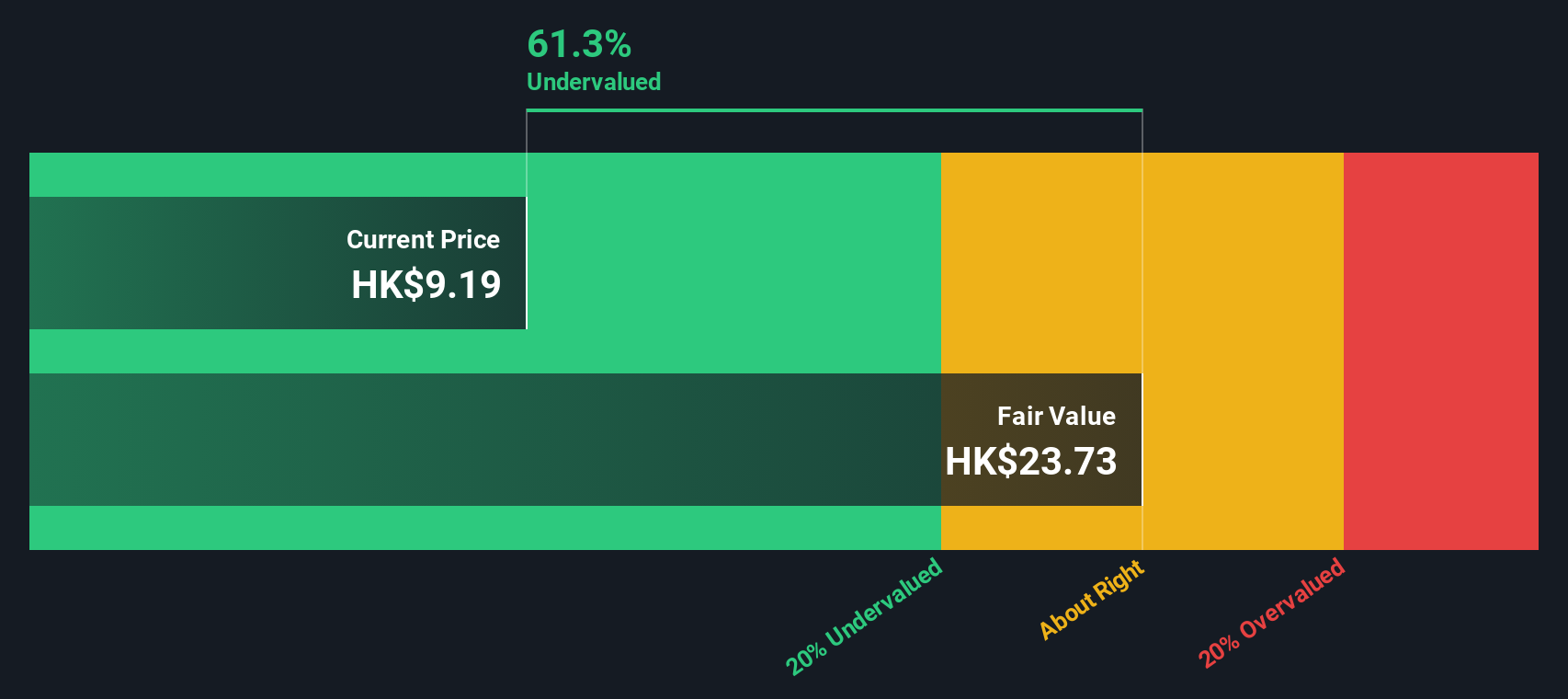

With shares trading only slightly below analyst targets yet at a hefty intrinsic discount, the key question now is whether investors still have upside left to capture or if the market has already priced in the next leg of growth.

Price to Earnings of 12.2x: Is it justified?

On a trailing price to earnings ratio of 12.2x at HK$11.15, Aluminum Corporation of China screens as meaningfully undervalued against both its peers and our intrinsic view.

The price to earnings multiple compares the current share price to per share earnings. It is a straightforward way to judge how much investors are paying for each unit of profit in a cyclical, capital intensive sector like metals and mining.

Here, the market is assigning Aluminum Corporation of China a 12.2x multiple. Our SWS DCF model estimates fair value closer to HK$25.25, implying the shares trade at roughly a 55.8% discount to intrinsic value and at a notable discount to similar Hong Kong metals and mining names.

Relative to the industry average of 17.1x and an estimated fair price to earnings ratio of 16.3x, the current multiple looks compressed. This suggests investors have yet to fully reflect the company’s recent earnings acceleration and improved margins in the valuation they are willing to pay.

Explore the SWS fair ratio for Aluminum Corporation of China

Result: Price-to-Earnings of 12.2x (UNDERVALUED)

However, lingering policy uncertainty in China and a potential reversal in global metals prices could quickly undermine both earnings momentum and the valuation discount.

Find out about the key risks to this Aluminum Corporation of China narrative.

Another View on Value

Our SWS DCF model points to a very different picture, with fair value around HK$25.25 versus the current HK$11.15, suggesting Aluminum Corporation of China could still be deeply undervalued. If cash flows are right and sentiment turns, is the market mispricing a long runway of earnings here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aluminum Corporation of China for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aluminum Corporation of China Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Aluminum Corporation of China.

Looking for more investment ideas?

Next, put your research to work by running targeted screens on Simply Wall Street, so you do not miss high conviction opportunities hiding in plain sight.

- Capture potential multibagger upside by scanning these 3611 penny stocks with strong financials that already show solid financial underpinnings instead of speculative hype.

- Position early in powerful technology trends by filtering for these 26 AI penny stocks that blend strong growth prospects with real business traction.

- Identify potentially attractive entry points by focusing on these 908 undervalued stocks based on cash flows where current prices may be below the estimated value implied by the company’s fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报