Premier Energy PLC (BVB:PE) Stock Catapults 27% Though Its Price And Business Still Lag The Market

Despite an already strong run, Premier Energy PLC (BVB:PE) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 45%.

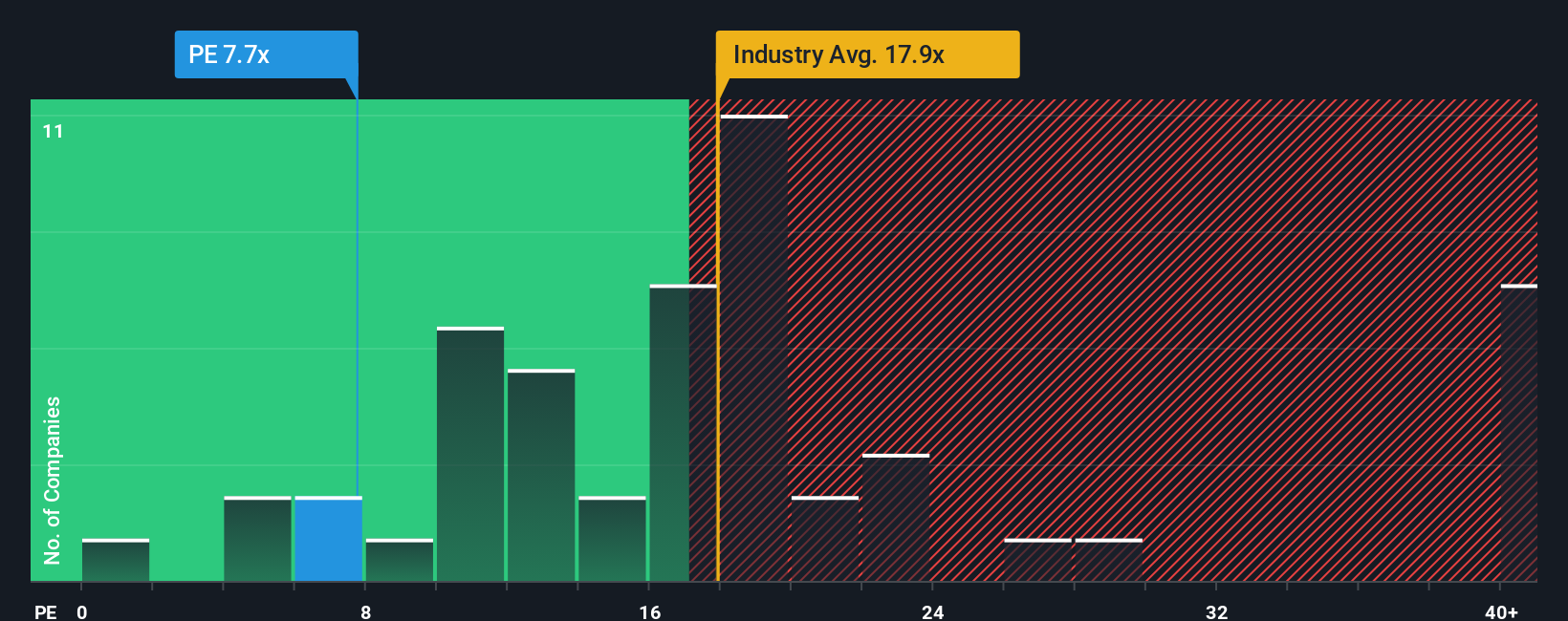

In spite of the firm bounce in price, Premier Energy's price-to-earnings (or "P/E") ratio of 7.7x might still make it look like a buy right now compared to the market in Romania, where around half of the companies have P/E ratios above 15x and even P/E's above 39x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Premier Energy certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Premier Energy

How Is Premier Energy's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Premier Energy's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 104%. However, this wasn't enough as the latest three year period has seen a very unpleasant 56% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 10% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Premier Energy's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

The latest share price surge wasn't enough to lift Premier Energy's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Premier Energy maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Premier Energy that you need to be mindful of.

You might be able to find a better investment than Premier Energy. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报