Does MVV Energie’s Higher Dividend and Green Capex Shift Its Capital Allocation Story (XTRA:MVV1)?

- MVV Energie AG recently reported full-year results for the 12 months to 30 September 2025, with sales falling to €6,001 million and net income to €124.54 million, leading to basic earnings per share from continuing operations of €1.89.

- Despite lower profits, the company lifted its dividend to €1.30 per share, increased investments in green heat, renewables, and grid expansion by about 20%, and reaffirmed its ambition to be climate-positive by 2035 while cautioning that earnings may be lower in the 2026 financial year.

- Next, we assess how MVV Energie’s higher green investment and dividend increase shape its investment narrative following the recent earnings announcement.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is MVV Energie's Investment Narrative?

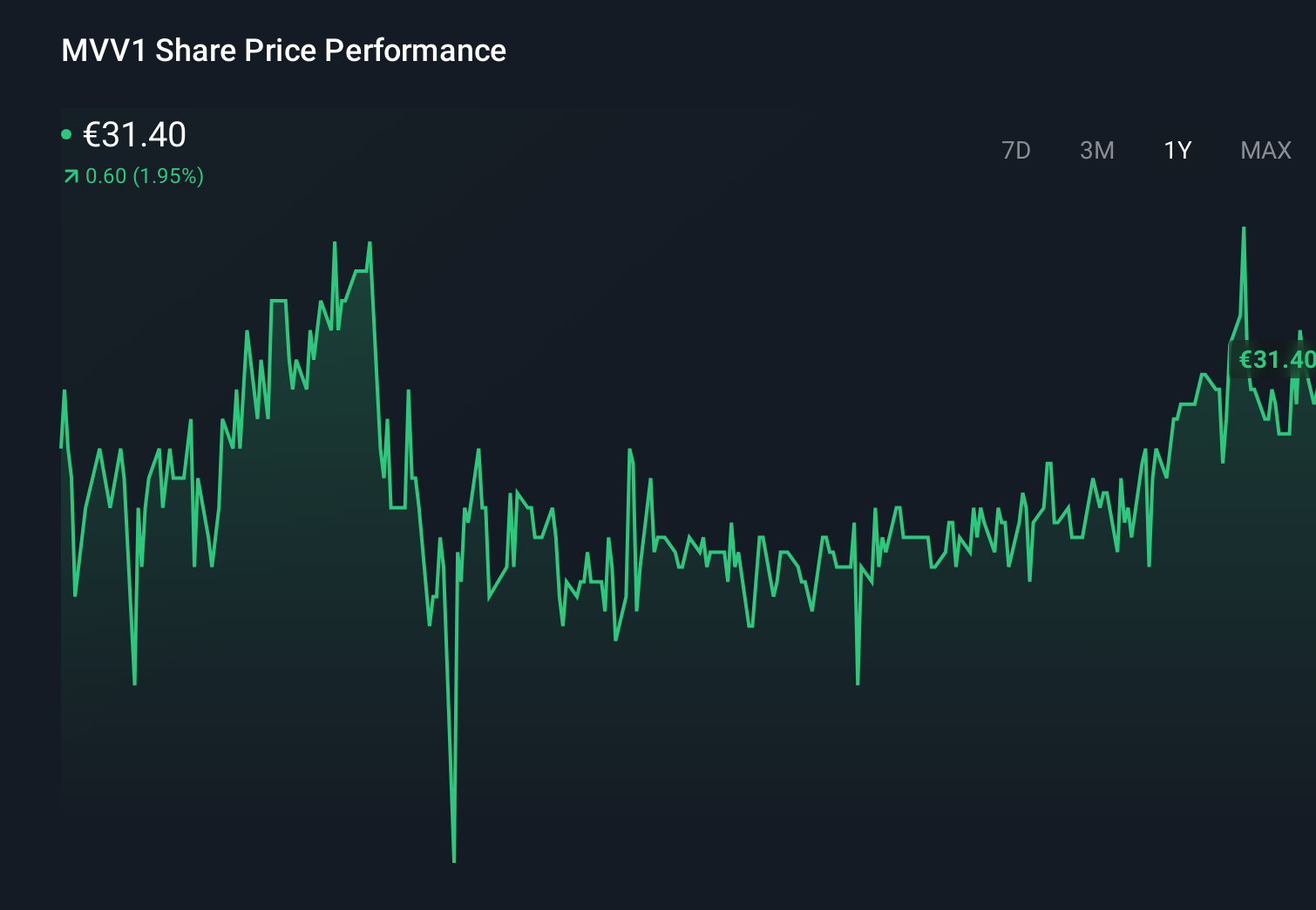

To own MVV Energie today, you need to be comfortable with a utility that is trading on a mid-teens earnings multiple, carries high debt and is leaning hard into a capital-intensive energy transition story. The latest results, with profits easing and the dividend nudged up to €1.30 per share while green investments rose about 20%, reinforce that near-term earnings are being traded for progress on climate-positive ambitions. Management has already flagged that 2026 earnings could be lower, which likely keeps upcoming quarterly results and any update on cash flow and balance sheet strength as the key short-term catalysts. So far the share price reaction has been muted, suggesting the market expected some moderation in profits, but it also means execution and funding of the transition remain the biggest swing factors from here.

However, investors should also be aware of how MVV’s high debt load interacts with softer earnings. MVV Energie's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster between €18.69 and €24.67, underscoring how differently individual investors see MVV’s transition-heavy story. Set that against the recent earnings drop and higher dividend, and you can see why opinions split over how comfortably the balance sheet can support both investment and payouts over time.

Explore 2 other fair value estimates on MVV Energie - why the stock might be worth 41% less than the current price!

Build Your Own MVV Energie Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MVV Energie research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free MVV Energie research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MVV Energie's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报