Is STAG Industrial Still Attractive After Strong 5 Year Gains and New Logistics Leases?

- Wondering if STAG Industrial is still a smart way to play the e commerce logistics trend, or if the stock has quietly moved beyond a good value? That is exactly what we are going to unpack here.

- Despite a small pullback of 2.9% over the last week and 2.0% over the past month, STAG is still up 14.2% year to date, with gains of 9.4% over 1 year, 31.2% over 3 years, and 52.1% over 5 years. This suggests the market has steadily warmed up to its story.

- Recent headlines have focused on STAG expanding its industrial portfolio in key distribution hubs and locking in long term leases with tenants tied to e commerce and logistics, underscoring the durability of its cash flows. At the same time, broader market chatter about interest rates and real estate sensitivity has kept REITs like STAG under closer scrutiny.

- Right now, STAG scores a 4 out of 6 on our valuation checks, suggesting it looks undervalued on several, but not all, metrics. You can see the breakdown in this valuation score. Next we will walk through the usual valuation approaches and then finish with a more complete way to think about what the stock is really worth.

Approach 1: STAG Industrial Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what STAG Industrial is worth today by projecting its adjusted funds from operations into the future and discounting those cash flows back to the present.

STAG is currently generating about $458.2 Million in free cash flow, and analysts expect this to grow steadily over time as the portfolio expands and rents reset higher. Based on analyst forecasts and Simply Wall St extrapolations, free cash flow could reach roughly $840.3 Million by 2035, reflecting a healthy but moderating growth path as the business matures.

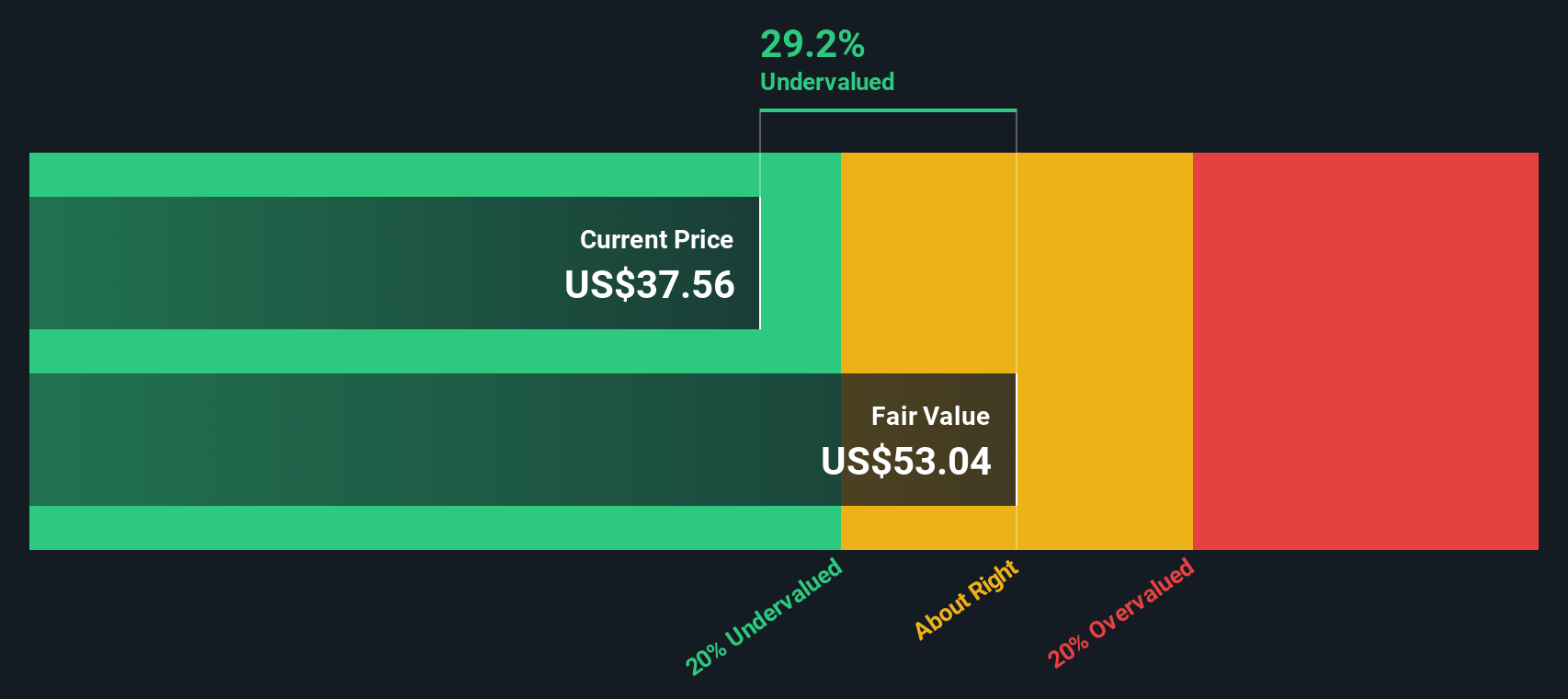

When these projected cash flows are discounted back to today using a reasonable required return, the model arrives at an estimated intrinsic value of about $53.10 per share. Compared with the current market price, this implies STAG trades at roughly a 29.0% discount to its DCF fair value, suggesting investors are not fully pricing in its long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests STAG Industrial is undervalued by 29.0%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: STAG Industrial Price vs Earnings

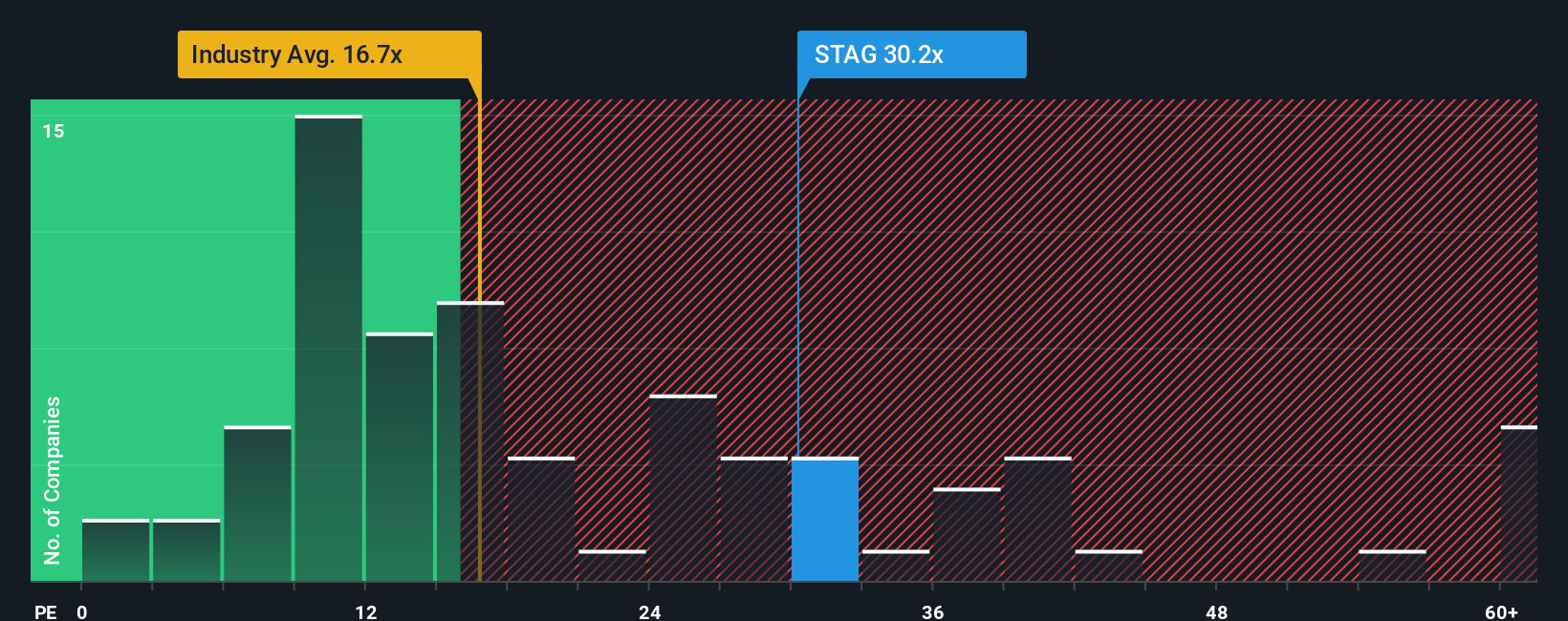

For profitable companies like STAG Industrial, the price to earnings (PE) ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher risk should lead to a lower, more conservative multiple.

STAG currently trades on a PE of about 29.2x, which is well above the Industrial REITs average of roughly 16.2x, but slightly below the 30.2x average of its closest peers. To move beyond simple comparisons, Simply Wall St models a Fair Ratio for STAG of around 31.5x. This reflects what the multiple should be when you factor in its earnings growth outlook, profit margins, industry positioning, market cap and specific risk profile.

This Fair Ratio framework is more robust than just lining STAG up against the sector because it adjusts for the company’s own fundamentals rather than assuming all REITs deserve the same multiple. With the shares at 29.2x versus a Fair Ratio of 31.5x, the stock screens as modestly undervalued on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your STAG Industrial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple framework on Simply Wall St’s Community page that lets you attach a clear story, your assumptions for STAG Industrial’s future revenue, earnings and margins, and a resulting fair value to the share price. It then continually compares that Fair Value to the current Price so you can see when your thesis says buy, hold or sell, while updating dynamically as new news or earnings arrive. One STAG Narrative might assume leasing momentum, disciplined acquisitions and resilient rent spreads justify a fair value near the top of analyst expectations around 47 dollars. A more cautious Narrative could focus on longer lease up times, uneven market growth and pressure on margins to arrive closer to the low end near 35 dollars, giving you a structured but accessible way to express your view and act on it.

Do you think there's more to the story for STAG Industrial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报