STAAR Surgical (STAA): Evaluating Valuation After Recent Share Price Weakness

STAAR Surgical (STAA) has quietly slipped over the past month, even as its revenue keeps growing and profitability improves. That gap between share performance and business trends is what makes the stock interesting now.

See our latest analysis for STAAR Surgical.

Over the past year, STAAR Surgical’s share price has largely moved sideways, despite a recent 1 month share price return of minus 8.32 percent and a 1 year total shareholder return of minus 2.94 percent. This suggests sentiment is still cautious rather than turning bullish.

If you are comparing STAAR’s trajectory with other medical names, this could be a good moment to explore similar opportunities across healthcare stocks.

With shares languishing after multi year underperformance despite double digit revenue growth and a sizeable intrinsic value discount, investors now face a key question: is STAAR Surgical a mispriced growth story, or is the market already discounting its comeback?

Most Popular Narrative: 6.7% Undervalued

With STAAR Surgical last closing at $24.13 against a narrative fair value of $25.88, the story frames a modest upside built on improving fundamentals.

STAAR Surgical has significant cash reserves and no debt, providing a strong financial base to navigate the current challenges, reduce production outputs temporarily, and invest selectively in growth initiatives, potentially stabilizing earnings and providing upside if conditions improve.

Want to see what kind of revenue surge, margin lift, and earnings turnaround are baked into that upside case? The narrative leans on ambitious growth shifts, changing profitability, and a future valuation multiple that usually belongs to market darlings. Curious how those moving parts stack up to justify today’s fair value tag?

Result: Fair Value of $25.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering weakness in China, along with ongoing distributor and inventory challenges, could easily derail those upbeat growth and valuation assumptions.

Find out about the key risks to this STAAR Surgical narrative.

Another View: Growth, But At A Price

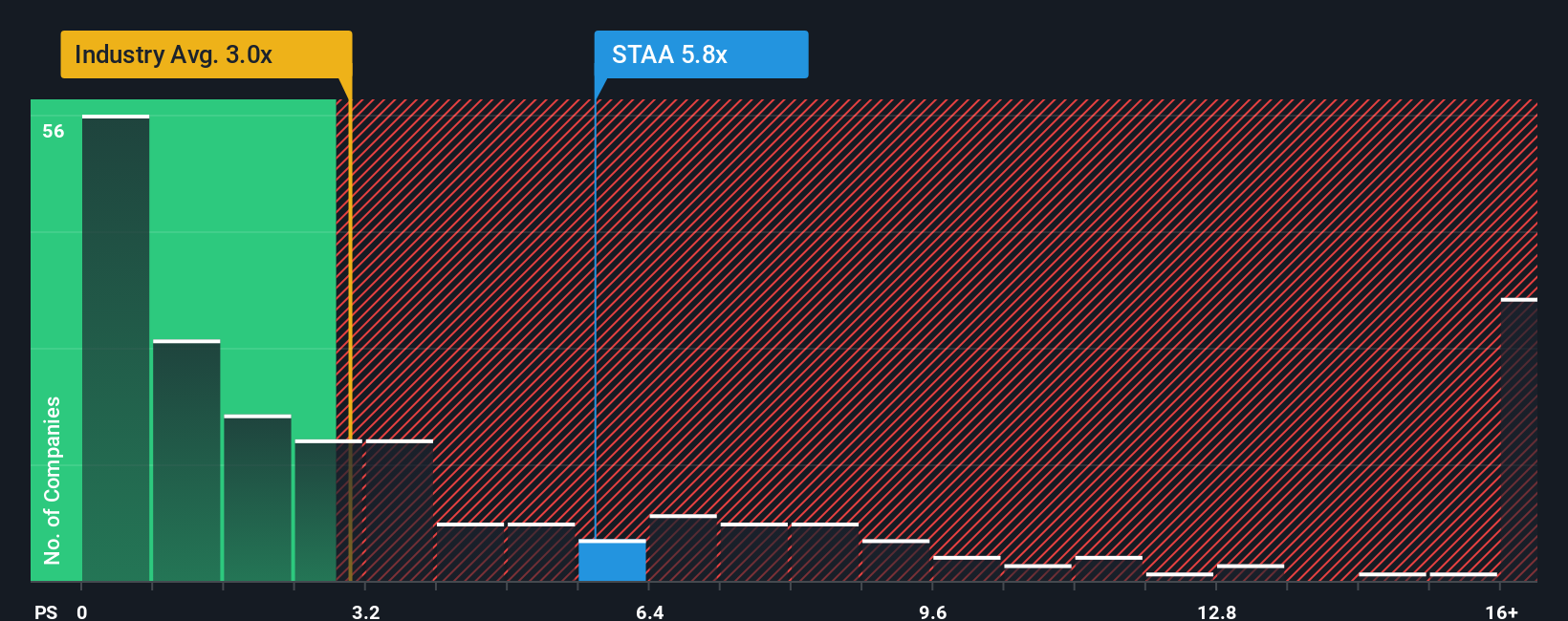

While the narrative fair value points to 6.7 percent upside, the market’s own pricing tells a cooler story. STAAR trades on a price to sales of 5.2 times, well above both peers and the US Medical Equipment industry at 3.5 times, and the 3.7 times fair ratio our model suggests.

That gap implies investors are already paying up for a turnaround that has not yet shown up in profits, leaving less room for error if China stays weak or margins disappoint. Is this a smart premium for future growth, or thin compensation for the risks you are taking on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own STAAR Surgical Narrative

If you think the story looks different from your angle, or simply want to dig into the numbers yourself, you can shape your own in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding STAAR Surgical.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by using the Simply Wall St Screener to uncover stocks that match your strategy and risk profile.

- Target steady cash returns by reviewing these 13 dividend stocks with yields > 3% that could strengthen your portfolio’s income stream.

- Capture early growth stories by scanning these 3611 penny stocks with strong financials where improving fundamentals may not yet be fully priced in.

- Position yourself ahead of the curve with these 26 AI penny stocks that are shaping the next wave of intelligent technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报