Assessing First American Financial (FAF) Valuation After RegsData Integration into MeridianLink Mortgage

First American Financial (FAF) just tightened its grip on the mortgage tech workflow, with its RegsData compliance engine now fully embedded in MeridianLink Mortgage, giving lenders one click, in system access to automated regulatory checks.

See our latest analysis for First American Financial.

At a share price of $63.94, First American Financial has posted a modest year to date share price return. Its three year total shareholder return above 38 percent shows that longer term holders have still been rewarded, suggesting momentum has cooled even as initiatives like the RegsData integration aim to refresh the growth story.

If this kind of targeted workflow upgrade has you thinking about where else capital might work harder, now is a good time to discover fast growing stocks with high insider ownership.

With earnings growing faster than revenue and the share price still trading at a double digit discount to analyst targets, is First American quietly undervalued, or is the market already pricing in a new leg of growth?

Most Popular Narrative Narrative: 18.5% Undervalued

With the most followed fair value at $78.50 versus a $63.94 last close, the story centers on earnings power catching up to a muted valuation.

Analysts expect earnings to reach $888.8 million (and earnings per share of $12.93) by about September 2028, up from $188.7 million today.

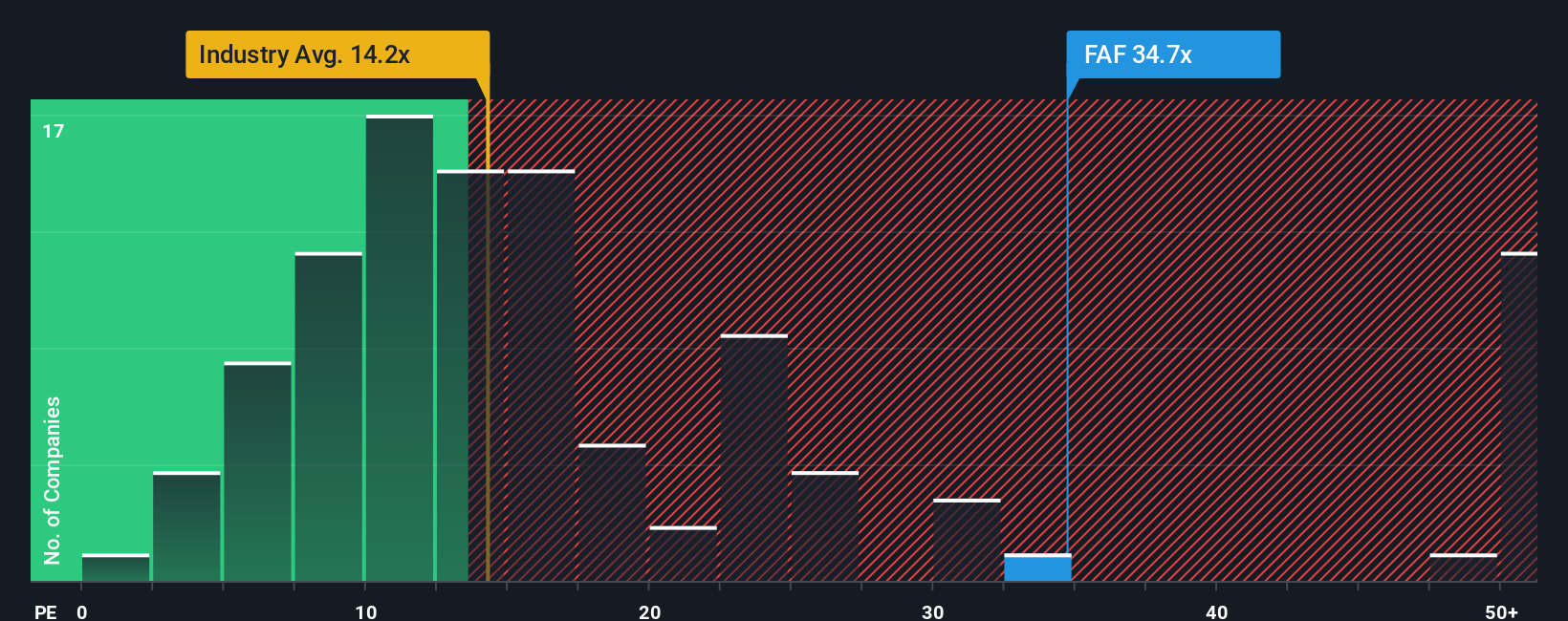

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, down from 36.0x today.

Want to see how moderate growth assumptions still point to a higher price? The narrative leans on rising margins and shrinking share count. Curious which projections really move the needle?

Result: Fair Value of $78.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing affordability challenges and potential FHFA title waivers could undermine transaction volumes and compress margins, which would challenge the upbeat valuation narrative.

Find out about the key risks to this First American Financial narrative.

Another View: Multiples Point to a Fuller Price

Step away from narratives and the picture looks tighter. FAF trades on a 13.5x earnings multiple, roughly in line with the US insurance average of 13.5x but richer than peer averages at 12.1x, even though a fair ratio of 14.5x suggests only limited upside from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First American Financial Narrative

If this take does not quite match your view, or you prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding First American Financial.

Looking for more investment ideas?

Before you move on, you may wish to consider your next move with focused stock ideas from the Simply Wall St Screener, built to surface opportunities you might be overlooking.

- Explore early uptrends in overlooked names by scanning these 3609 penny stocks with strong financials that combine speculative potential with improving fundamentals.

- Look into the evolving landscape of intelligent automation by targeting these 26 AI penny stocks involved in areas such as data centers and real time analytics.

- Review potential bargains with cash flow strength by checking these 906 undervalued stocks based on cash flows that appear attractive relative to their intrinsic value estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报