Reassessing Norfolk Southern (NSC) Valuation After Deutsche Bank’s Downgrade to Hold

Norfolk Southern (NSC) just got bumped down from Buy to Hold by Deutsche Bank, a shift that tends to cool enthusiasm and sharpen the market’s focus on whether the recent rally still makes sense.

See our latest analysis for Norfolk Southern.

That downgrade lands after a strong run, with the share price up 26.6% year to date and a 1 year total shareholder return of 23.2%. This suggests some momentum is cooling as sentiment turns more cautious.

If this shift in sentiment has you rethinking your transport exposure, it could be a good moment to explore aerospace and defense stocks as another pocket of the industrials space.

With the stock now hovering just below its revised price target after a strong run and solid profit growth, investors face a key question: Is Norfolk Southern still undervalued, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 4.7% Undervalued

Compared to Norfolk Southern's last close at $296.98, the most followed narrative points to a modest upside based on a higher long term fair value.

The commitment to $150 million in productivity and cost reduction initiatives over three years is being propelled by better labor productivity and fuel efficiency, which are anticipated to sustain EPS growth even if revenue growth slows. The company's focus on increasing customer confidence through consistent service improvements is leading to meaningful market share gains, particularly in merchandise and intermodal segments, which could bolster future revenue growth.

If you want to see what kind of earnings trajectory and margin profile could justify that higher valuation, even with only moderate top line growth baked in, tap through to uncover the full framework behind those assumptions. This includes how analysts think the profit multiple evolves as these efficiencies compound over time.

Result: Fair Value of $311.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, storm related restoration costs and weaker coal pricing could pressure margins and undermine the earnings and valuation assumptions behind the current upside case.

Find out about the key risks to this Norfolk Southern narrative.

Another View: Ratio Based Valuation Flips the Story

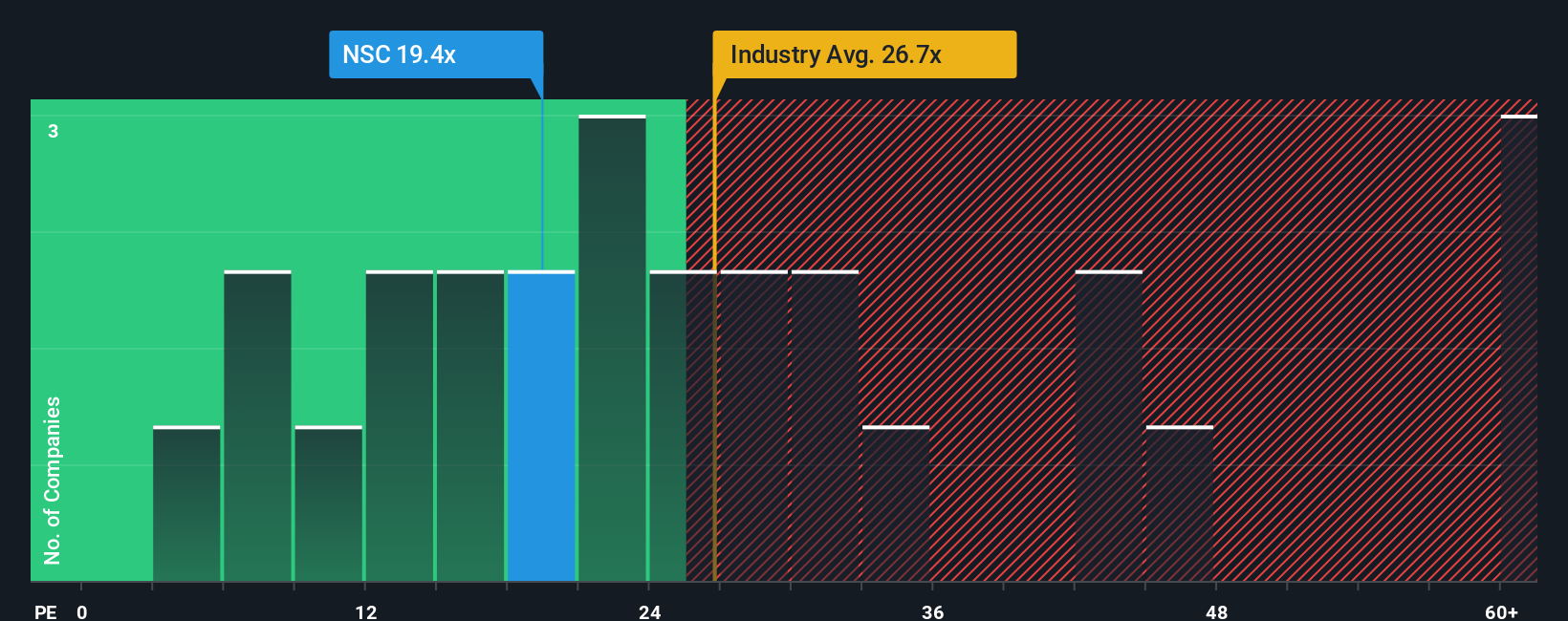

Our price to earnings work paints a starkly different picture. NSC trades on 22.5x earnings versus a fair ratio of 18.1x, even if that headline multiple still looks cheaper than the 32.3x industry average and 23x peer group. On this view, the stock screens as expensive, not cheap. Which lens do you trust when the next wobble hits?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Norfolk Southern for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Norfolk Southern Narrative

If you see things differently or want to dig into the numbers yourself, you can build a fresh perspective in minutes: Do it your way.

A great starting point for your Norfolk Southern research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing edge?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh ideas and avoid missing the stocks quietly building tomorrow's big returns.

- Capture potential turnaround winners by scanning these 3609 penny stocks with strong financials that already show real financial strength rather than just hype.

- Position your portfolio at the forefront of innovation by targeting these 26 AI penny stocks harnessing artificial intelligence to reshape entire industries.

- Lock in compelling value opportunities by zeroing in on these 905 undervalued stocks based on cash flows where strong cash flows are not yet fully recognized in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报