Aeva Technologies (AEVA) Is Up 8.9% After Winning Exclusive Level 3 LiDAR Platform Deal

- Earlier in December, Aeva Technologies announced that a top European passenger car maker selected Aeva as its exclusive LiDAR supplier for a global Level 3 automated driving platform spanning multiple models and powertrains outside China.

- This award, following a completed joint development program and complementing Aeva’s Daimler Truck relationship, underscores growing industry adoption of its 4D LiDAR technology over conventional 3D systems.

- Next, we’ll examine how becoming the exclusive LiDAR supplier for a major Level 3 platform shapes Aeva’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Aeva Technologies' Investment Narrative?

For Aeva, the core belief you have to buy into is that its 4D LiDAR can become a standard sensing platform across passenger and commercial vehicles before its cash burn forces difficult choices. The new Level 3 award with a top European OEM is a meaningful shift in that story: it gives more visibility on long-dated automotive revenue, supports the recent share price strength, and reinforces Aeva’s positioning alongside Daimler Truck as a Tier 1-type partner. In the near term, key catalysts now revolve around execution milestones for this platform, details expected in early 2026, and how convincingly management translates design wins into a manufacturing and margin structure that can support long-term operations. The main risks remain material: continued losses, rich valuation metrics, share dilution from recent capital raises, and a still-volatile stock.

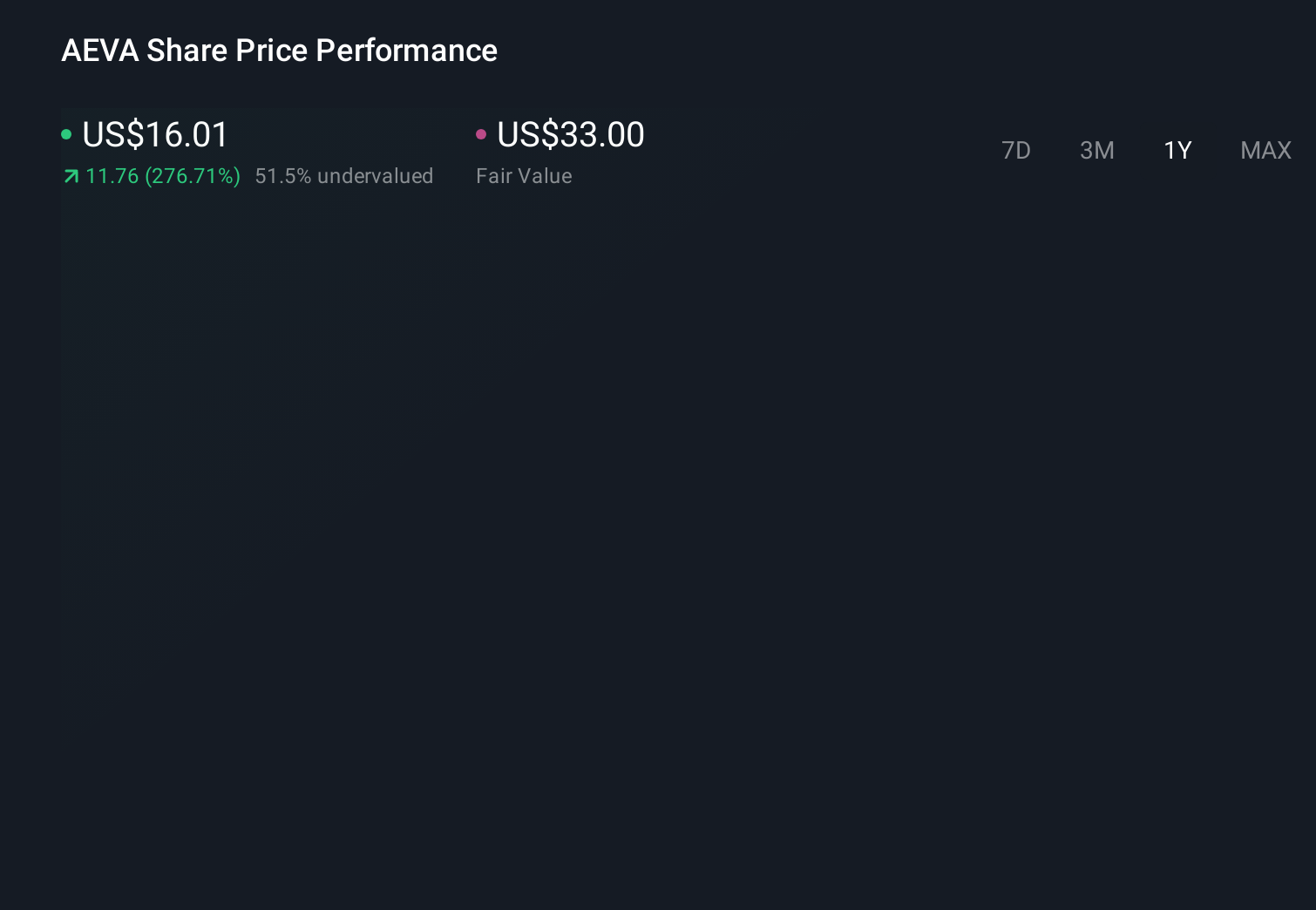

However, investors also need to weigh how ongoing losses and potential dilution could affect future upside. Our comprehensive valuation report raises the possibility that Aeva Technologies is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 11 other fair value estimates on Aeva Technologies - why the stock might be worth less than half the current price!

Build Your Own Aeva Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aeva Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Aeva Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aeva Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报