How Autobahn Labs Partnership Reshapes Astellas Pharma’s Early-Stage Pipeline Access Will Impact Astellas Pharma (TSE:4503) Investors

- Autobahn Labs recently announced a partnership with Astellas Pharma, giving Astellas’ Innovation Lab and Oncology units privileged access to Autobahn’s early-stage academic drug discovery programs and exclusive investment and licensing negotiation rights on jointly funded assets.

- This structure effectively embeds Astellas at the starting line of new biotech company formation, sharing equity with Autobahn and academic founders while potentially widening its future innovation funnel.

- We’ll now examine how Astellas’ equity-sharing access to Autobahn’s early academic pipeline could influence its existing investment narrative.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Astellas Pharma Investment Narrative Recap

To own Astellas Pharma, you generally have to believe that its strategic brands and oncology pipeline can offset pricing pressure and future loss of exclusivity on key drugs. The Autobahn Labs tie-up modestly supports the innovation story, but does not change that near term catalysts still center on execution around PADCEV, IZERVAY and cost discipline, while concentration in a handful of products and upcoming patent cliffs remain the core risks.

The Autobahn collaboration links most clearly to Astellas’ ongoing oncology work highlighted at the American Society of Hematology meeting, including new XOSPATA data in FLT3 mutation positive AML. Together, these announcements underscore how much of the near term pipeline momentum depends on successful oncology development and commercialization, even as pricing and competition pressures continue to build around existing blockbusters.

Yet while oncology partnerships broaden the innovation funnel, investors should also be aware that upcoming loss of exclusivity on key drugs could...

Read the full narrative on Astellas Pharma (it's free!)

Astellas Pharma's narrative projects ¥1,868.3 billion in revenue and ¥184.0 billion in earnings by 2028. This implies revenue declining by 1.3% per year and an earnings increase of about ¥102.4 billion from ¥81.6 billion today.

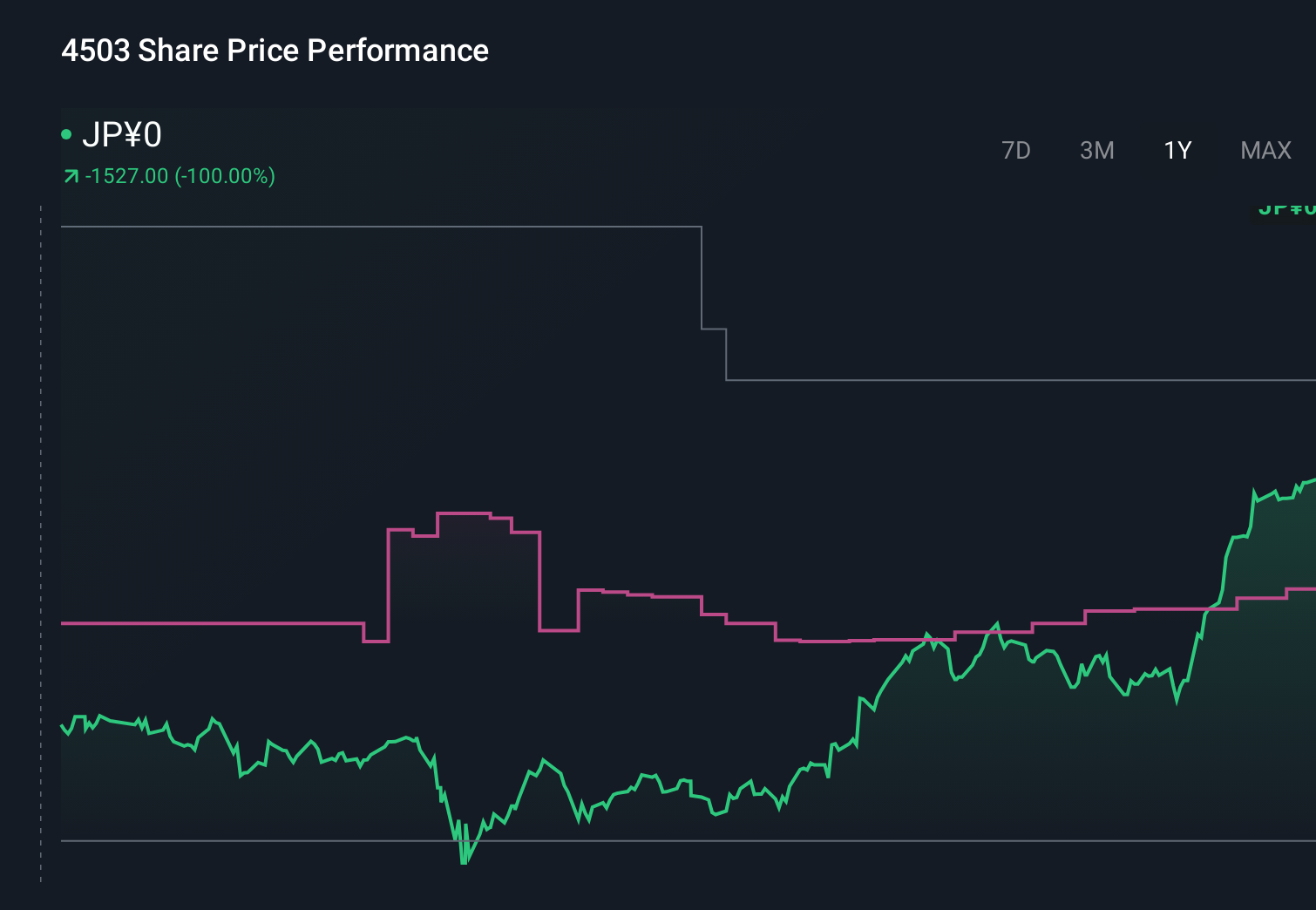

Uncover how Astellas Pharma's forecasts yield a ¥1792 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly ¥1,792 to ¥4,142, showing how far apart retail views can be. Against that backdrop, the concentration in a few strategic brands and looming patent expiries may influence how you weigh upside against long term earnings resilience, so it is worth comparing several independent assumptions about Astellas’ future.

Explore 2 other fair value estimates on Astellas Pharma - why the stock might be worth over 2x more than the current price!

Build Your Own Astellas Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astellas Pharma research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Astellas Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astellas Pharma's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报