Cimpress (CMPR): Exploring Whether the Rebound Story Still Leaves Upside in the Valuation

Cimpress (CMPR) has quietly turned into a strong multiyear rebound story, with the stock up roughly 30% over the past 3 months even though the 1 year return is still slightly negative.

See our latest analysis for Cimpress.

That recent 12.1% 1 month share price return, on top of a 29.6% 3 month share price gain and a powerful 3 year total shareholder return above 200%, suggests momentum is building again from a still recovering base.

If Cimpress has you thinking about turnarounds and fresh growth stories, this could be a good moment to scout other opportunities through fast growing stocks with high insider ownership.

With shares still below analyst targets and a hefty implied discount to intrinsic value, are investors looking at an underappreciated compounder, or has the market already started baking in another leg of growth?

Most Popular Narrative: 13.7% Undervalued

With Cimpress last closing at $74.62 against a narrative fair value of $86.50, the current share price sits below the favored storyline.

Strategic investments in proprietary production technology, customer experience, and manufacturing well above maintenance levels are expected to deliver $70 to $80 million in incremental annualized adjusted EBITDA improvements by FY '27. This is described as setting the stage for significant margin expansion and higher operating income in future years. The company's growing focus on acquiring and retaining high-value customers, together with rising per customer lifetime value from broader product adoption, is expected to enhance both gross profit dollars and reduce acquisition and advertising costs as a percentage of revenue, which the narrative argues could drive stronger net margins over time.

Curious how modest top line growth can still justify a higher value? The narrative leans on rising margins, shrinking share count, and a future earnings multiple that would not typically be associated with a mature printing business.

Result: Fair Value of $86.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this outlook still hinges on newer product lines scaling fast enough and elevated capital spending ultimately translating into the promised cash flow rebound.

Find out about the key risks to this Cimpress narrative.

Another Angle on Value

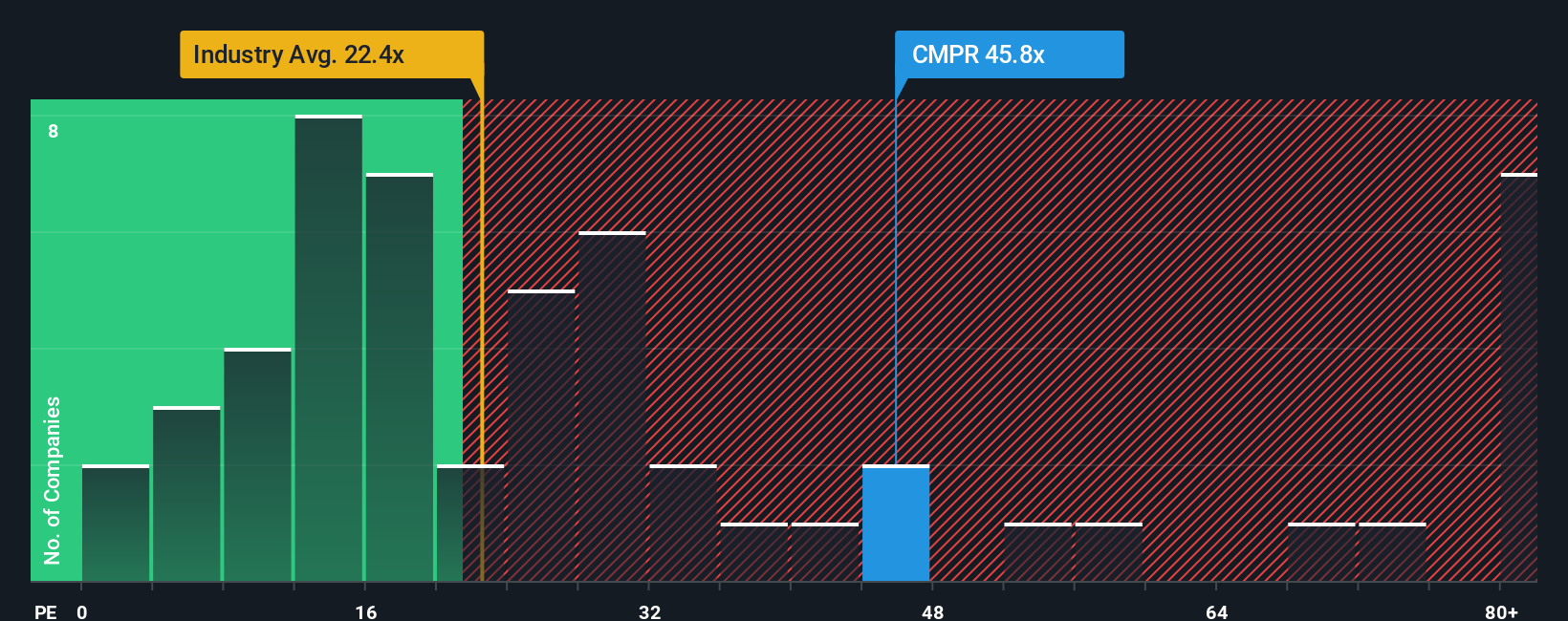

While the narrative fair value points to upside, the earnings multiple paints a tougher picture. Cimpress trades on a price to earnings ratio of 52.4 times, compared with 24.6 times for the US Commercial Services industry, 14.6 times for peers, and a fair ratio of 24.5 times. This suggests the market could easily rerate the stock lower if growth stumbles. Are investors being paid enough for that risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cimpress Narrative

If this perspective does not quite fit your view, or you prefer digging into the numbers yourself, you can build a custom storyline in just minutes: Do it your way.

A great starting point for your Cimpress research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more market opportunities?

Before you move on, lock in your next potential winner by tapping into targeted stock ideas from the Simply Wall Street Screener that many investors overlook.

- Capture overlooked value by running through these 904 undervalued stocks based on cash flows that could be trading well below their long term cash flow potential.

- Position yourself at the frontier of innovation by scanning these 26 AI penny stocks shaping the next wave of intelligent technologies.

- Strengthen your income strategy by reviewing these 13 dividend stocks with yields > 3% that aim to keep your portfolio working harder with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报