Should PM’s Reaffirmed Earnings Guidance and Expanded Credit Lines Require Action From Philip Morris International (PM) Investors?

- Earlier in December, Philip Morris International’s board declared a regular quarterly dividend of US$1.47 per share and renewed multi‑year credit facilities totaling US$2.00 billion and €1.50 billion to support general corporate needs and working capital.

- Ferrari announced it has renewed and upgraded its long‑running partnership with Philip Morris International, while the company continues to emphasize smoke‑free products and reaffirmed its 2025 earnings guidance of US$7.39 to US$7.49 in reported diluted EPS.

- Now we’ll examine how reaffirmed earnings guidance and expanded credit facilities might reshape Philip Morris International’s existing investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Philip Morris International Investment Narrative Recap

To own Philip Morris International, you generally need to believe its shift toward smoke free products can outgrow declining cigarette volumes and support the current income heavy profile. Right now, the key near term catalyst is execution in smoke free earnings, while the biggest risk is regulatory and tax pressure on both nicotine pouches and heated tobacco. The new dividend and credit announcements slightly reinforce balance sheet flexibility but do not materially change those core drivers.

The most relevant update here is PMI’s renewal and extension of its US$2.0 billion and €1.50 billion revolving credit facilities, which supports liquidity through 2029 to 2031. For investors focused on smoke free growth and pending product approvals, this depth of committed funding may matter if PMI chooses to push harder on commercialization, working capital or potential bolt on deals that could either amplify upside or, if misjudged, increase execution risk.

Yet in contrast to the reassuring dividend and credit headlines, tighter regulation and tax changes on smoke free products remain a risk investors should be aware of...

Read the full narrative on Philip Morris International (it's free!)

Philip Morris International's narrative projects $49.4 billion revenue and $14.5 billion earnings by 2028.

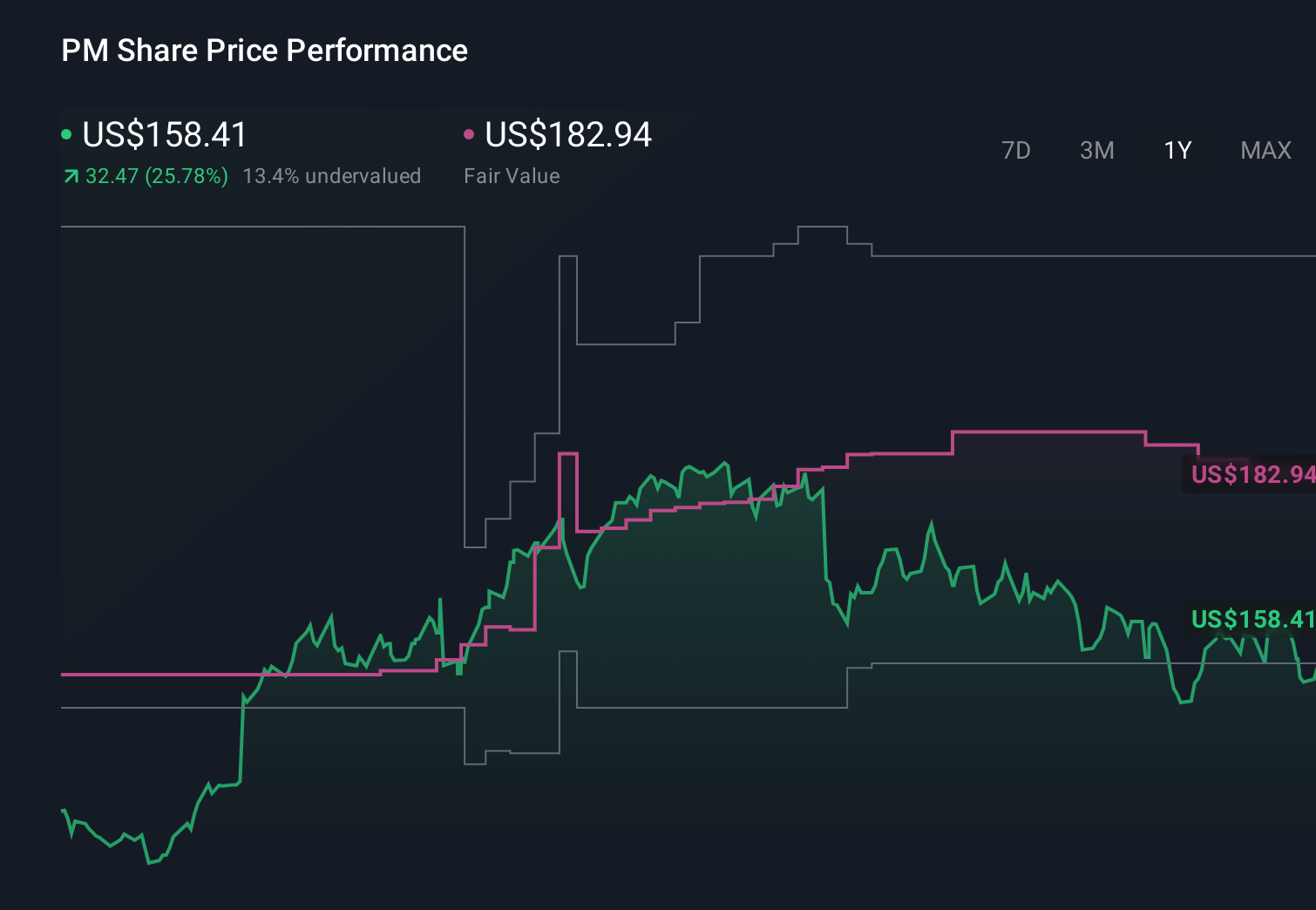

Uncover how Philip Morris International's forecasts yield a $182.94 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts already expected PMI’s revenue to reach about US$53.2 billion and earnings US$15.7 billion, so you should consider whether the latest dividend and expanded credit capacity strengthen that bullish view of faster ZYN and smoke free growth or instead highlight how far opinions can differ on the same numbers.

Explore 11 other fair value estimates on Philip Morris International - why the stock might be worth just $153.00!

Build Your Own Philip Morris International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Philip Morris International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Philip Morris International's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报