Ollie’s (OLLI) Valuation Check After Q3 Earnings Beat and Raised 2025 Guidance

Why Ollie's latest earnings caught Wall Street's attention

Ollie's Bargain Outlet Holdings (OLLI) just delivered third quarter numbers that topped profit expectations and came with a guidance bump, a combination that usually makes investors sit up and take notice.

See our latest analysis for Ollie's Bargain Outlet Holdings.

Even with the latest beat and a guidance raise, the stock’s recent momentum has cooled, with a roughly 16 percent 3 month share price decline. However, a solid 3 year total shareholder return above 120 percent shows the longer term story remains intact.

If this kind of earnings driven move has you thinking bigger about opportunities in retail and beyond, it could be a good moment to explore fast growing stocks with high insider ownership.

With sales and profits climbing and the stock still trading around a 24 percent discount to analyst targets, is Ollie’s quietly offering value here, or are investors already paying up for years of growth ahead?

Most Popular Narrative: 20.8% Undervalued

With Ollie's Bargain Outlet Holdings last closing at $113.91 against a narrative fair value of $143.80, the story points to meaningful upside if assumptions hold.

The company is benefiting from a growing value conscious consumer base, amplified by economic uncertainty and inflation. This is driving more customers toward discount retailers like Ollie's and is boosting both store traffic and revenue growth, as seen by accelerated customer acquisition and rising loyalty program membership. (Revenue)

Curious how steady mid teens growth, rising margins, and a still rich future earnings multiple can all coexist in one model? The narrative maps out an aggressive earnings ramp, modest share shrink, and a premium valuation usually reserved for faster growing sectors. Want to see which assumptions need to stay intact for that upside to materialize?

Result: Fair Value of $143.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story hinges on a continued supply of closeout inventory and successful store expansion, where missteps or tighter sourcing could quickly challenge that upside case.

Find out about the key risks to this Ollie's Bargain Outlet Holdings narrative.

Another Lens on Value

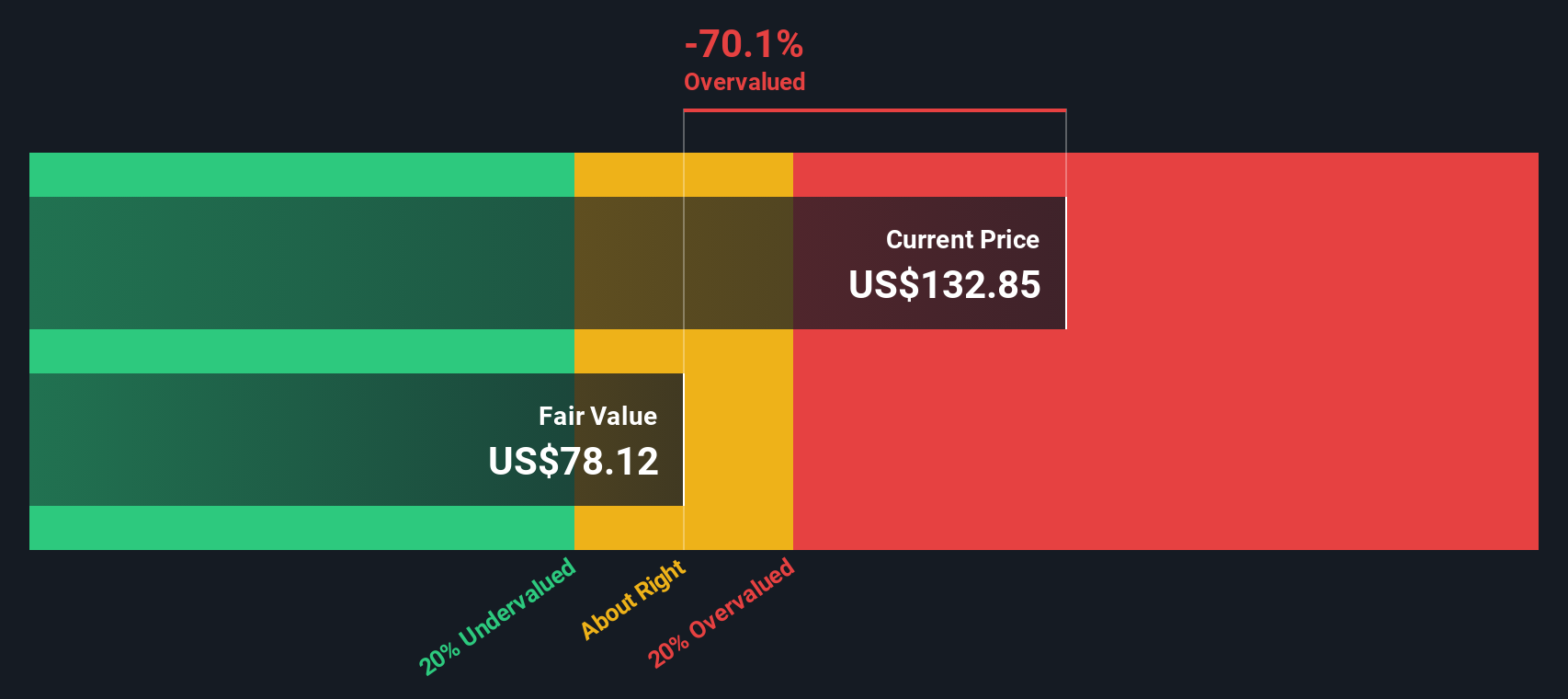

While the narrative fair value suggests upside, our SWS DCF model paints a cooler picture, indicating Ollie's might actually be overvalued versus its estimated cash flow worth. When growth slows or margins wobble, which story do you think the market will ultimately price in?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ollie's Bargain Outlet Holdings Narrative

If you see things differently or would rather dig into the numbers yourself and shape your own perspective in just a few minutes, start here: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ollie's Bargain Outlet Holdings.

Looking for more investment ideas?

Before you move on, consider your next potential opportunity with focused stock lists that match different strategies, so you are not overlooking possibilities that fit your approach.

- Explore potential bargains by scanning these 903 undervalued stocks based on cash flows that the market may be mispricing based on their projected cash flows.

- Follow long term innovation trends by targeting these 26 AI penny stocks involved in areas such as automation and intelligent infrastructure.

- Assess your income potential by reviewing these 13 dividend stocks with yields > 3% that may contribute to total returns through regular payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报