How Tamarack’s New Rights Plan and Board Appointment Will Impact Tamarack Valley Energy (TSX:TVE) Investors

- Tamarack Valley Energy Ltd. recently adopted a Shareholder Rights Plan, appointed former Veren Inc. CEO Craig Bryksa to its board effective December 2, 2025, and issued 2026 production guidance of 69,000–71,000 boe/d.

- Taken together, the rights plan and board appointment highlight a stronger focus on boardroom experience and deal oversight at a time of potential corporate interest in the company.

- We’ll now examine how the new Shareholder Rights Plan may influence Tamarack Valley Energy’s investment narrative and perceived takeover optionality.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Tamarack Valley Energy Investment Narrative Recap

To own Tamarack Valley Energy, you need to believe its Western Canadian oil assets and waterflood program can convert into durable cash flow despite current losses, leverage and commodity volatility. The new Shareholder Rights Plan and Craig Bryksa’s appointment refine governance and potential deal oversight, but do not materially change the near term production and balance sheet execution story, or the key risk around sustained low oil prices and heavy oil differentials.

Among the recent announcements, the 2026 production guidance of 69,000 to 71,000 boe/d is most relevant, because it anchors expectations around how efficiently Tamarack can grow and sustain output while servicing its sizeable net debt and funding capital intensive development programs.

Yet while production guidance looks clear, the real test for investors will be how Tamarack manages its leverage and exposure to...

Read the full narrative on Tamarack Valley Energy (it's free!)

Tamarack Valley Energy's narrative projects CA$1.7 billion revenue and CA$80.5 million earnings by 2028. This requires 4.8% yearly revenue growth and an earnings decrease of about CA$178.7 million from CA$259.2 million today.

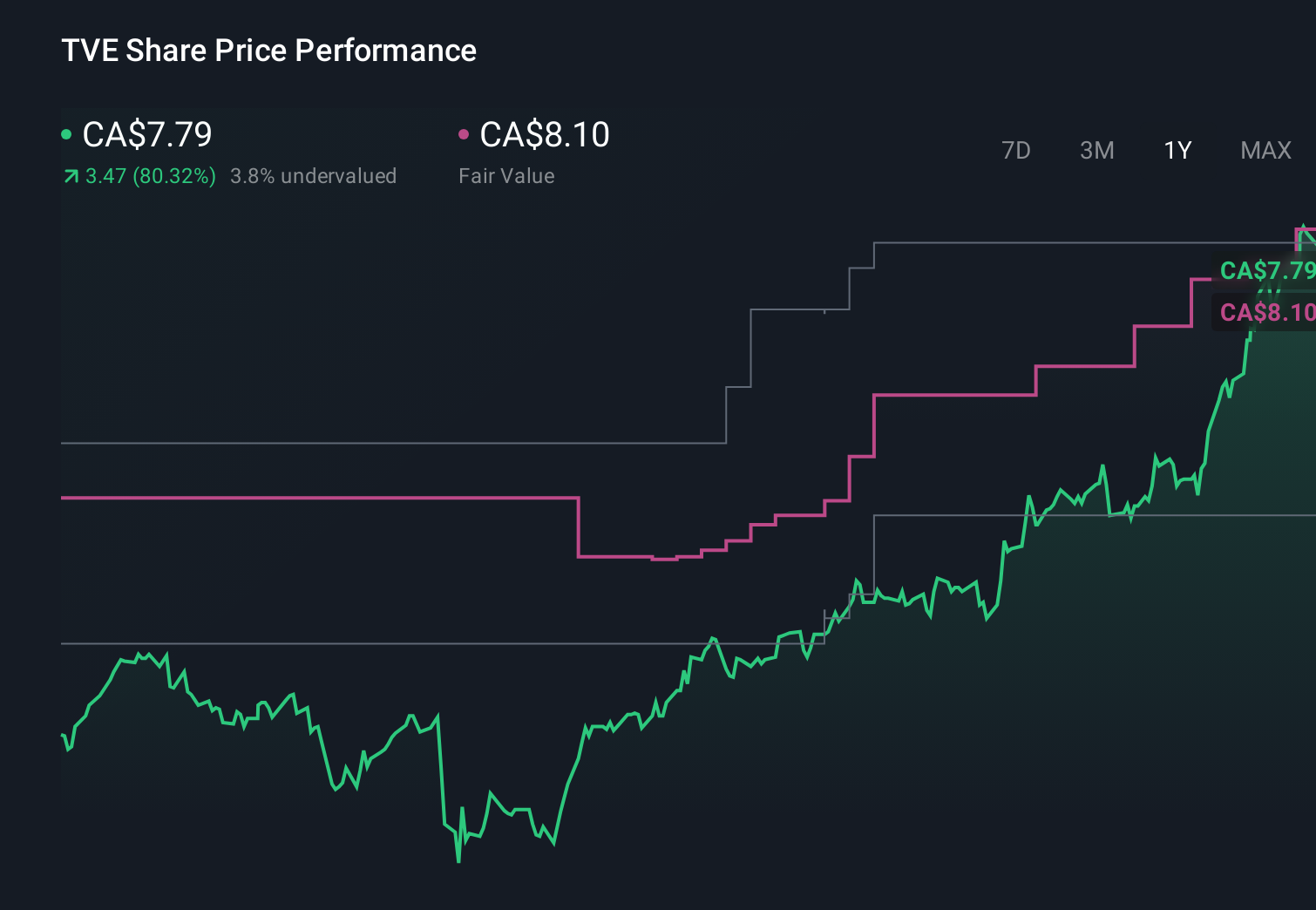

Uncover how Tamarack Valley Energy's forecasts yield a CA$8.10 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from CA$7.47 to CA$16.96, underlining how differently investors see Tamarack’s potential. Against that backdrop, Tamarack’s reliance on debt funded, capital intensive growth in Western Canadian heavy oil raises important questions about how resilient those expectations really are if pricing or differentials move against the company.

Explore 4 other fair value estimates on Tamarack Valley Energy - why the stock might be worth over 2x more than the current price!

Build Your Own Tamarack Valley Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tamarack Valley Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tamarack Valley Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tamarack Valley Energy's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报