CVC Capital Partners (ENXTAM:CVC): Assessing Valuation After Leadership Succession Moves and Major Promotions Round

CVC Capital Partners (ENXTAM:CVC) just reshuffled its top ranks, creating a new president role for veteran dealmaker Peter Rutland and elevating nearly 220 staff. These moves sharpen the firm’s leadership succession story.

See our latest analysis for CVC Capital Partners.

The leadership shake up arrives after a tough stretch in the market, with a 1 day share price return of 4.26 percent to $14.21 offering a rare bright spot against a year to date share price return of minus 32.53 percent and a 1 year total shareholder return of minus 33 percent. This suggests sentiment is stabilising but not yet reversing.

If this kind of succession story has you thinking about where the next compounding machines might be, it could be worth exploring fast growing stocks with high insider ownership.

With earnings still growing, a double digit discount to analyst targets and fresh leadership in place, is CVC now trading below its true potential, or are markets already pricing in its next leg of growth?

Most Popular Narrative Narrative: 26.3% Undervalued

With CVC Capital Partners last closing at €14.21 versus a narrative fair value near €19.28, the story focuses on powerful profit and margin upgrades.

Continued investment in growth areas such as Private Wealth, insurance, and AI could lead to operational efficiencies and new revenue streams, supporting margin expansion over time. Recent strategic acquisitions and fund launches in infrastructure and secondaries indicate scaling efforts that could lead to significant long-term revenue growth and enhanced EBITDA margins.

If you are curious how mid single digit revenue assumptions can still justify a premium valuation multiple in a cyclical market, and what margin profile underpins it, explore the full narrative to see the earnings pathway behind that upside case.

Result: Fair Value of €19.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower fundraising cycles and tougher exit conditions could delay fee growth and realisations, putting pressure on those ambitious margin and earnings assumptions.

Find out about the key risks to this CVC Capital Partners narrative.

Another View On Valuation

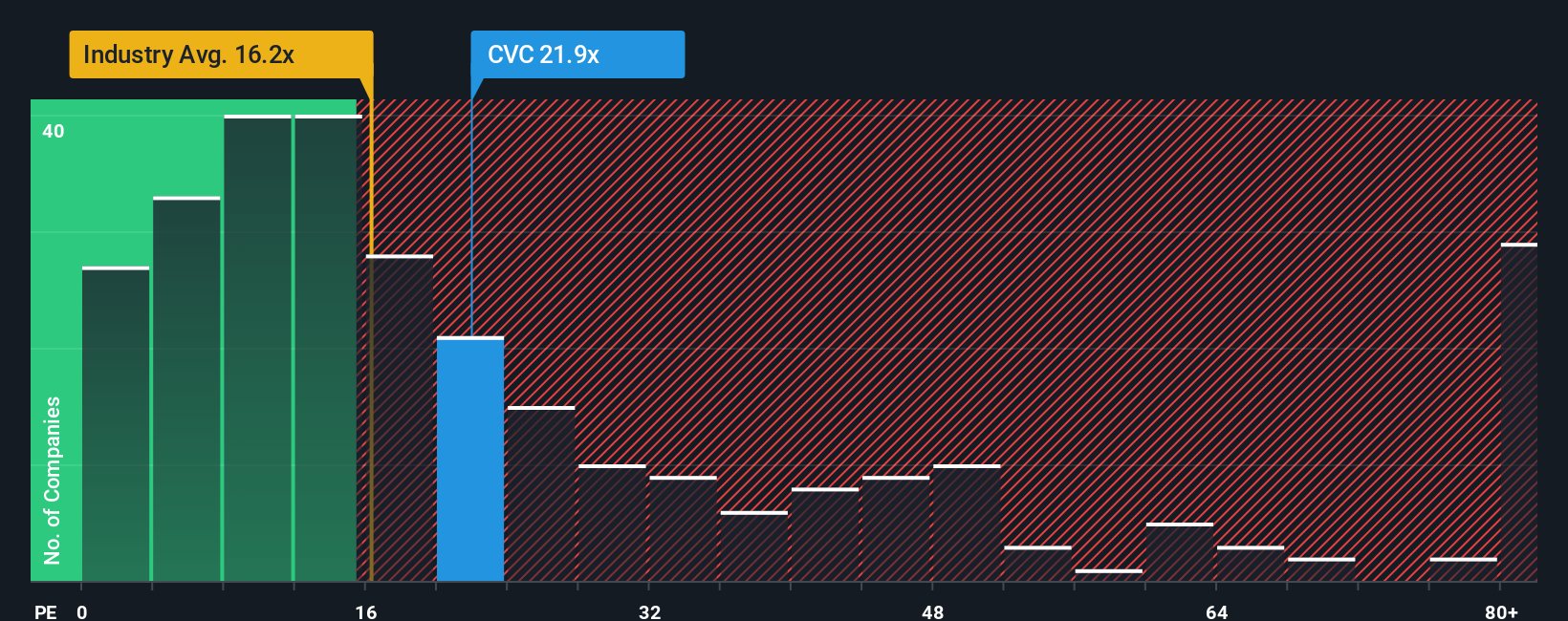

While the narrative suggests CVC is 26.3 percent undervalued on future earnings power, the current price already bakes in a punchy 20 times earnings tag versus 14.8 times for the wider European capital markets space and a fair ratio of 18.7 times. Is the quality premium enough to offset the valuation risk if sentiment sours again?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CVC Capital Partners Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your CVC Capital Partners research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop at CVC, use Simply Wall St's powerful screener to uncover fresh, data backed opportunities.

- Explore income potential by targeting reliable payers through these 13 dividend stocks with yields > 3% and consider building a steadier, yield focused portfolio.

- Look at structural trends by reviewing innovators with these 26 AI penny stocks to see where momentum may be developing.

- Search for possible mispricing by scanning these 903 undervalued stocks based on cash flows and identify quality businesses the market may not fully reflect in current prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报