Luye Pharma Group (SEHK:2186): Valuation Check After New Exchangeable Preference Share Deal in Boan Biotech

Luye Pharma Group (SEHK:2186) just wrapped up a financing move through its subsidiary, issuing 1,500,000 exchangeable preference shares tied to Boan Biotech’s stock, effectively tightening its grip on the biotech side of the business.

See our latest analysis for Luye Pharma Group.

The latest exchangeable preference share issuance comes after a year in which Luye Pharma’s 38.68% year to date share price return contrasts with a still negative 5 year total shareholder return of 21.81%. This suggests improving momentum but a long recovery arc.

If this move has you rethinking healthcare exposure, it could be worth scanning healthcare stocks to spot other names where recent catalysts might be setting up the next leg of growth.

With the stock still trading below analyst targets despite double digit revenue and profit growth, investors face a familiar dilemma: is Luye Pharma quietly undervalued, or is the market already pricing in the next leg of growth?

Price to Earnings of 26.8x: Is it justified?

On a headline basis, Luye Pharma’s HK$2.94 share price embeds a rich price to earnings multiple, pointing to an optimistic view versus peers.

The price to earnings ratio compares the current share price with the company’s earnings per share, making it a simple shorthand for how much investors are willing to pay today for each unit of current profits. For a pharmaceutical and biotech group where future pipelines and approvals can reshape earnings, this multiple often reflects expectations for future growth and profitability rather than just the latest year’s results.

In Luye Pharma’s case, the market is paying 26.8 times earnings, which is slightly above the peer average of 26.2 times and almost double the Hong Kong Pharmaceuticals industry average of 13.5 times. That premium sits alongside a low current return on equity of 3.4 percent and a recent profit margin step down from 12.2 percent to 6.4 percent, implying investors are focusing on the forecast earnings rebound rather than rewarding recent performance. Our fair price to earnings estimate of 23.2 times suggests there may still be room for the multiple to compress if sentiment toward those growth expectations softens.

Explore the SWS fair ratio for Luye Pharma Group

Result: Price-to-Earnings of 26.8x (OVERVALUED)

However, sustained low return on equity and any setback in key oncology or CNS products could quickly challenge the case for Luye’s premium valuation.

Find out about the key risks to this Luye Pharma Group narrative.

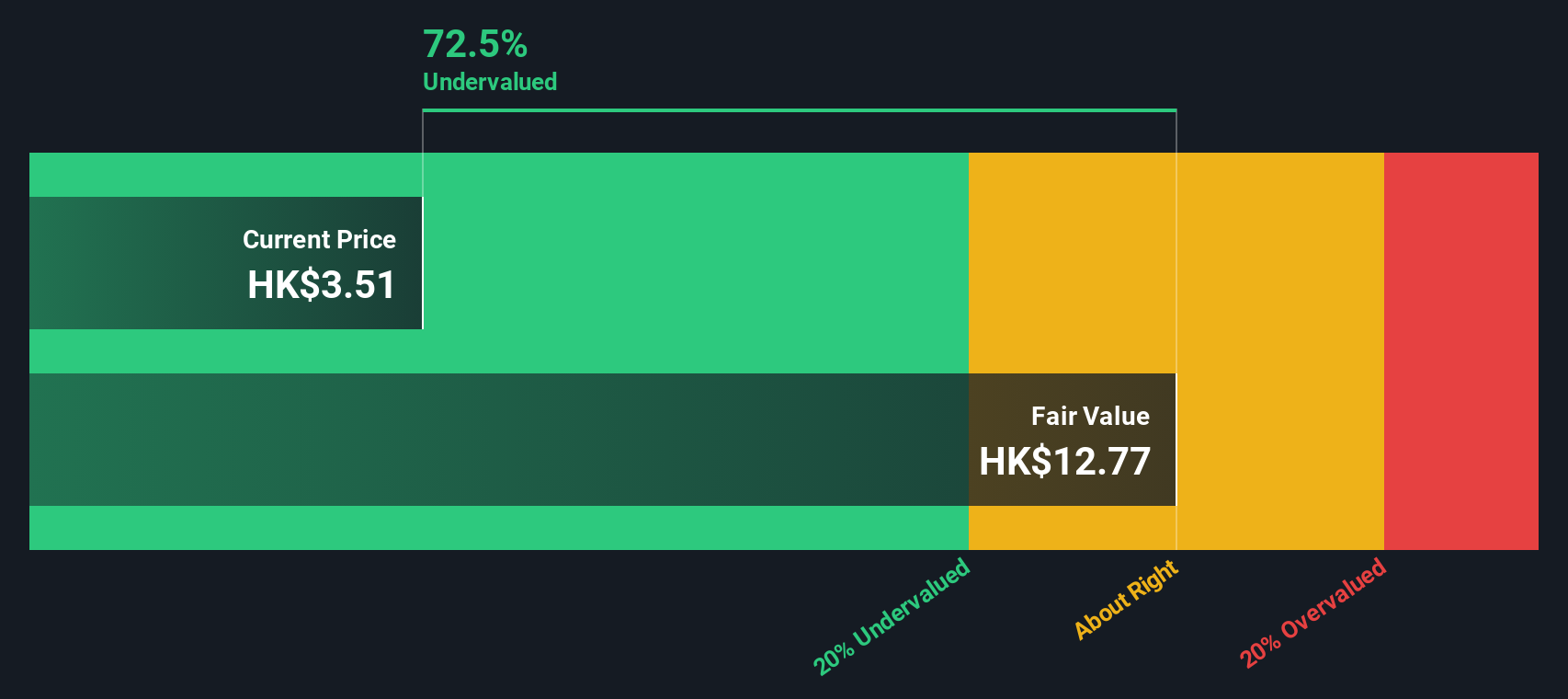

Another View: Our DCF Points the Other Way

While earnings multiples flag Luye Pharma as expensive, our DCF model paints a very different picture. It suggests fair value near HK$13.27 versus the current HK$2.94 share price. If markets slowly close that gap instead of compressing the multiple, could patient holders be underestimating the upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Luye Pharma Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Luye Pharma Group Narrative

If you see things differently or would rather dig into the numbers yourself, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Luye Pharma Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you wrap up your research on Luye Pharma, take a moment to check other opportunities on Simply Wall St so you are not leaving potential returns on the table.

- Position your portfolio for long term compounding by focusing on income generating ideas such as these 13 dividend stocks with yields > 3% that can support total return through varied market cycles.

- Get ahead of structural innovation by scanning these 26 AI penny stocks where real business adoption of artificial intelligence could translate into powerful operating leverage over time.

- Seize mispriced potential with these 903 undervalued stocks based on cash flows that may offer attractive margins of safety when cash flow strength is not yet fully recognized in current share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报