How Investors Are Reacting To Bayerische Motoren Werke (XTRA:BMW) Appointing Production Chief as Next CEO

- BMW announced that Milan Nedeljković, currently head of production and a board member since 2019, has been appointed CEO to succeed Oliver Zipse after the company’s May 13, 2026 annual general meeting, while Zipse retires after leading the launch of the Neue Klasse electric vehicle strategy.

- This handover from the architect of BMW’s current EV push to the executive who managed Neue Klasse production brings fresh focus to how BMW executes its next phase of electrification and manufacturing efficiency.

- We’ll now examine how the appointment of production-focused Milan Nedeljković as CEO could reshape BMW’s investment narrative and execution priorities.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bayerische Motoren Werke Investment Narrative Recap

To own BMW today you need to believe in its ability to turn its Neue Klasse EV and premium lineup into resilient cash generation while managing margin pressure from tariffs and China. The incoming, production-focused CEO does not materially change the near term catalyst around EV product execution, but it could slightly sharpen attention on cost discipline. The biggest risk remains that intense EV competition and volatile regulations pressure pricing and returns.

The all solid state battery collaboration with Solid Power and Samsung SDI sits right at the center of this transition story, tying BMW’s EV roadmap to potential step changes in range, safety and cost. How effectively management converts this technology work and the Neue Klasse platform into attractive, profitable products will matter more for shareholders than the CEO handover itself, at least over the next few years.

Yet investors should be aware that rising tariff and EV price pressures could still...

Read the full narrative on Bayerische Motoren Werke (it's free!)

Bayerische Motoren Werke's narrative projects €150.8 billion revenue and €8.3 billion earnings by 2028. This requires 3.4% yearly revenue growth and about a €2.6 billion earnings increase from €5.7 billion today.

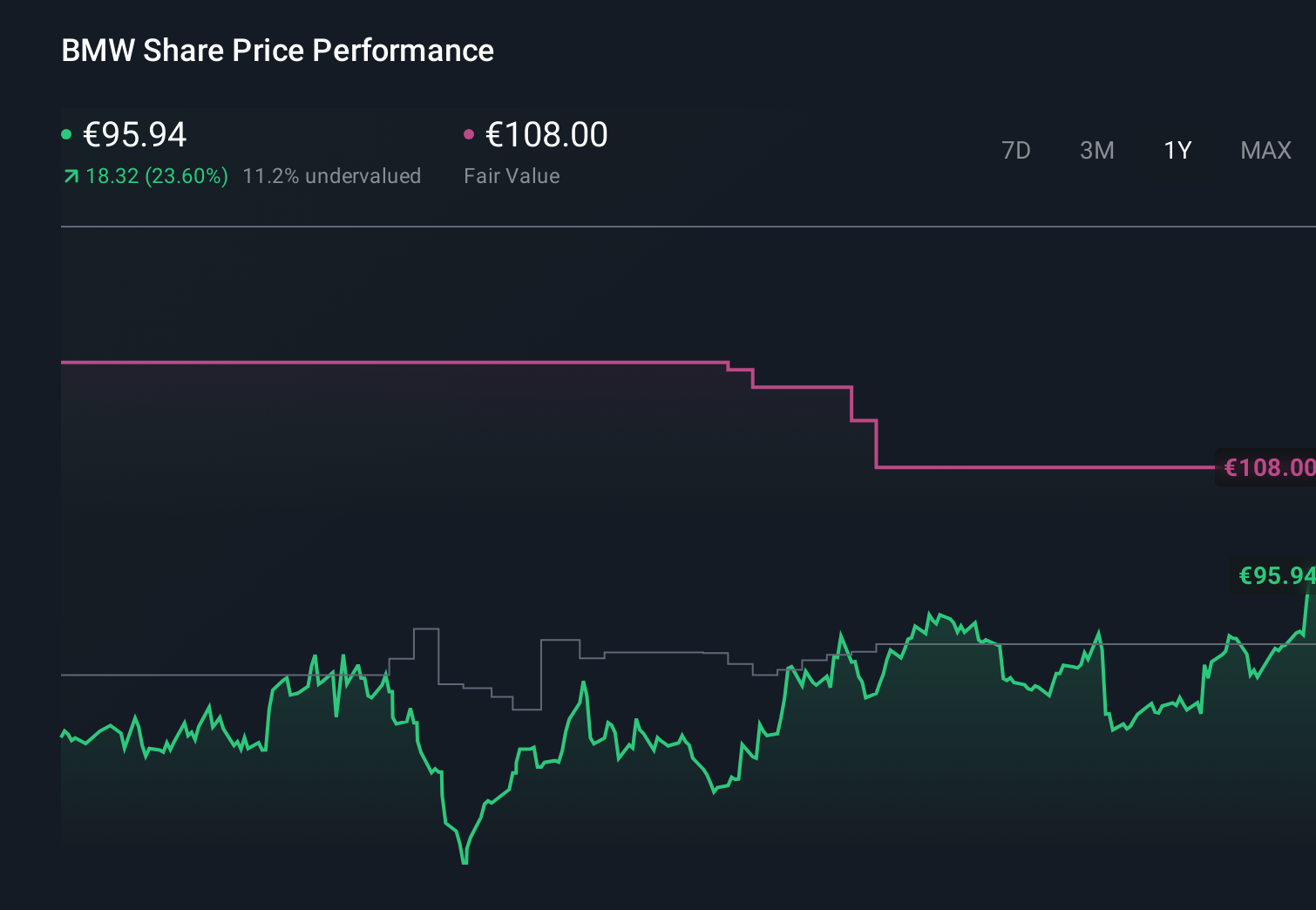

Uncover how Bayerische Motoren Werke's forecasts yield a €88.59 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community currently see BMW’s fair value anywhere between €65.65 and €135.07, highlighting very different expectations. When you set that against execution risks in crowded EV markets, it underlines why many investors compare several viewpoints before forming a view on BMW’s long term potential.

Explore 8 other fair value estimates on Bayerische Motoren Werke - why the stock might be worth as much as 41% more than the current price!

Build Your Own Bayerische Motoren Werke Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bayerische Motoren Werke research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bayerische Motoren Werke research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bayerische Motoren Werke's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报