Evaluating Medpace (MEDP) After Strong Growth, Investor Support, and Aggressive Buybacks Fuel a Rerating

Medpace Holdings (MEDP) is back in the spotlight after fresh investor letters praised its latest quarter, where revenue climbed about 24% year over year and hefty buybacks amplified earnings power.

See our latest analysis for Medpace Holdings.

Those strong Q3 numbers and hefty buybacks helped fuel a powerful re-rating, with the share price now at $557.9 and a year-to-date share price return of 66.66%. The five-year total shareholder return of 298.16% shows that momentum, despite a recent 6.64% one-month pullback in the share price, is still very much a long-term story rather than a quick trade.

If Medpace has you thinking about where else growth and execution are lining up, this could be a good moment to explore healthcare stocks for more ideas in the space.

With the stock already trading slightly above the average analyst price target but still showing a double digit intrinsic discount, is Medpace a rare case of growth at a reasonable price, or is the market already factoring in years of outperformance?

Most Popular Narrative Narrative: 3.6% Overvalued

Compared with Medpace Holdings last close at $557.9, the most followed narrative points to a slightly lower fair value anchored in detailed long term forecasts.

The analysts have a consensus price target of $423.636 for Medpace Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $510.0, and the most bearish reporting a price target of just $305.0.

Curious how steady but slowing earnings growth, slimmer margins, and a lower future earnings multiple still combine into a premium valuation story? The narrative breaks down the math and the tension between robust buybacks, moderating profitability, and a sector multiple that has to fall meaningfully from today. Want to see exactly which long range assumptions make that lower fair value add up?

Result: Fair Value of $538.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if biotech funding stays resilient and Medpace sustains strong bookings and productivity gains, earnings and valuation could surprise meaningfully to the upside.

Find out about the key risks to this Medpace Holdings narrative.

Another View: Market Ratios Tell a Different Story

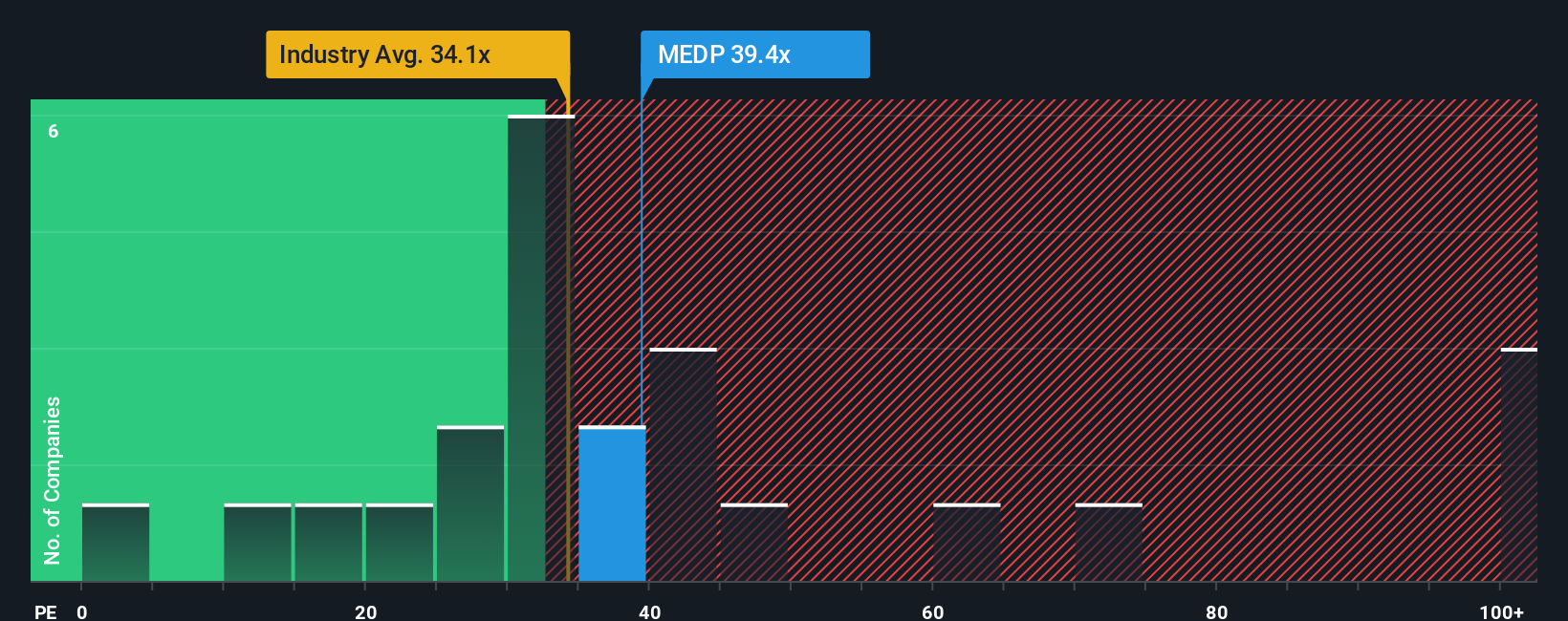

While the narrative points to Medpace as modestly overvalued, earnings based valuation paints a more mixed picture. The stock trades on a 36.3 times price to earnings ratio, slightly richer than the North American Life Sciences average of 35.8 times, yet well below direct peers at 53.2 times.

Our fair ratio sits nearer 25.1 times. This implies that today’s multiple still bakes in a lot of optimism and leaves room for a de rating if growth cools. At the same time, the peer gap hints at upside if momentum holds. Which risk will the market focus on next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Medpace Holdings Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full narrative from scratch in minutes, Do it your way.

A great starting point for your Medpace Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put today’s insights to work by lining up your next opportunities using focused screens that highlight strong fundamentals, growth, and income potential.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value through these 907 undervalued stocks based on cash flows and keep a watchlist of candidates the market has overlooked.

- Tap into cutting edge innovation by scanning these 26 AI penny stocks for businesses harnessing artificial intelligence to reshape industries and power the next wave of earnings growth.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% and pinpointing mature companies that pair solid payouts with balance sheets built to handle uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报