How Sanoma Oyj’s New €220m Term Loan At Sanoma Oyj (HLSE:SANOMA) Has Changed Its Investment Story

- Sanoma Corporation has completed a €220 million syndicated term loan facility with nine banks, maturing in March 2029 and earmarked to prepay a €119 million term loan in 2025 and refinance a €150 million hybrid bond in 2026, partly supported by improved operating cash flow.

- By locking in long-term funding and replacing more complex instruments such as the hybrid bond, Sanoma appears to be simplifying its capital structure and potentially improving balance sheet flexibility for its learning and media operations.

- We’ll now examine how this long-term refinancing, including the replacement of the hybrid bond, may influence Sanoma’s existing investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sanoma Oyj Investment Narrative Recap

To own Sanoma, you need to believe in its twin learning and media model, where digital education growth and subscription media can offset pressure in advertising and curriculum cycles. The new €220 million term loan mainly tidies up the balance sheet and extends maturities, but it does not change the near term demand catalysts or the key risks around curriculum timing and ongoing weakness in B2B advertising.

Among recent announcements, the reaffirmed 2025 guidance for net sales of €1.281–1.331 billion and operational EBIT (excluding PPA) of €170–190 million is most relevant here, because extended funding visibility could support execution on cost efficiency and digital initiatives embedded in that outlook. Investors watching for margin improvement and curriculum driven growth in 2026 may see the refinancing as background support rather than a direct earnings driver.

Yet while the balance sheet looks better aligned, investors still need to be aware of the risk that...

Read the full narrative on Sanoma Oyj (it's free!)

Sanoma Oyj's narrative projects €1.4 billion revenue and €181.7 million earnings by 2028.

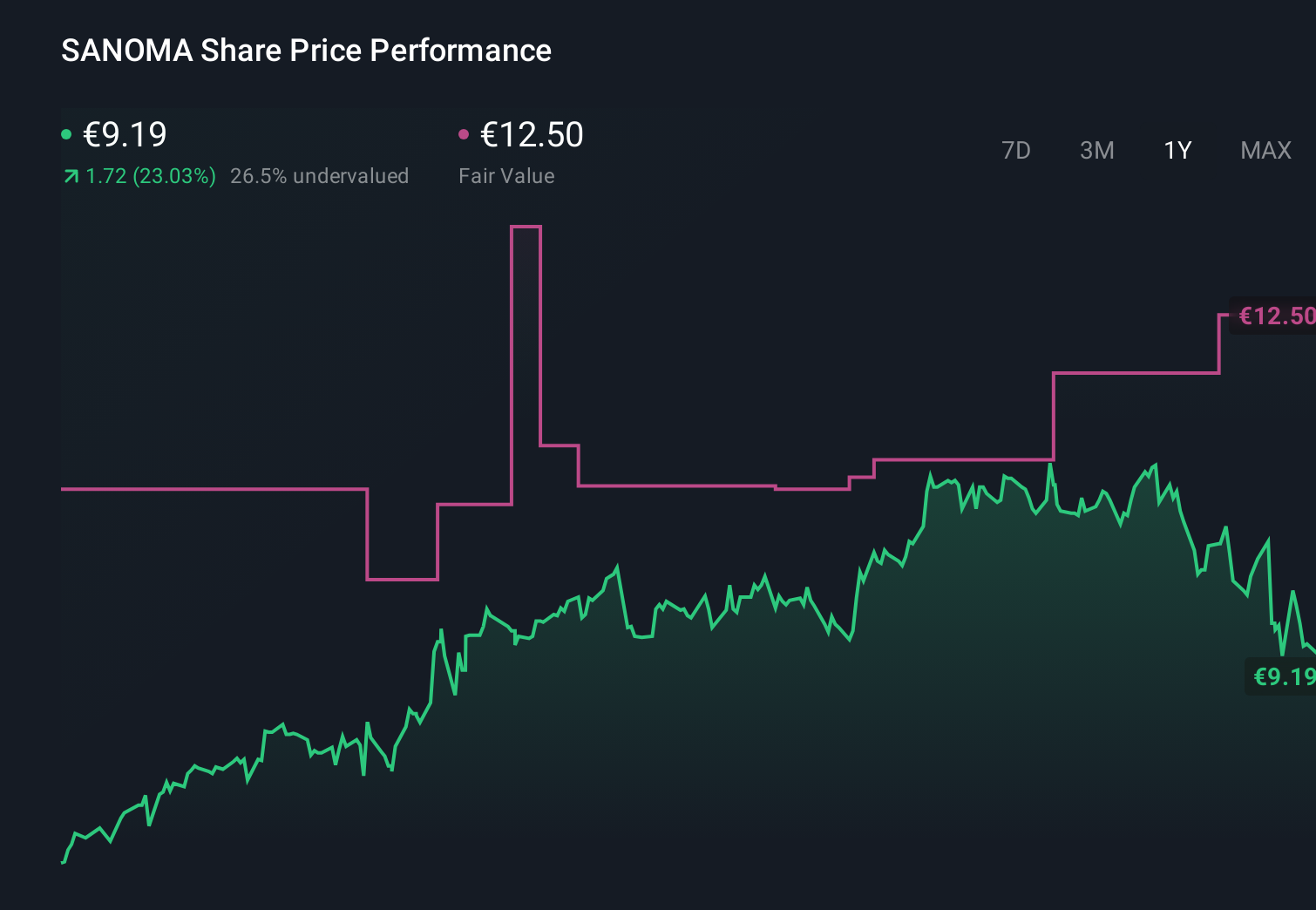

Uncover how Sanoma Oyj's forecasts yield a €12.50 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster between €12.50 and about €18.35, showing how far apart individual views can be. When you set these against the reliance on large curriculum renewal cycles and public funding in Learning, it underlines why you may want to compare several perspectives before forming your own view on Sanoma’s prospects.

Explore 2 other fair value estimates on Sanoma Oyj - why the stock might be worth just €12.50!

Build Your Own Sanoma Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sanoma Oyj research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Sanoma Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sanoma Oyj's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报