Dutch Bros (BROS): Assessing Valuation as Rapid Store Expansion and Same‑Store Sales Growth Accelerate

Rapid expansion is the big story for Dutch Bros (BROS) right now, with new drive thru shops planned across Louisiana, Florida, Tennessee, and Ohio, and rising same store sales backing up that growth.

See our latest analysis for Dutch Bros.

That expansion story is increasingly reflected in the market, with the share price at $61.16, an 8.61% year to date share price return and a powerful 98.44% three year total shareholder return suggesting momentum is still building rather than fading.

If Dutch Bros rapid rollout has you thinking about what else could compound over time, it might be worth exploring fast growing stocks with high insider ownership as another hunting ground for long term growth ideas.

With the business compounding fast and the stock still trading about 25% below consensus price targets despite nearly doubling over three years, is this a fresh buying opportunity or is the market already baking in years of growth?

Most Popular Narrative Narrative: 19.1% Undervalued

With the narrative fair value at $75.61 versus a $61.16 last close, the story leans toward upside and leans heavily on rapid growth and fatter margins ahead.

The evolving menu, featuring specialty beverages, energy drinks, and an expanded food pilot, taps into the consumer trend toward premiumization and customization in beverages; these higher-margin offerings and incremental morning daypart food sales support higher average ticket sizes and future margin/earnings growth. Tight operational control through a focus on company-owned stores (versus franchising), more efficient new shop build-outs, and favorable labor and input cost management are creating operational leverage as scale increases, supporting higher net margins and earnings growth as new units mature.

Curious how this growth engine supposedly scales from strong shop openings to dramatically higher per share profits without losing steam? The projection playbook behind that fair value might surprise you.

Result: Fair Value of $75.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost inflation and aggressive unit growth, which raise saturation risks, could quickly compress margins and undermine the upbeat long term growth narrative.

Find out about the key risks to this Dutch Bros narrative.

Another Lens on Valuation

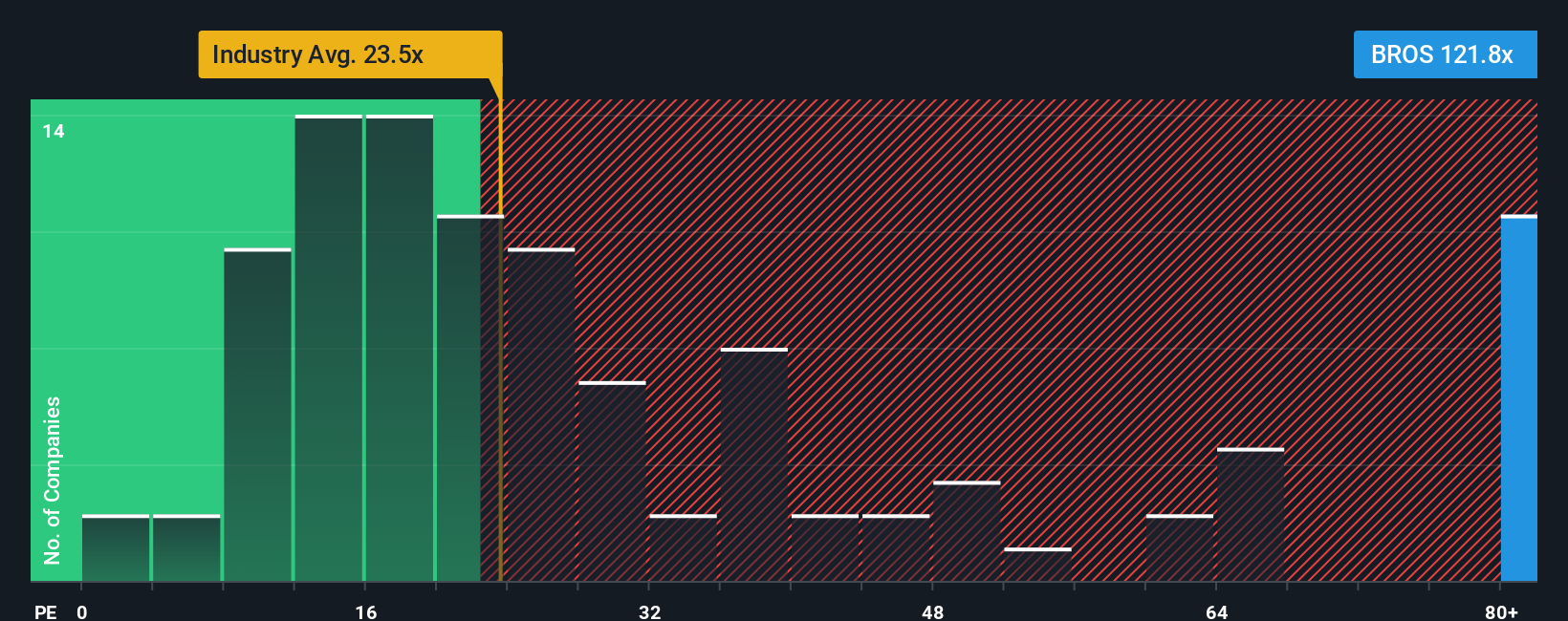

Those upbeat growth narratives meet a very different reality when you look at earnings based valuation. At 125.1 times earnings versus 24.6 times for the US Hospitality industry and a fair ratio of 35.1 times, Dutch Bros screens as richly priced. Is the market paying too far in advance for the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dutch Bros Narrative

If this storyline does not quite match your view or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your Dutch Bros research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investment move?

If you stop your research here, you could miss stronger opportunities. Put Simply Wall Street's Screener to work finding what Dutch Bros alone cannot.

- Capture potential bargain entries by running through these 907 undervalued stocks based on cash flows that look mispriced relative to their long term cash flow prospects.

- Capitalize on powerful technology shifts by targeting these 26 AI penny stocks riding structural demand for intelligent software and automation.

- Lock in income streams by focusing on these 13 dividend stocks with yields > 3% that can support compounding through regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报