Coca-Cola (KO) Stock Has Quietly Rallied: Is the Beverage Giant Now Over or Undervalued?

Why Coca-Cola Stock Is Back on Investors Radar

Coca-Cola (KO) has quietly outperformed the wider market over the past year, and with the stock up about 5% in the past 3 months, investors are revisiting its long term appeal.

See our latest analysis for Coca-Cola.

The latest move takes Coca-Cola's share price to $70.52, and that steady upward drift, alongside a roughly 15% one year total shareholder return, suggests resilient momentum as investors lean into its dependable earnings and dividend profile.

If Coca-Cola's defensive strength appeals to you, it might also be worth exploring fast growing stocks with high insider ownership as a way to uncover lesser known growth names where management has serious skin in the game.

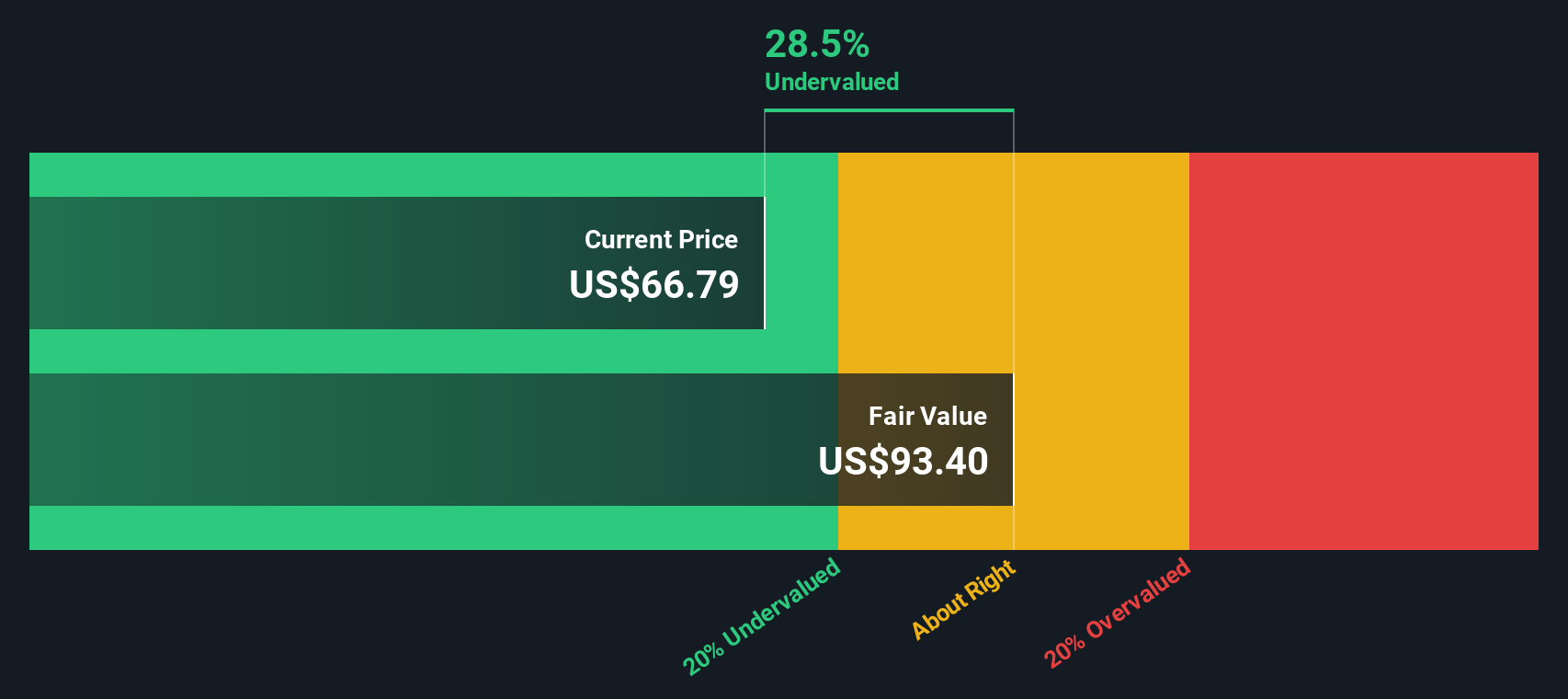

With earnings still growing modestly and the share price sitting below analyst targets, investors face a familiar dilemma: is Coca-Cola quietly undervalued today, or are markets already pricing in years of dependable growth?

Most Popular Narrative Narrative: 4.5% Overvalued

With Coca-Cola closing at $70.52 versus a narrative fair value of $67.50, the story hinges on how investors price its long term cash engine.

In discounted cash flow (DCF) analysis, the discount rate represents the cost of capital investors demand for future cash flows. A lower Fed Funds rate reduces borrowing costs and the weighted average cost of capital (WACC). Even a quarter-point cut can noticeably lift the present value of a durable cash generator like Coca-Cola.

Want to see why modest revenue growth, strong margins, and a premium profit multiple still point to potential upside? The narrative leans on surprisingly powerful compounding assumptions. Curious which cash flow path and valuation band do the heavy lifting? Click through to unpack the full model behind that fair value estimate.

Result: Fair Value of $67.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting consumer preferences toward healthier drinks and tougher sugar regulations could pressure Coca-Cola's volumes and margins, challenging this seemingly reliable cash flow story.

Find out about the key risks to this Coca-Cola narrative.

Another View: DCF Points to Deeper Value

Our DCF model paints a very different picture, putting Coca-Cola's fair value around $89.90 per share, which means the stock looks roughly 22% undervalued versus today’s price. If the cash flows prove as durable as history suggests, the real risk may be missing a slow compounding opportunity.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coca-Cola for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coca-Cola Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Coca-Cola research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas beyond Coca-Cola?

Before the market moves on without you, use the Simply Wall Street Screener to uncover fresh, data backed opportunities tailored to how you like to invest.

- Capture potential market mispricings by targeting companies trading below their estimated worth with these 907 undervalued stocks based on cash flows.

- Position yourself for the next wave of innovation by focusing on businesses shaping artificial intelligence through these 26 AI penny stocks.

- Strengthen your income stream by zeroing in on reliable payers using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报