TELUS (TSX:T) Valuation Check After New Social Initiative, AI Security Partnership and Capital Structure Moves

TELUS (TSX:T) is in the spotlight after launching its Mobility for Good for Indigenous Women at Risk program in Manitoba, along with a new Qohash partnership that tightens AI data protection across its Fuel iX platform.

See our latest analysis for TELUS.

These community and AI initiatives land while momentum in the shares has been weak, with a roughly double digit year to date share price decline and mid single digit negative one year total shareholder return, suggesting sentiment is still cautious despite improving fundamentals.

If TELUS has you thinking about where digital infrastructure and AI security go next, it could be worth exploring high growth tech and AI stocks for other potential long term compounders.

With the stock down over the past year but trading at a meaningful discount to analyst targets and intrinsic value estimates, are investors getting a mispriced dividend telecom in transition, or is TELUS fairly reflecting its growth runway?

Most Popular Narrative Narrative: 23.6% Undervalued

With TELUS last closing at CA$17.63 against a narrative fair value of about CA$23.06, the story leans toward a sizable upside if assumptions hold.

Deployment and commercialization of next generation technologies including AI powered customer experience platforms, data center assets for "sovereign AI" infrastructure, and private 5G position TELUS to create new revenue streams, lower cost to serve, and enhance its competitive moat, translating into higher future earnings and margin improvements.

Curious how modest revenue growth, rising margins, and a premium future earnings multiple can still add up to meaningful upside potential? See how this narrative connects the dots.

Result: Fair Value of $23.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intense competition pressuring wireless ARPU and heavy ongoing capex with elevated debt could weigh on margins and derail the long term upside.

Find out about the key risks to this TELUS narrative.

Another Lens on Valuation

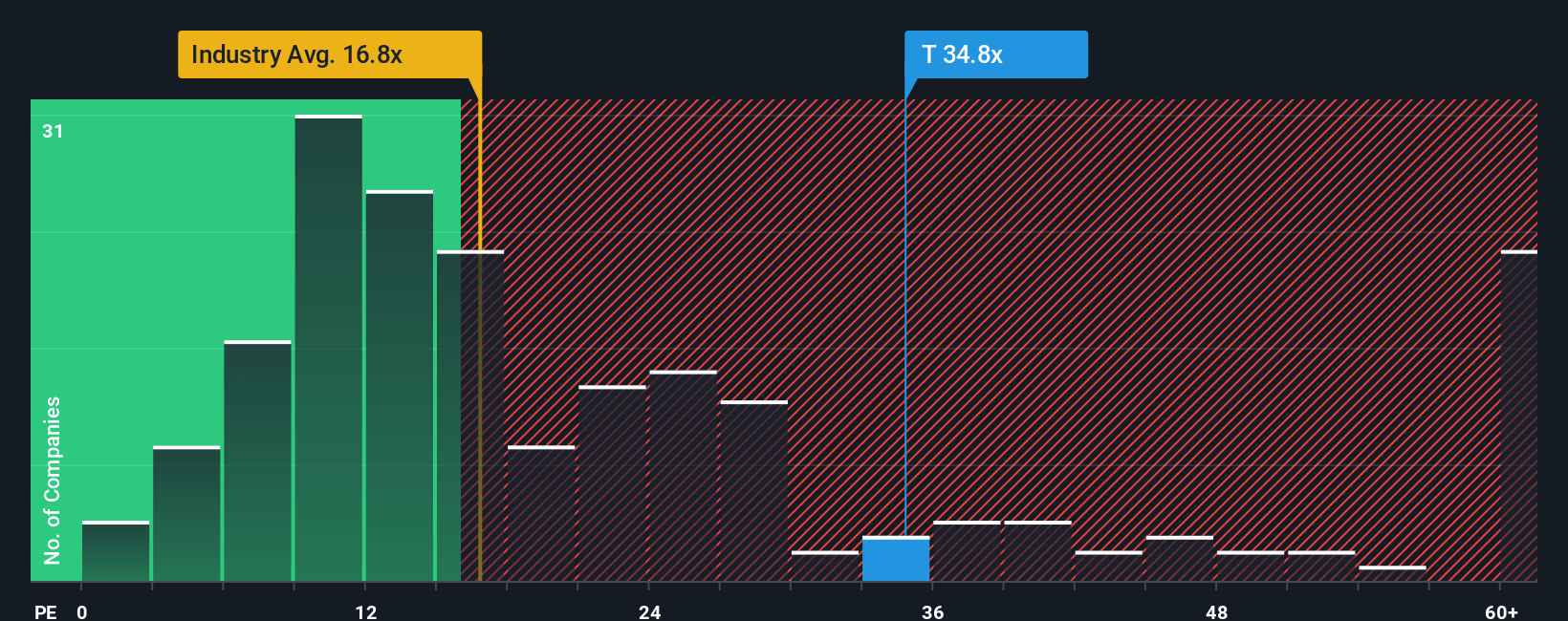

On earnings measures, TELUS looks much less like a bargain. The current P/E of 23.1 times is well above the global telecom average of 16.2 times, the peer average of 8.8 times, and even our fair ratio of 12.5 times, hinting at real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TELUS Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized TELUS view in just minutes using Do it your way.

A great starting point for your TELUS research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the chance to spot your next winner by using these focused screeners that surface opportunities most investors overlook.

- Capture potential multi baggers early by scanning these 3606 penny stocks with strong financials with improving fundamentals and room to grow.

- Position your portfolio for the next productivity boom by targeting these 26 AI penny stocks that are building real world AI solutions.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that can help support reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报