Revenues Not Telling The Story For China National Building Material Company Limited (HKG:3323)

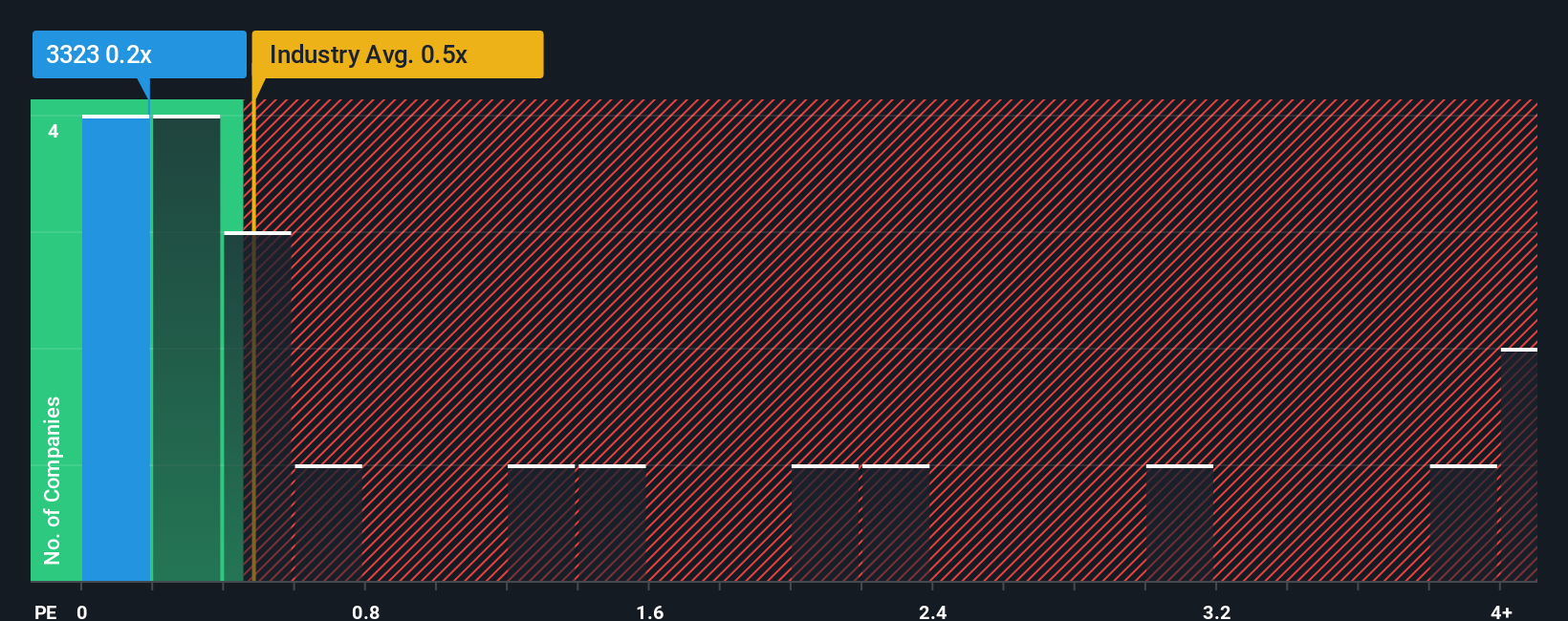

There wouldn't be many who think China National Building Material Company Limited's (HKG:3323) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Basic Materials industry in Hong Kong is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for China National Building Material

How Has China National Building Material Performed Recently?

With revenue that's retreating more than the industry's average of late, China National Building Material has been very sluggish. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on China National Building Material.Is There Some Revenue Growth Forecasted For China National Building Material?

In order to justify its P/S ratio, China National Building Material would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 2.4% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 29% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 2.7% as estimated by the ten analysts watching the company. That's shaping up to be materially lower than the 7.0% growth forecast for the broader industry.

In light of this, it's curious that China National Building Material's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does China National Building Material's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of China National Building Material's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It is also worth noting that we have found 2 warning signs for China National Building Material (1 can't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on China National Building Material, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报