Loar Holdings (LOAR): Reassessing Valuation After Record Q3, New Buy Ratings and Expanded Credit Capacity

Loar Holdings (LOAR) just gave investors a fresh data point to consider by pairing a larger delayed draw term loan commitment with record third quarter sales and positive new Wall Street coverage.

See our latest analysis for Loar Holdings.

Despite the fresh optimism, Loar’s 1 year total shareholder return of minus 10.02 percent and year to date share price return of minus 3.53 percent show that longer term momentum has been soft. However, a 7 day share price return of 5.23 percent hints that sentiment may be turning with the latest financing and coverage news.

If this kind of aerospace and defense story has your attention, it might be a good time to explore other names in the space using our aerospace and defense stocks.

With analysts calling Loar a high quality aerospace aftermarket compounder and the stock still trading well below consensus targets, is this a mispriced growth story, or is the market already discounting its next leg higher?

Most Popular Narrative: 25.2% Undervalued

With Loar Holdings last closing at $71.37 against a narrative fair value near the mid 90 dollar range, the story hinges on powerful earnings expansion and premium multiples.

Ongoing productivity initiatives, adoption of advanced value based pricing, and continuous improvement in manufacturing processes including the integration of advanced digital technologies are facilitating annual margin expansion. This trend is expected to enhance both operating leverage and net margins as topline scales. Strategic bolt on acquisitions such as Beadlight and the pending LMB Fans & Motors provide access to niche product markets with significant aftermarket and proprietary exposure; these deals are expected to be highly accretive in the coming years (with Beadlight specifically forecast to be "significantly accretive" to earnings by 2026) due to cross-selling opportunities and margin improvements as operational synergies are realized, resulting in increased EPS.

Want to see what kind of revenue climb, margin reset, and future earnings power are baked into that fair value, and why the implied multiple stays sky high? Dive in to uncover the exact growth pathway this narrative is betting on.

Result: Fair Value of $95.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration stumbles on niche acquisitions, or a sharper than expected downturn in commercial build rates, could quickly challenge this high multiple growth story.

Find out about the key risks to this Loar Holdings narrative.

Another View on Valuation

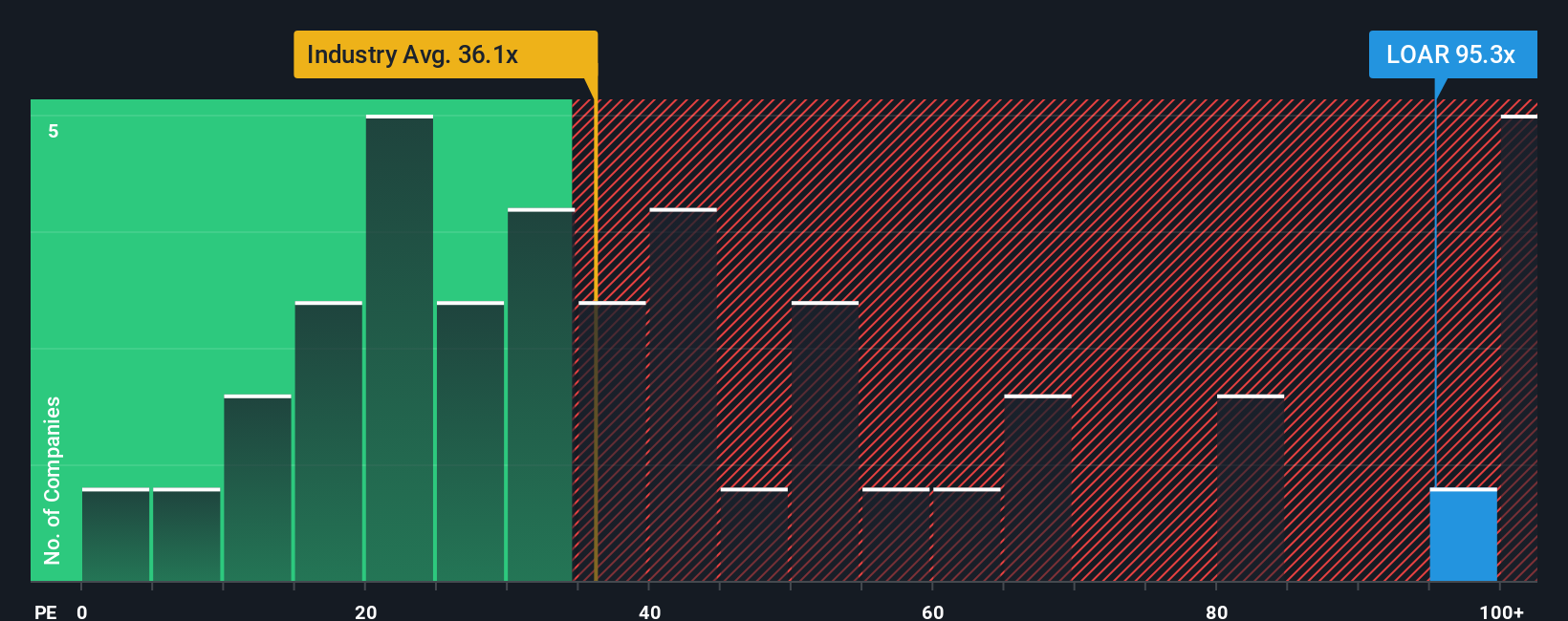

Step away from narrative fair value and the picture changes. On a price to earnings basis, Loar trades around 105.5 times, versus 36.7 times for the US Aerospace and Defense group and a 28.7 times fair ratio, and even peers sit closer to 59.2 times. That kind of premium can work, but how long will investors keep paying up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Loar Holdings Narrative

If you are not fully aligned with this perspective or would rather dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Loar Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, put Simply Wall Street to work for you, uncovering targeted stock ideas that match your strategy so real opportunities do not slip past.

- Capitalize on mispriced quality by scanning these 903 undervalued stocks based on cash flows where strong cash flows meet attractive entry prices.

- Harness the next wave of innovation by focusing on these 30 healthcare AI stocks that blend medical breakthroughs with intelligent automation.

- Supercharge your income strategy by targeting reliable payers through these 12 dividend stocks with yields > 3% that clear a 3% yield hurdle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报