Sportradar Group (NasdaqGS:SRAD): Revisiting Valuation After S&P Credit Upgrade and Growth-Focused Acquisition

Sportradar Group (NasdaqGS:SRAD) just picked up an S&P Global Ratings upgrade to BB from BB minus, a vote of confidence tied to its IMG Arena acquisition and disciplined balance sheet.

See our latest analysis for Sportradar Group.

That stronger credit profile sits against a mixed backdrop, with the latest share price at $23.14 and a roughly 32.7% year to date share price return, but a weaker 90 day share price return signaling that momentum has cooled, even as the three year total shareholder return above 120% still points to a solid long term story.

If you like the growth angle behind Sportradar, this could also be a good moment to explore fast growing stocks with high insider ownership for more under the radar opportunities with aligned insiders.

With analysts' targets sitting well above the current share price and growth still robust, investors face a pivotal question: is Sportradar quietly undervalued here, or is the market already baking in the next leg of expansion?

Most Popular Narrative Narrative: 29.7% Undervalued

With Sportradar last closing at $23.14 against a narrative fair value near $32.92, the story centers on sustained growth meeting richer long term margins.

Increasing demand for advanced, real time sports data, in play betting, and micro markets is driving greater adoption of premium, higher margin products like MTS and 4Sight, supporting both revenue acceleration and EBITDA margin expansion.

Deepening integration with clients and cross selling/upselling a broader suite of products, evidenced by 40% of clients now using four or more Sportradar products, boosts take rates, retention and generates high quality, recurring revenue, positively impacting earnings growth.

Curious how this growth engine turns into that higher price tag, the narrative focuses on bolder earnings, faster revenue compounding and richer margins than today.

Result: Fair Value of $32.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and the potential renegotiation of key sports data rights could undermine pricing power and stall the margin expansion that this narrative relies on.

Find out about the key risks to this Sportradar Group narrative.

Another View: Rich Multiples Signal Caution

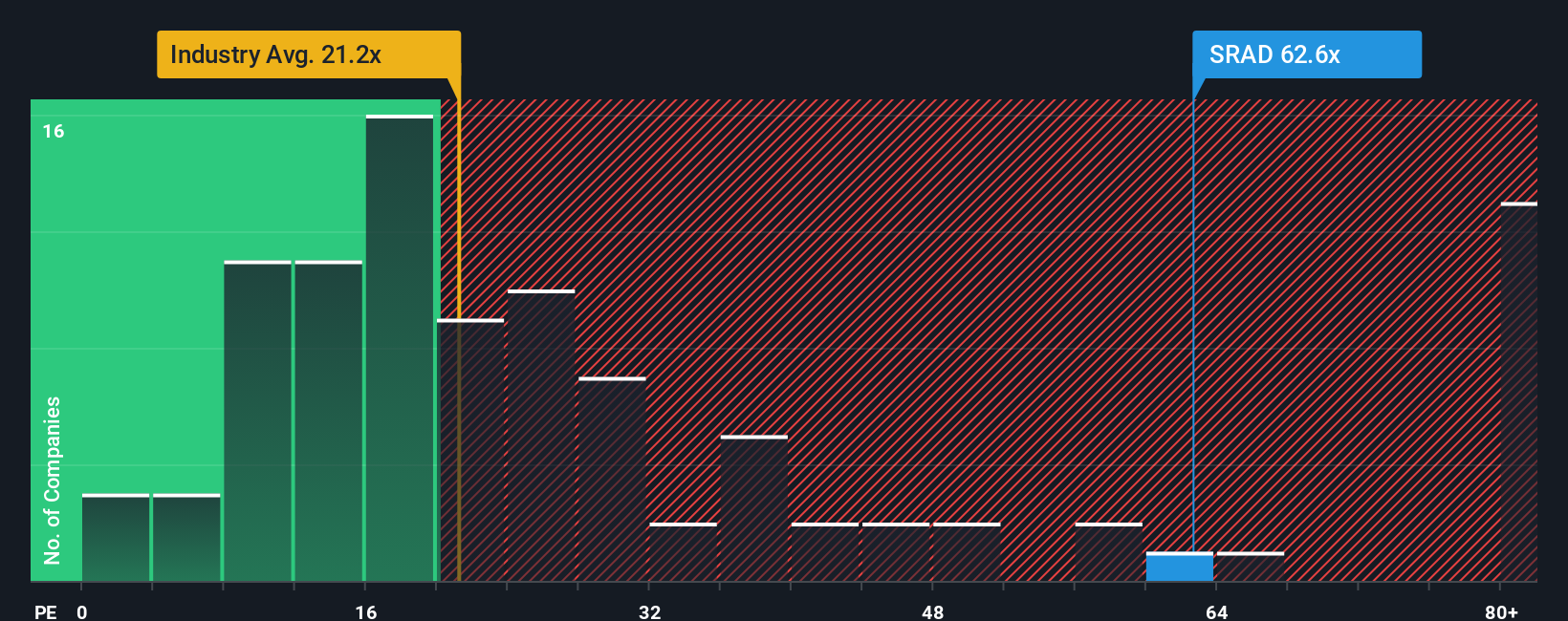

Set against that 29.7% narrative undervaluation, Sportradar trades on a steep 62.1x price to earnings ratio versus 23.6x for the US Hospitality industry and a 31.2x fair ratio. If sentiment cools, the share price could fall back toward those lower benchmarks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sportradar Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sportradar Group.

Ready for more high conviction ideas?

Before you move on, take a moment to line up your next opportunities with targeted screens on Simply Wall St that match your strategy and risk profile.

- Lock in potential income streams by scanning these 12 dividend stocks with yields > 3% for companies that combine solid payouts with sustainable fundamentals.

- Position yourself early in transformative themes by reviewing these 25 AI penny stocks shaping the future of intelligent automation and data driven services.

- Strengthen your hunt for bargains by sorting through these 903 undervalued stocks based on cash flows that the market may be mispricing today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报