Assessing Wihlborgs Fastigheter (OM:WIHL) Valuation After New Werket Leases in Malmö

Wihlborgs Fastigheter (OM:WIHL) is drawing fresh attention after signing Media Evolution to 3,600 square metres at Werket in Malmö, just as Cloetta shifts its largest Scandinavian office into the same property.

See our latest analysis for Wihlborgs Fastigheter.

These new leases land while Wihlborgs’ share price has drifted lower, with a year to date share price return of around minus 16% and a 1 year total shareholder return of roughly minus 14%. However, the 3 year total shareholder return of nearly 20% suggests the longer term story remains intact even as near term sentiment cools.

If this kind of district transformation has your attention, it could be worth broadening your search and exploring fast growing stocks with high insider ownership as potential next wave opportunities.

With earnings still growing, a double digit discount to analyst targets and fresh momentum in key Malmö assets, is Wihlborgs quietly undervalued here or are markets already pricing in its next leg of growth?

Most Popular Narrative: 19.1% Undervalued

With the most followed narrative pointing to a fair value above the SEK 88.7 last close, the focus shifts to how earnings and cash flows evolve from here.

The analysts have a consensus price target of SEK112.4 for Wihlborgs Fastigheter based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK120.0, and the most bearish reporting a price target of just SEK100.0.

Curious how steady revenue growth, shifting margins and a richer future earnings multiple combine to justify a higher value than today? Want to see the full playbook behind that projection?

Result: Fair Value of $109.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high leverage and rising vacancies in certain sub markets could pressure earnings, challenge refinancing, and undermine the more optimistic long term projections.

Find out about the key risks to this Wihlborgs Fastigheter narrative.

Another Angle on Value

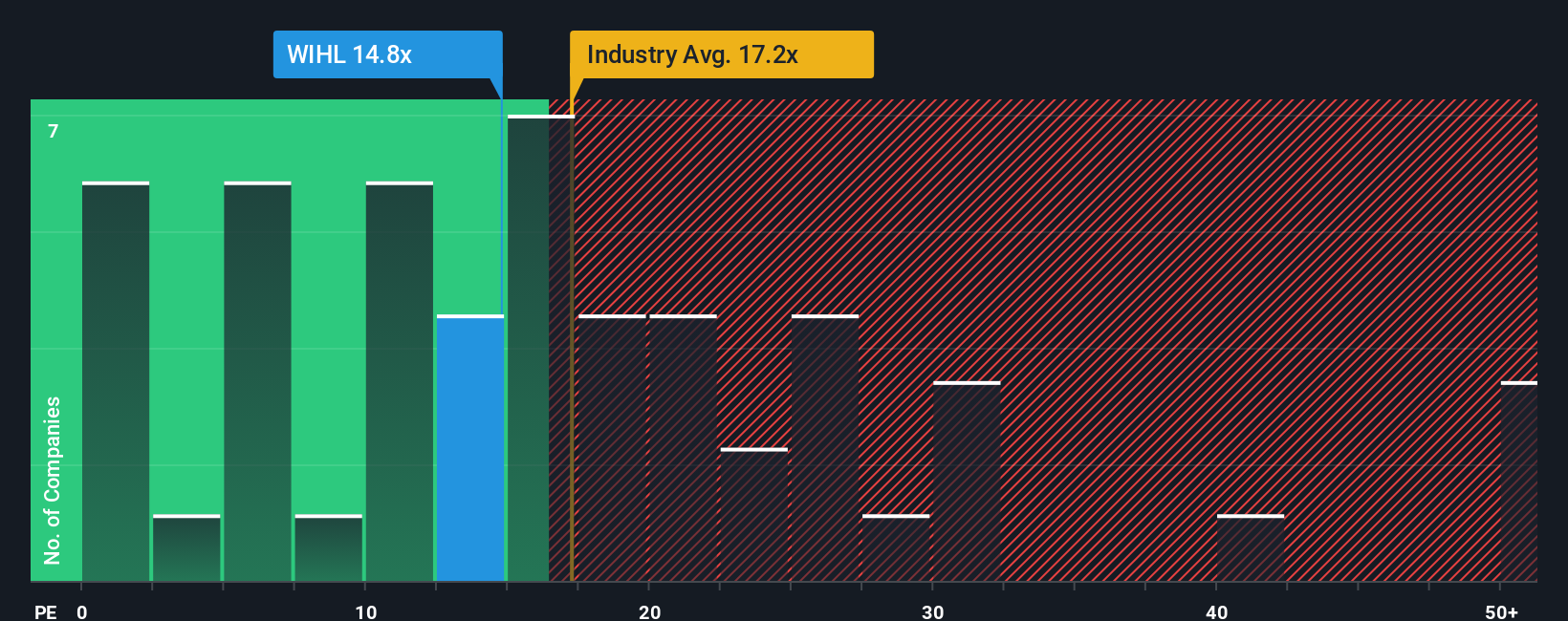

Analysts think Wihlborgs is cheap on earnings, with a 12.2x price to earnings ratio versus 14.3x for the Swedish real estate sector, 34.8x for peers and a 16.3x fair ratio. If sentiment normalises toward that fair ratio, are investors being paid enough to wait?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wihlborgs Fastigheter for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wihlborgs Fastigheter Narrative

If you see things differently or simply enjoy digging into the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Wihlborgs Fastigheter research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more high conviction ideas?

Before you move on, put Simply Wall Street’s powerful Screener to work and uncover focused opportunities that match your style instead of settling for broad market noise.

- Supercharge your search for potential market leaders by targeting growth potential and pricing power with these 908 undervalued stocks based on cash flows that already look compelling on cash flows.

- Tap into cutting edge innovation by scanning these 25 AI penny stocks positioned at the front line of artificial intelligence, automation and data driven business models.

- Explore possible income streams by reviewing these 12 dividend stocks with yields > 3% that combine current yields with the financial strength to support payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报