Is UPS Attractively Priced After Recent Share Price Rebound In 2025?

- If you are wondering whether United Parcel Service is a bargain or a value trap at current levels, you are not alone. This breakdown is designed to cut through the noise for long-term investors.

- Despite a tough longer-term picture, with the stock down 18.9% year to date and 16.7% over the past year, UPS has bounced 6.0% in the last week and 5.7% over the past month as sentiment has started to thaw.

- That shift comes as investors refocus on UPS's leverage to global e-commerce volumes and the ongoing reset of its cost base, including labor and network efficiencies. At the same time, renewed discussion about reshoring and supply chain resilience has put established logistics networks like UPS back in the spotlight as potential long-term winners.

- On our framework, UPS scores a solid 5 out of 6 for undervaluation checks. That makes it a prime candidate to test across multiple valuation lenses, and we will not only compare those methods but also finish with a more holistic way to think about what the stock may be worth.

Find out why United Parcel Service's -16.7% return over the last year is lagging behind its peers.

Approach 1: United Parcel Service Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes UPS's expected future cash flows, then discounts them back to today using a required rate of return to estimate what the business is worth right now.

UPS generated last twelve months free cash flow of about $3.7 billion, and analysts see this growing steadily as efficiency gains and volume recovery feed through. Simply Wall St combines analyst forecasts for the next few years with its own extrapolations, projecting free cash flow rising to roughly $6.2 billion by 2029 and continuing to climb over the following decade.

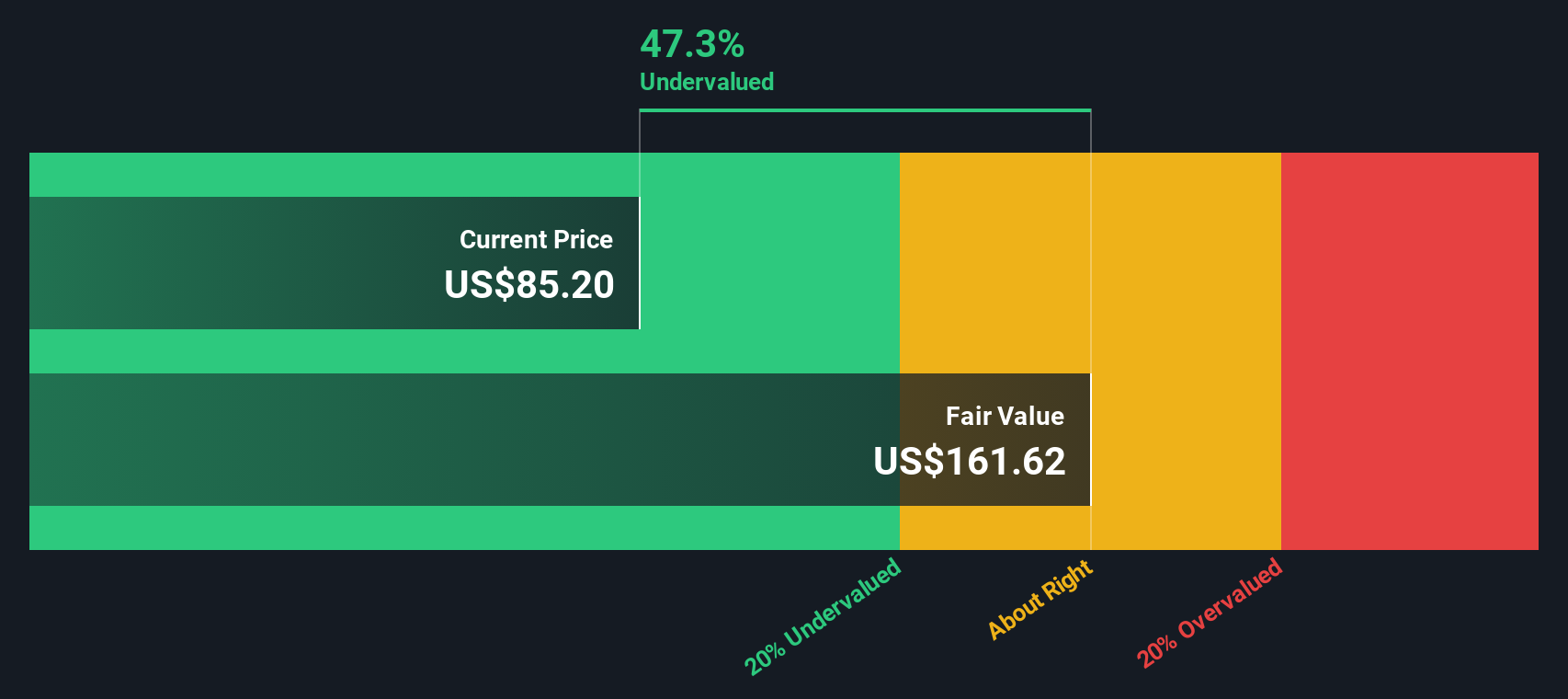

When these projected cash flows are discounted back to today using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value comes out at $136.13 per share. Compared with the current share price, this implies the stock is trading at a 26.2% discount, which indicates potential upside if the cash flow path is roughly achieved.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Parcel Service is undervalued by 26.2%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: United Parcel Service Price vs Earnings

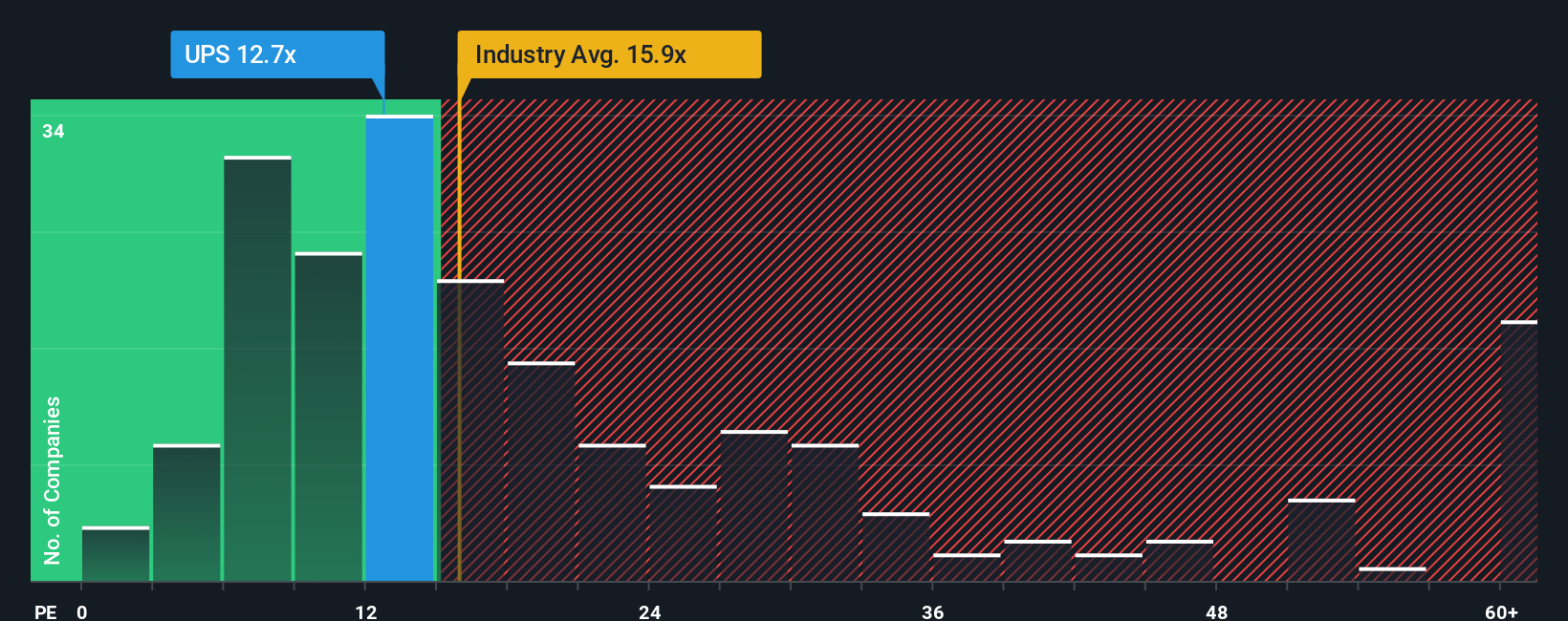

For a mature, profitable business like United Parcel Service, the price to earnings ratio is a useful way to gauge how much investors are paying for each dollar of current profit. In general, companies with stronger growth prospects and lower perceived risk can justify a higher PE multiple, while slower growing or riskier names tend to trade on lower multiples.

UPS currently trades on a PE of about 15.5x, slightly below the Logistics industry average of around 16.0x and well below the broader peer group average near 21.3x. On the surface, that discount suggests the market is more cautious on UPS than on many of its peers, despite its scale and entrenched position in global parcel delivery.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple UPS should trade on given its earnings growth profile, profitability, industry, market cap and risk characteristics. For UPS, that Fair Ratio is 19.4x, which is meaningfully above the current 15.5x. Because this metric blends both company specific factors and sector context, it offers a more tailored benchmark than simple peer or industry comparisons, and on this basis UPS screens as undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Parcel Service Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of UPS’s future with concrete numbers like revenue, earnings, margins and a fair value estimate.

A Narrative is essentially your story for the company, where you spell out what you think will happen with UPS’s strategy, risks and competitive position, and then link that story to a financial forecast and a resulting fair value that you can compare to today’s share price to decide whether to buy, hold or sell.

On Simply Wall St, millions of investors build and share these Narratives on the Community page. They are kept up to date as new information, such as earnings reports or major news, is released, so your valuation can move as the story evolves rather than staying frozen in time.

For example, one UPS Narrative on the platform sees fair value near $95 per share based on modest revenue growth and constrained margins. Another, more optimistic view points to around $132 per share with stronger growth, higher margins and a richer PE multiple. Narratives make these differences transparent and easy to compare.

For United Parcel Service, however, we will make it really easy for you with previews of two leading United Parcel Service Narratives:

🐂 United Parcel Service Bull Case

Fair value: $132.37

Implied undervaluation vs last close: 24.1%

Assumed revenue growth: 2.30%

- Sees UPS executing its automation and network overhaul faster than the market expects, which is described as driving structurally higher margins, free cash flow and revenue per piece by 2026 and beyond.

- Builds in outsized growth from international trade lanes and an $82 billion healthcare logistics opportunity, supported by the Andlauer acquisition and differentiated tech capabilities.

- Targets 2028 earnings of $8.0 billion and a PE multiple of 17.3x, implying a bullish price of $132.37, while stressing that investors must be comfortable with competition, labor, regulatory and sustainability risks.

🐻 United Parcel Service Bear Case

Fair value: $95.21

Implied overvaluation vs last close: 5.0%

Assumed revenue growth: 1.75%

- Focuses on execution risk around the Efficiency Reimagined program, with facility closures, headcount cuts and heavy automation spend potentially disrupting operations and constraining profitability.

- Flags rising leverage, higher interest costs, union tensions, governance concerns and only modest expected improvements in margins and growth as reasons to stay cautious.

- Projects 2028 earnings of $6.9 billion and a 14.5x PE, leading to a fair value of $95.21, which is described as only modestly above today’s price and as leaving limited upside if the plan underdelivers.

Do you think there's more to the story for United Parcel Service? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报