Uranium Energy (UEC): Assessing Valuation After a Sharp 10% Move and 86% Year-to-Date Rally

Uranium Energy (UEC) has been on traders radar after a sharp 10% daily move, capping an impressive YTD climb of around 86%. That kind of run naturally raises questions about sustainability and entry points.

See our latest analysis for Uranium Energy.

That surge to a share price of $14.15 builds on a strong uranium upcycle story, with a 30 day share price return of 14.11% and a three year total shareholder return of 338.08% suggesting momentum is still very much on investors side.

If this kind of sustained move has you thinking about what else could run, now is a good time to explore fast growing stocks with high insider ownership.

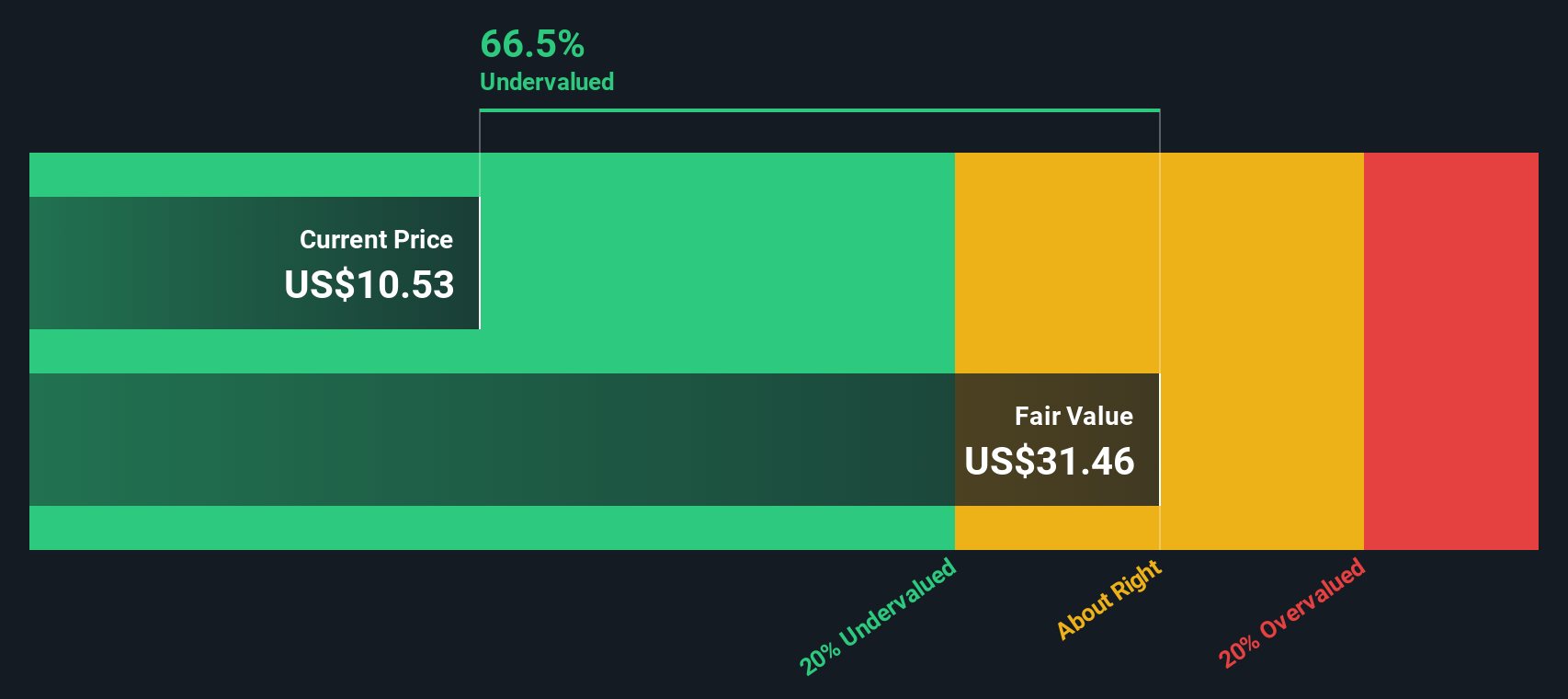

With the stock sitting near its highs, yet still trading below the average analyst price target, investors face a key question: Is Uranium Energy still undervalued, or is the market already pricing in its future growth?

Price to Book of 5.2x: Is it justified?

Compared with the last close at $14.15, Uranium Energy screens as expensive on a price to book basis relative to both its sector and peers.

The price to book multiple compares a company’s market value to its net assets. This metric is often used for capital intensive, asset heavy businesses like miners and energy producers. A higher ratio can signal that investors expect strong future returns on those assets or are willing to pay up for strategic reserves and growth potential.

In this case, Uranium Energy trades at a price to book ratio of 5.2 times. This is well above the broader US Oil and Gas industry average of 1.4 times and higher than its closer peer group average of 4.4 times, suggesting the market is assigning a clear premium to its growth profile and uranium exposure.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 5.2x (OVERVALUED)

However, investors should weigh risks, including volatile uranium pricing and ongoing losses, which could quickly undermine the premium valuation currently embedded in the stock.

Find out about the key risks to this Uranium Energy narrative.

Another View: DCF Points to a Richer Price

Our DCF model paints a similar picture, with Uranium Energy trading above its estimated fair value of $12.48 at the current $14.15 share price. If both book value and cash flow point to limited upside, are investors leaning too hard into the uranium story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Uranium Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Uranium Energy Narrative

If you are skeptical of this view or simply prefer digging into the numbers yourself, you can build a personalized thesis in minutes: Do it your way.

A great starting point for your Uranium Energy research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities with hand picked stock ideas from our powerful Screener so you are not chasing the market later.

- Explore early stage potential by targeting these 3609 penny stocks with strong financials that show stronger fundamentals than the typical speculative name.

- Track structural shifts in automation and data by focusing on these 25 AI penny stocks positioned at the center of real world AI adoption.

- Look for a margin of safety with these 905 undervalued stocks based on cash flows that appear mispriced based on their projected cash flows, before the rest of the market revalues them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报