What Chipotle Mexican Grill (CMG)'s Expanded Multi-Quarter Buyback Authorization Means For Shareholders

- Earlier this month, Chipotle Mexican Grill’s board authorized an additional US$1.80 billion in share repurchases, shifting from smaller quarterly approvals to a larger, multi-quarter buyback pool that leaves about US$1.85 billion available and can be adjusted or halted at any time.

- This expanded, flexible repurchase capacity highlights management’s confidence in Chipotle’s long-term prospects even as the company contends with softer traffic and macroeconomic pressures.

- We’ll now examine how this enlarged multi-quarter buyback authorization fits into Chipotle’s growth-focused investment narrative and alters its risk-reward profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Chipotle Mexican Grill Investment Narrative Recap

To own Chipotle, you need to believe its brand, unit growth and efficiency investments can offset softer traffic and macro pressure. The enlarged US$1.80 billion buyback authorization supports that long-term view, but does little to change the near term catalyst around traffic stabilization or the key risk from ongoing consumer spending weakness and inflation-sensitive lower income guests.

Among recent announcements, the Q3 2025 update is most relevant, with 7.5% revenue growth alongside margin pressure from higher labor costs and softer foot traffic. That backdrop makes the bigger, flexible buyback more about capital deployment than business acceleration, while investors still watch how new menu items, digital efforts and international expansion translate into healthier comparable sales.

Yet while the buyback grabs attention, investors should also be aware of how prolonged consumer pullbacks could...

Read the full narrative on Chipotle Mexican Grill (it's free!)

Chipotle Mexican Grill’s narrative projects $16.4 billion revenue and $2.3 billion earnings by 2028. This requires 12.3% yearly revenue growth and a $0.8 billion earnings increase from $1.5 billion today.

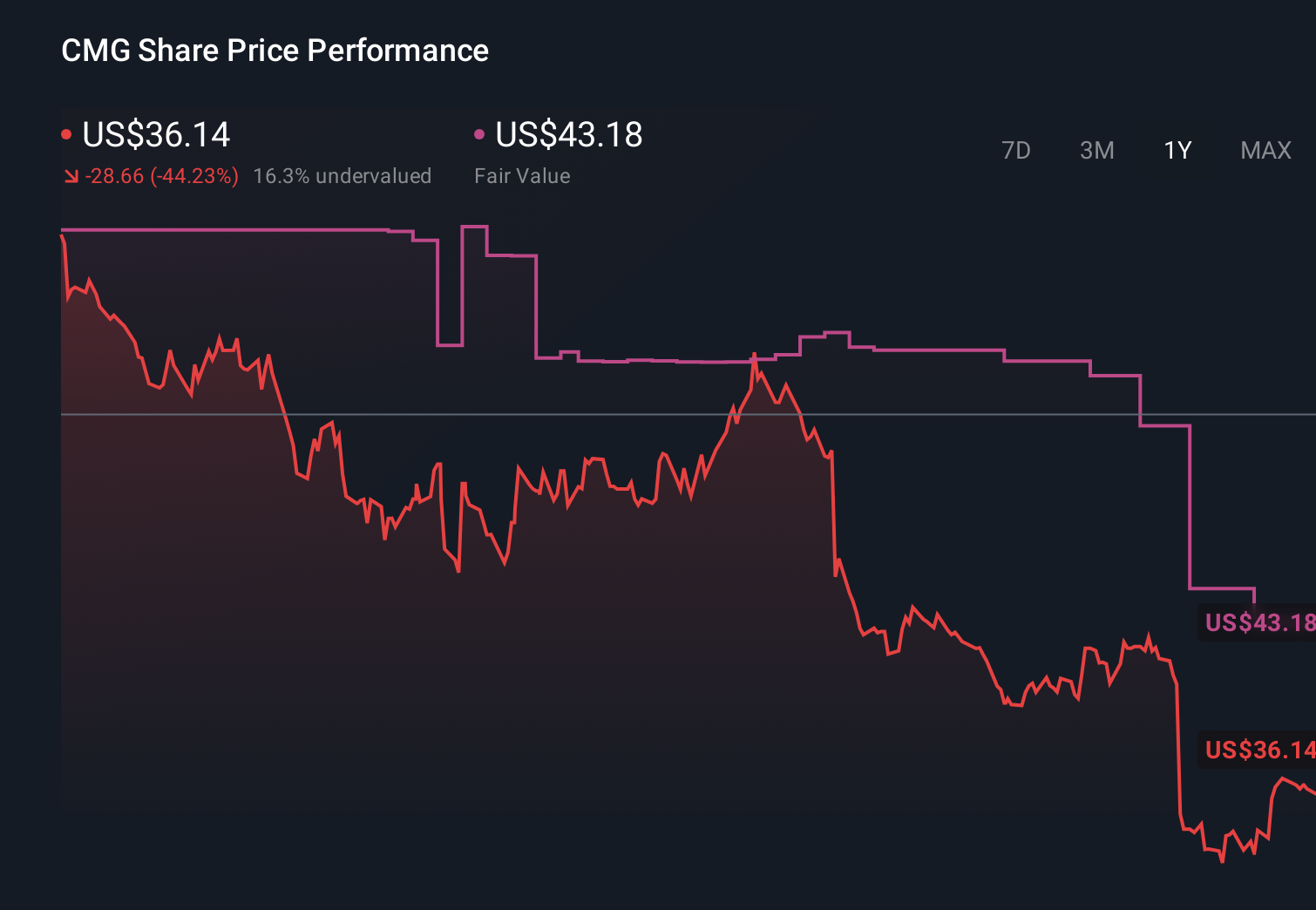

Uncover how Chipotle Mexican Grill's forecasts yield a $43.18 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Twenty two fair value estimates from the Simply Wall St Community span roughly US$35 to US$68 per share, reflecting very different expectations for Chipotle. As you compare those views with the risk of weaker consumer spending and soft traffic, it helps to weigh how each assumption could influence Chipotle’s ability to sustain its current growth and margin profile.

Explore 22 other fair value estimates on Chipotle Mexican Grill - why the stock might be worth as much as 94% more than the current price!

Build Your Own Chipotle Mexican Grill Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chipotle Mexican Grill research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Chipotle Mexican Grill research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chipotle Mexican Grill's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 11 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报