Is UniCredit’s Accelerated Russia Exit Reshaping The Investment Case For UniCredit (BIT:UCG)?

- In recent weeks, UniCredit has accelerated its pullback from Russia by selling almost all long-term leasing assets from UniCredit Leasing to Russia-based PR-Leasing and seeing several senior executives depart, as it works toward a full exit under European regulatory pressure.

- This retrenchment marks a meaningful reshaping of UniCredit’s geographic risk profile and reduces its exposure to a market that had previously contributed to group profits.

- We’ll now examine how UniCredit’s rapid disposal of Russian leasing assets could influence its existing investment narrative and future earnings mix.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

UniCredit Investment Narrative Recap

To own UniCredit, you need to believe in a disciplined, capital-focused European bank that is reshaping its risk footprint while returning large amounts of capital to shareholders. The rapid Russia pullback slightly accelerates an already expected earnings headwind from that market, but near term the more important catalyst remains UniCredit’s ability to sustain high net income and distributions, while the key risk is whether replacement growth in other regions and products can offset the phased loss of Russian profits.

The most relevant recent announcement here is UniCredit’s confirmation of its 2025 net profit guidance of €10.5 billion and an expectation of net profit well above €11 billion by 2027. Against the backdrop of exiting Russia, this guidance frames how management sees the earnings mix evolving, and it links directly to the main short term catalyst for the stock: whether UniCredit can maintain strong profitability and capital returns while managing geopolitical, regulatory and cross border M&A constraints.

Yet the retreat from Russia also exposes an underappreciated risk that investors should keep in mind as UniCredit’s future earnings mix becomes increasingly reliant on...

Read the full narrative on UniCredit (it's free!)

UniCredit’s narrative projects €26.0 billion revenue and €10.3 billion earnings by 2028.

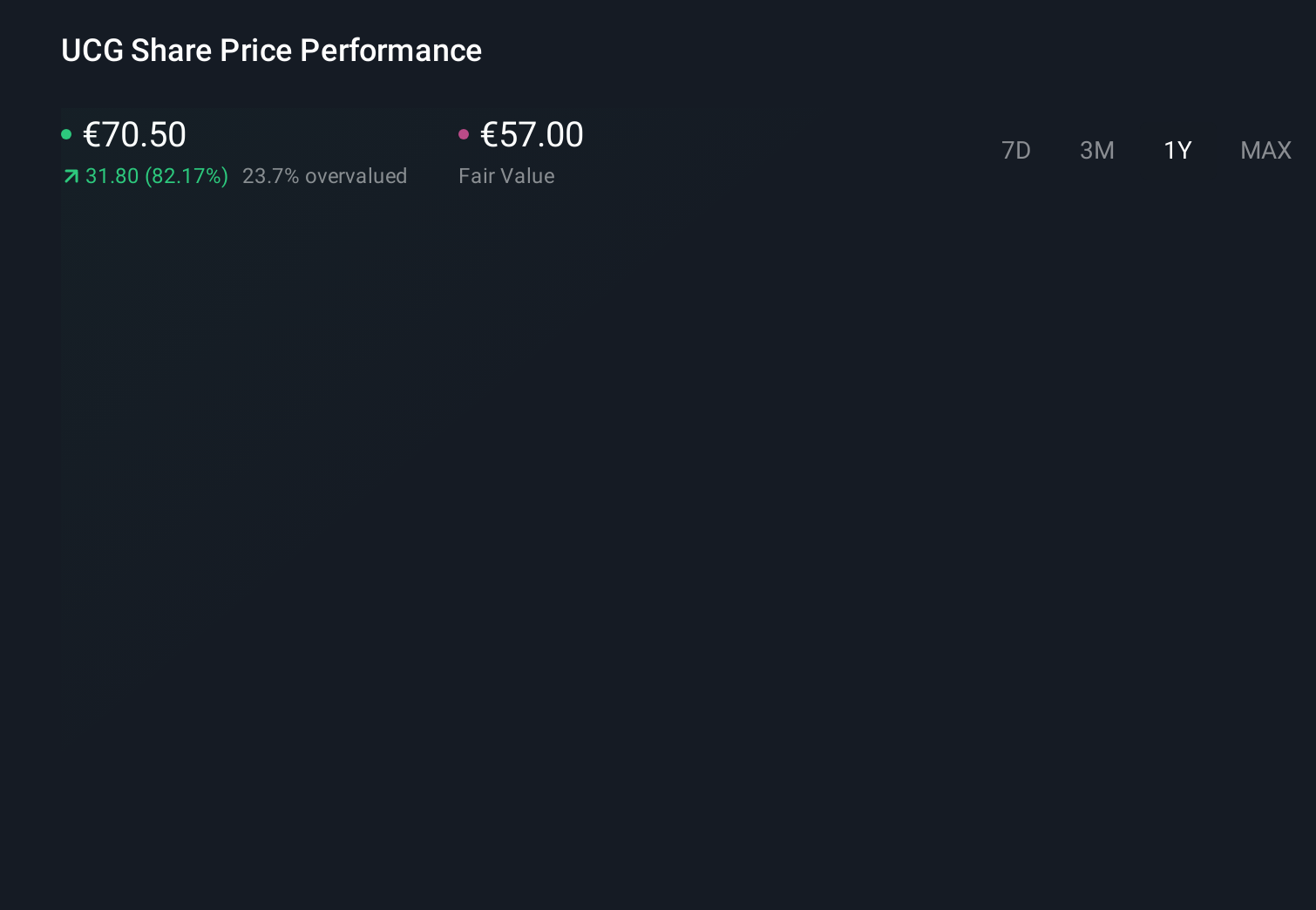

Uncover how UniCredit's forecasts yield a €71.12 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see UniCredit’s fair value between €71.12 and €80.74, highlighting a relatively tight cluster of views. You can compare those against the risk that withdrawing from a once profitable Russian business may leave UniCredit more dependent on slower growing core markets and less mature regions for future earnings momentum.

Explore 4 other fair value estimates on UniCredit - why the stock might be worth just €71.12!

Build Your Own UniCredit Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UniCredit research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UniCredit research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UniCredit's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报