Hansoh Pharmaceutical Group (SEHK:3692) Valuation Update After New NRDL Wins for Ameile, Saint Luolai and Hengmu

Hansoh Pharmaceutical Group (SEHK:3692) just secured fresh National Reimbursement Drug List approvals for new Ameile indications, plus renewals for Saint Luolai and Hengmu, a policy shift that could reshape its revenue mix from 2026.

See our latest analysis for Hansoh Pharmaceutical Group.

That backdrop helps explain why sentiment has swung so hard in Hansoh’s favour, with a 30 day share price return of 18.79 percent and a one year total shareholder return of 137.26 percent signalling strong, building momentum rather than a short lived spike.

If this kind of reimbursement driven rerating interests you, it is worth exploring other healthcare stocks that may be lining up similar catalysts.

Yet with the shares already near analyst targets and trading after a 160 percent year to date surge, investors must now ask whether Hansoh is still undervalued or if the market is already pricing in future growth.

Price to Earnings of 49.8x: Is it justified?

Hansoh trades on a steep 49.8x price to earnings ratio against a last close of HK$43.36, suggesting investors are paying a premium for growth.

The price to earnings multiple reflects how much the market is willing to pay today for each unit of the company’s current earnings. This is a key lens for profitable pharma names like Hansoh, where pipeline visibility and margin durability matter as much as near term profit.

Here, the market is assigning Hansoh a valuation that is more than double the peer average P E of 23.3x and significantly above the estimated fair P E of 26.8x. This implies that expectations for future earnings expansion, pipeline success, and reimbursement gains are already richly capitalised in the share price and may have limited room to shift higher toward that fair ratio level.

Compared with the wider Hong Kong Pharmaceuticals industry average of 13.5x, Hansoh’s multiple looks even more stretched. This underscores how aggressively the market is repricing its earnings relative to sector norms.

Explore the SWS fair ratio for Hansoh Pharmaceutical Group

Result: Price to Earnings of 49.8x (OVERVALUED).

However, risks remain, including potential reimbursement setbacks, slower than expected uptake of new indications, or pipeline disappointments that could puncture the current growth premium.

Find out about the key risks to this Hansoh Pharmaceutical Group narrative.

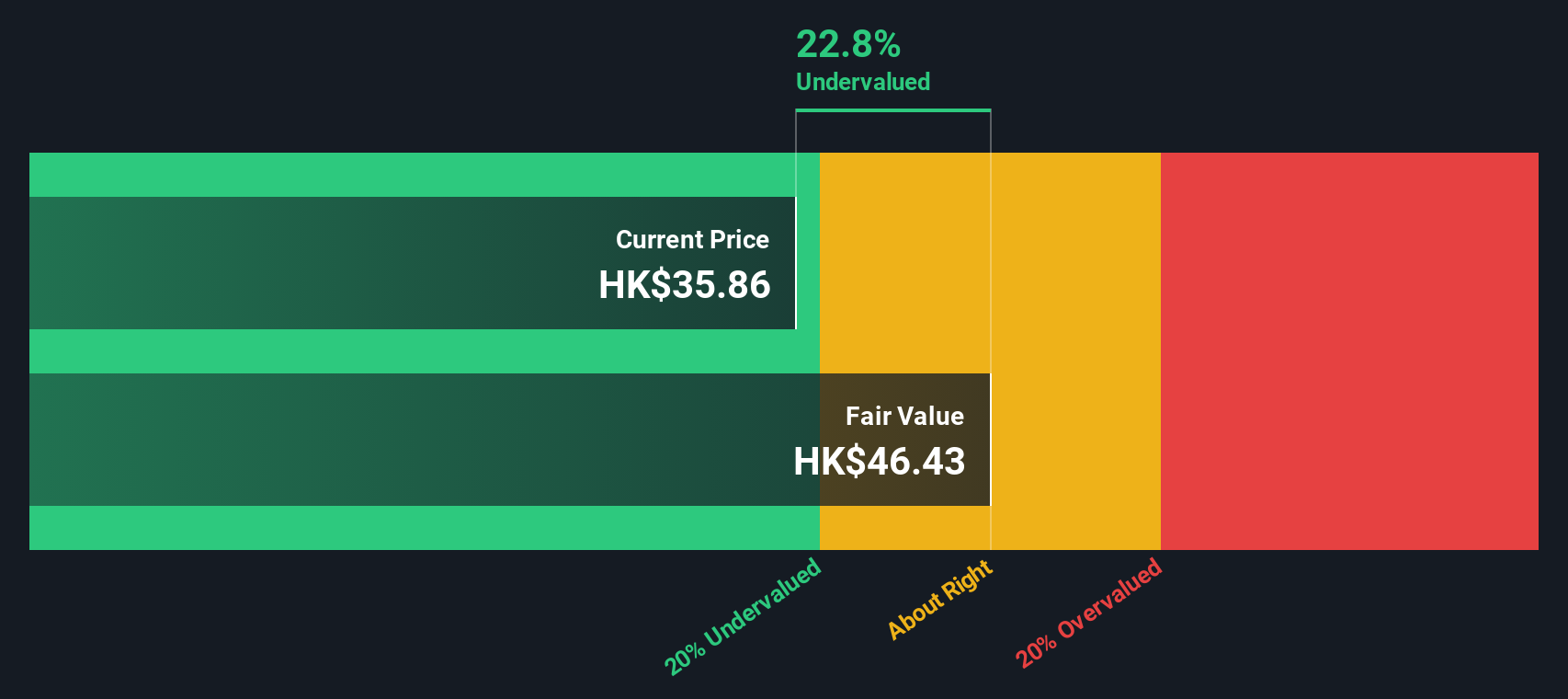

Another View: DCF Suggests the Shares Are Cheap

While the 49.8x earnings multiple appears expensive, our DCF model points the other way, with fair value at about HK$46.62 versus the current HK$43.36. Trading roughly 7 percent below that mark, is the market underestimating the durability of Hansoh’s cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hansoh Pharmaceutical Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hansoh Pharmaceutical Group Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised view on Hansoh in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Hansoh Pharmaceutical Group.

Ready for your next strong idea?

Before the market moves on without you, put more candidates on your radar with the Simply Wall St Screener and keep compounding smart decisions.

- Capture potential mispricings early by scanning these 909 undervalued stocks based on cash flows, where solid cash flows may not yet be fully recognised in market prices.

- Target powerful income streams by focusing on these 12 dividend stocks with yields > 3%, which can strengthen total returns through consistent cash payouts.

- Ride structural growth themes by assessing these 25 AI penny stocks, which could benefit from accelerating adoption of artificial intelligence across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报