3 ASX Penny Stocks With Market Caps Reaching A$900M

The Australian stock market has faced challenges recently, with the ASX200 underperforming compared to its global peers despite a US Fed Rate Cut. In such conditions, investors often look towards penny stocks as a potential avenue for growth. Although the term "penny stocks" may seem outdated, these smaller or newer companies can offer opportunities when they possess strong financials and clear growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.405 | A$116.07M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.475 | A$69.58M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.79 | A$49.19M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.80 | A$430.33M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.20 | A$236.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.98M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.76 | A$3.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.36B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.935 | A$134.58M | ✅ 4 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.42 | A$634.71M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 421 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Civmec (ASX:CVL)

Simply Wall St Financial Health Rating: ★★★★★★

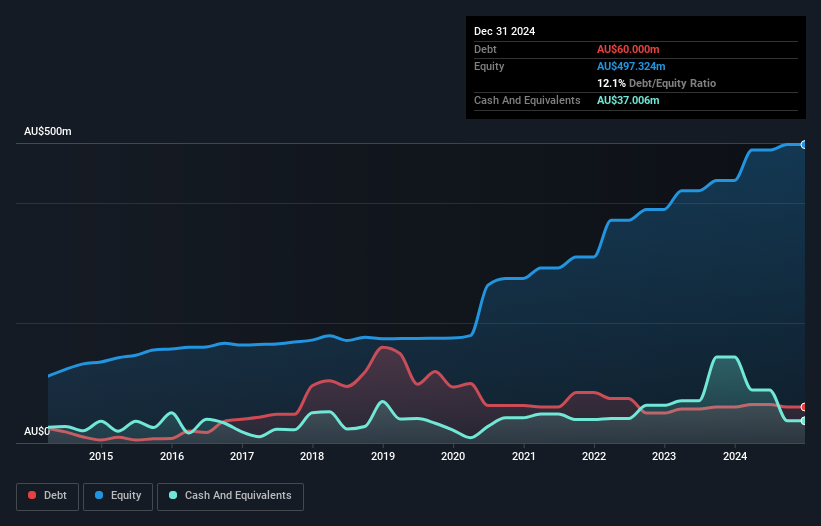

Overview: Civmec Limited is an investment holding company that offers construction and engineering services across the energy, resources, infrastructure, marine, and defense sectors in Australia, with a market cap of A$708.38 million.

Operations: The company generates its revenue from three main segments: Energy (A$65.19 million), Resources (A$641.23 million), and Infrastructure, Marine & Defence (A$104.17 million).

Market Cap: A$708.38M

Civmec Limited is trading at a significant discount to its estimated fair value, which could appeal to value-focused investors. The company maintains a strong financial position with cash exceeding total debt and short-term assets comfortably covering both short-term and long-term liabilities. Despite this, Civmec's profitability has declined recently, with net profit margins decreasing from the previous year. Additionally, the management team is relatively new, suggesting potential transitional challenges. However, Civmec's earnings are expected to grow annually by 13.97%, indicating potential future upside if operational efficiencies improve alongside market conditions stabilizing.

- Jump into the full analysis health report here for a deeper understanding of Civmec.

- Assess Civmec's future earnings estimates with our detailed growth reports.

Focus Minerals (ASX:FML)

Simply Wall St Financial Health Rating: ★★★★★★

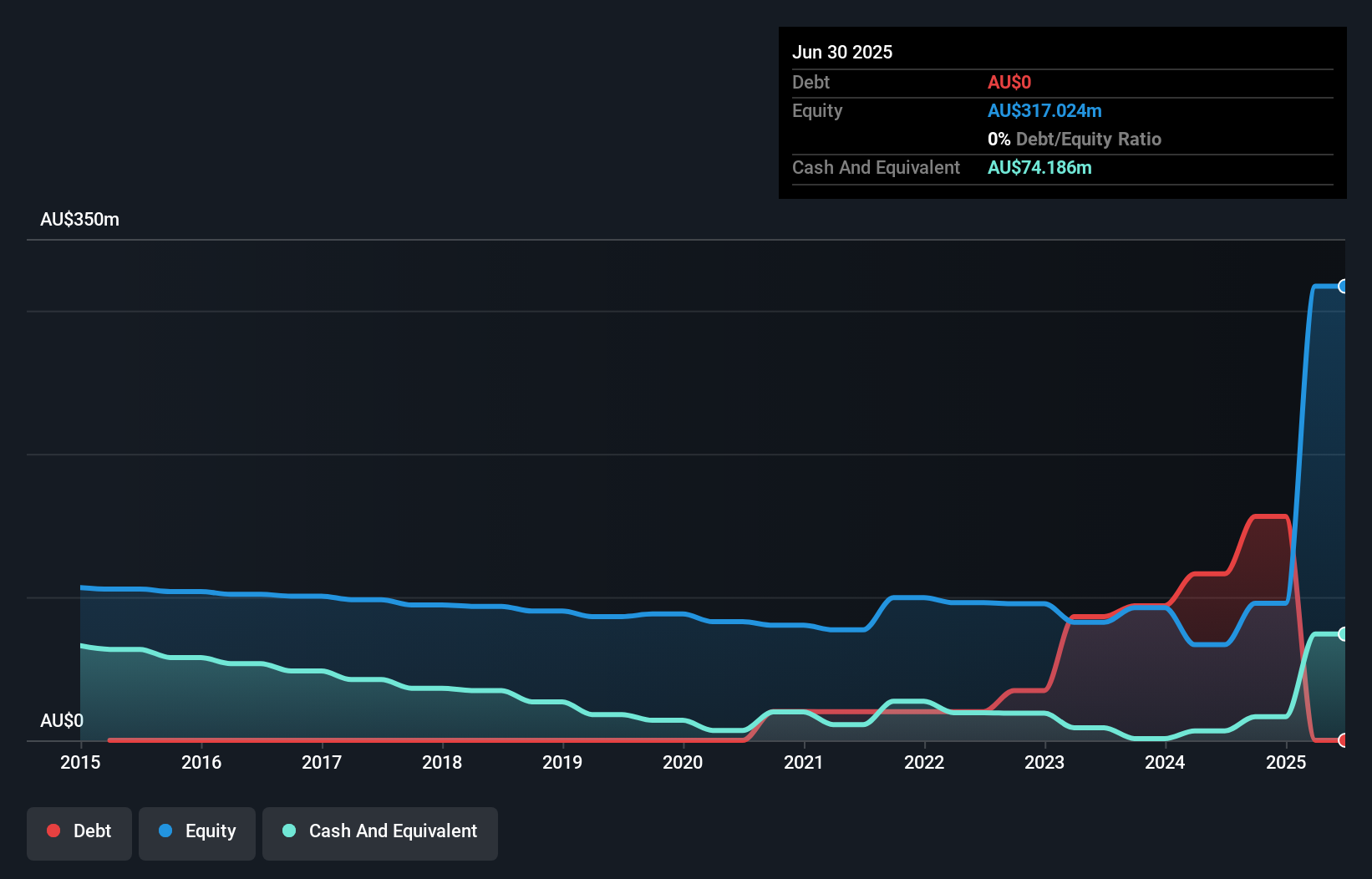

Overview: Focus Minerals Limited is involved in the exploration and development of gold properties in Western Australia, with a market capitalization of A$874 million.

Operations: The company generates its revenue primarily from the Coolgardie segment, amounting to A$151.74 million.

Market Cap: A$874M

Focus Minerals Limited has demonstrated significant financial improvement, reporting A$77.73 million in sales for the half year ending June 30, 2025, up from A$41.22 million the previous year. The company achieved a net income of A$221.4 million compared to a net loss previously, reflecting high-quality earnings and robust profit growth over the past year (135.6%). With no debt and stable management tenure averaging five years, Focus Minerals shows prudent financial management. However, its share price remains highly volatile and Return on Equity is low at 6.1%, indicating potential risks for investors seeking stability in penny stocks.

- Take a closer look at Focus Minerals' potential here in our financial health report.

- Assess Focus Minerals' previous results with our detailed historical performance reports.

Strickland Metals (ASX:STK)

Simply Wall St Financial Health Rating: ★★★★★★

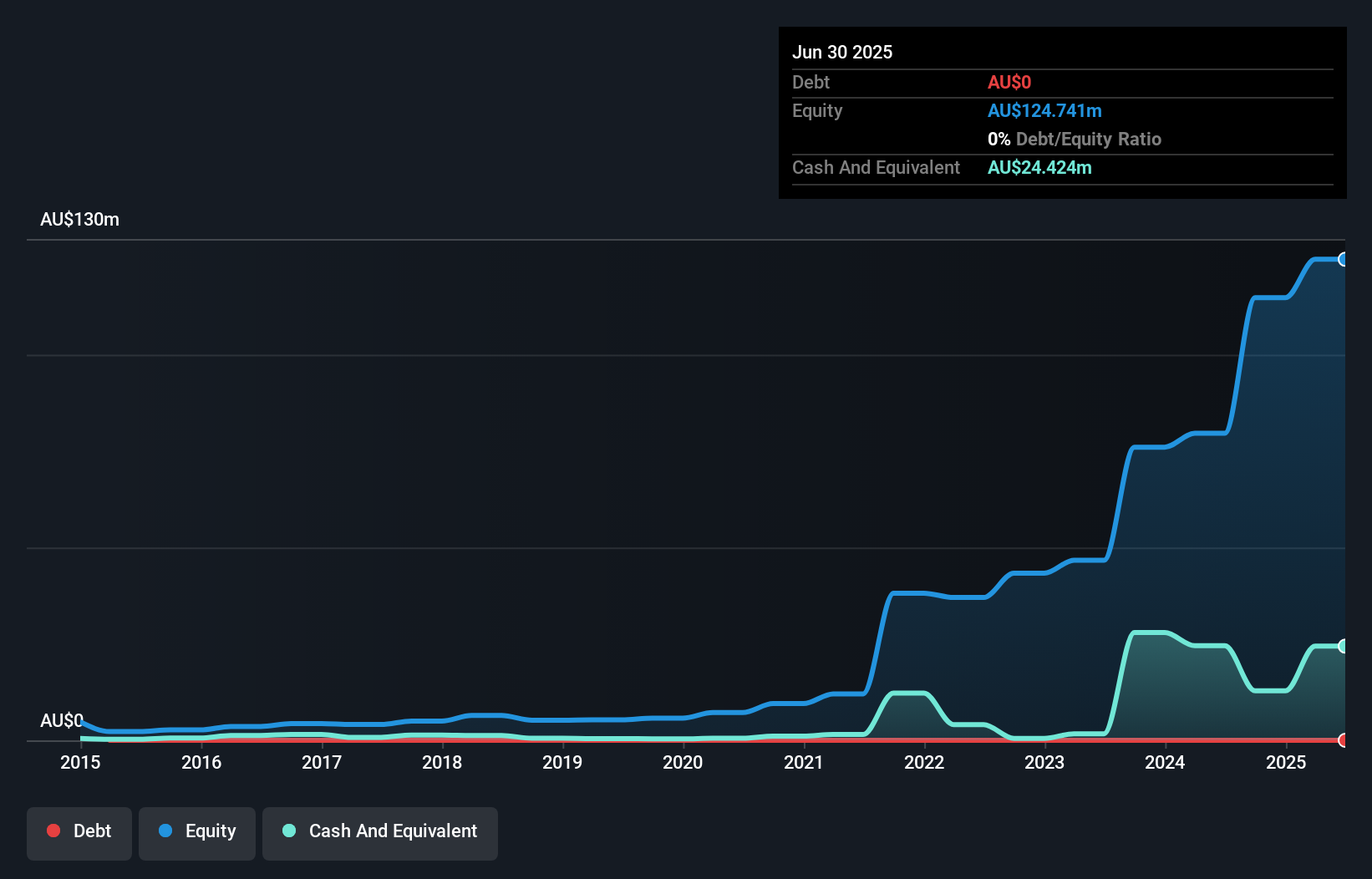

Overview: Strickland Metals Limited is involved in the exploration of mineral resources in Australia, with a market capitalization of A$423.29 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: A$423.29M

Strickland Metals Limited, with a market capitalization of A$423.29 million, has recently transitioned to profitability, though it remains pre-revenue. The company has no debt and maintains strong short-term asset coverage over its liabilities. Despite this financial stability, Strickland's management and board are relatively inexperienced with an average tenure of less than two years. The company's earnings have shown volatility and are forecasted to decline significantly in the coming years. Recent presentations at key industry conferences indicate active engagement with investors but highlight the speculative nature typical of penny stocks in the mining sector.

- Click to explore a detailed breakdown of our findings in Strickland Metals' financial health report.

- Evaluate Strickland Metals' prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Dive into all 421 of the ASX Penny Stocks we have identified here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报