Fortive (FTV): Reassessing Valuation After Q3 Earnings Beat and Cautious Analyst Optimism

Fortive (FTV) jumped after its Q3 report showed revenue and earnings coming in ahead of expectations, giving investors a reason to revisit a stock that has lagged the broader tech space.

See our latest analysis for Fortive.

At around $54.80, Fortive’s one month share price return of 6.76 percent and 90 day share price return of 10.55 percent hint at improving momentum. This is the case even though the year to date share price return remains sharply negative and the one year total shareholder return is still slightly in the red, with longer term total shareholder returns modestly positive.

If you like Fortive’s rebound but want to see what else fits a similar profile, now is a good time to explore fast growing stocks with high insider ownership.

With earnings momentum picking up but analysts only seeing modest upside, the real question is whether Fortive is still trading below its true potential or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 2.4% Undervalued

With Fortive closing at $54.80 against a narrative fair value of $56.13, the valuation gap is small but hinges on some bold assumptions.

Ongoing operational excellence via the Amplified Fortive Business System and disciplined capital allocation including targeted bolt on acquisitions in niche software and analytics are expected to deliver further cost productivity, improved net margins, and robust free cash flow conversion.

Want to see what justifies paying up for shrinking revenue but rising margins? The narrative leans on richer earnings power and a stretched future multiple. Curious which precise profit and discount assumptions make that math work?

Result: Fair Value of $56.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent healthcare softness and tariff uncertainty could derail margin gains, challenging analysts’ upbeat assumptions and forcing a rethink on Fortive’s premium multiple.

Find out about the key risks to this Fortive narrative.

Another View: Market Ratio Check

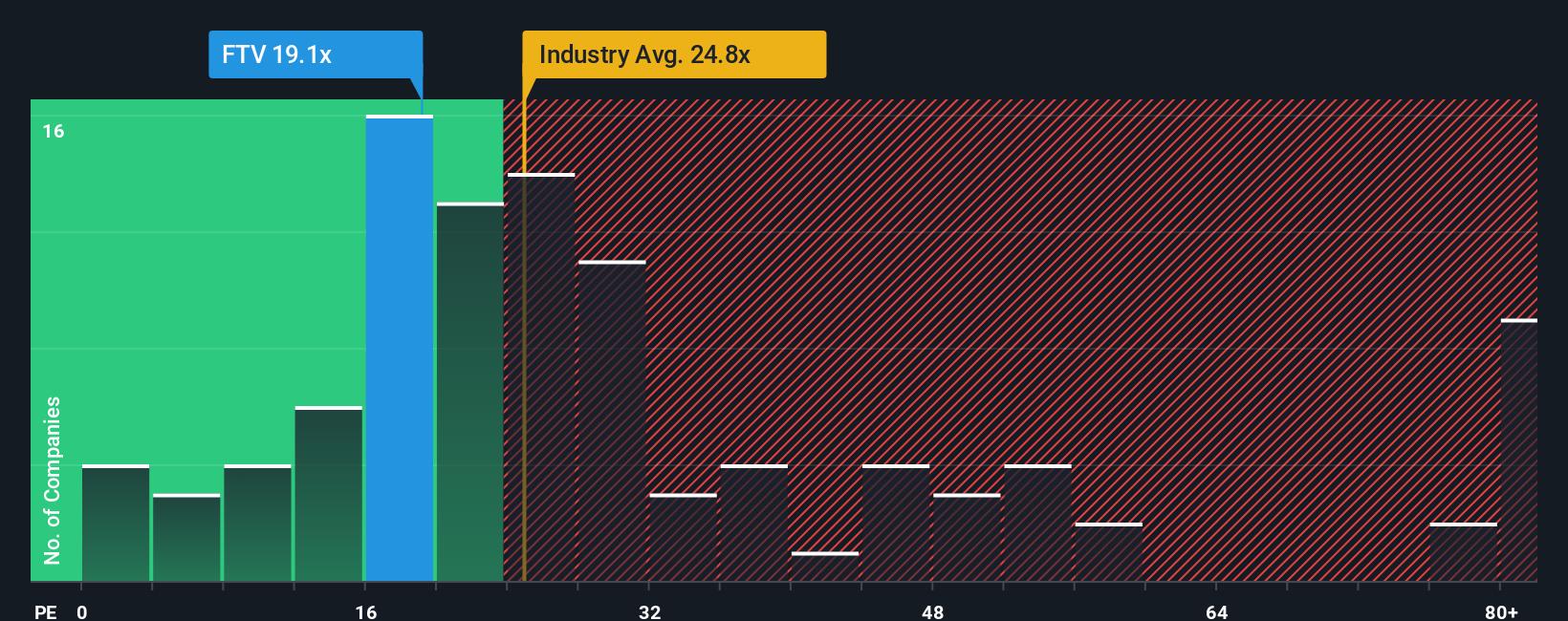

Our valuation using earnings multiples paints a more cautious picture. Fortive trades on a 19.7x price to earnings ratio versus a 24.9x Machinery industry average, yet above its 18.5x fair ratio. This suggests limited upside and real de rating risk if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fortive for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fortive Narrative

If you see Fortive differently or want to stress test the numbers yourself, you can craft a custom view in just minutes, Do it your way.

A great starting point for your Fortive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Fortive might only be the beginning, and you may want to explore other high potential ideas available in the Simply Wall St Screener.

- Identify potential multi baggers early by scanning these 3603 penny stocks with strong financials that pair small market caps with strong fundamentals.

- Explore the next wave of intelligent automation by targeting these 25 AI penny stocks positioned at the intersection of software, data, and scalable platforms.

- Research future return potential with these 904 undervalued stocks based on cash flows that appear mispriced based on their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报